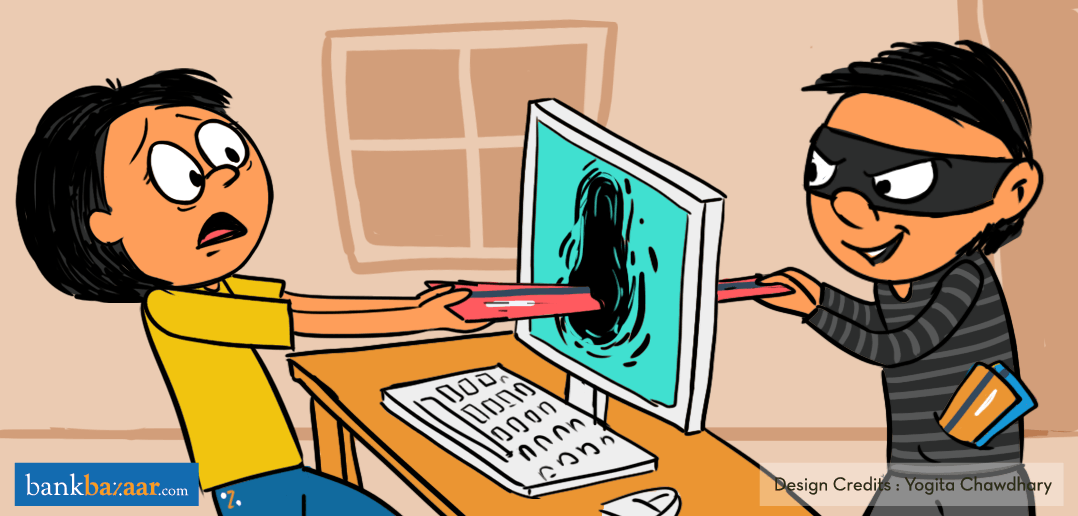

If you’re confounded by the perils of identity theft, we’re here with practical ways to detect as well as prevent it. Keep calm and read on.

With the rising number of cases of identity theft and Credit Card fraud, you’re probably no longer in the dark about how easy it is for hackers to steal Credit Card information. However, all is not lost. Rest assured as there are ways to protect your Credit Card information from being stolen and misused.

With the rising number of cases of identity theft and Credit Card fraud, you’re probably no longer in the dark about how easy it is for hackers to steal Credit Card information. However, all is not lost. Rest assured as there are ways to protect your Credit Card information from being stolen and misused.

Losing your financial data can be quite a harrowing experience. The sooner you realise that your confidential Credit Card details are in the wrong hands, the better it is. Immediate action is the only way out.

Additional Reading: What To Do When Your Financial Data is Stolen

Unfortunately, most victims don’t find out that their information has been stolen until after the card has already been used and it’s too late to prevent it. So, how do you actually spot the signs of such an occurrence? Confused? We’ll tell you how. Let’s check out the ways you can recognise identity theft.

Receiving strange bills for purchases not made by you

If you suddenly start receiving bills of outstanding payments, chances are that you’ve probably become a victim of identity theft.

If this is the case, contact your Credit Card provider and notify them that your credentials have been compromised and that it’s not your debt. To handle matters more seriously and just be on the safer side, it’s advisable that you file a police complaint.

Additional Reading: Hit And Run By Credit Card Fraud? Here’s What To Do

When you check your Credit Score by yourself it qualifies as a soft enquiry. On the other hand, when you apply for credit, the lender checks your score to gauge your credit worthiness. This is called a hard enquiry.

Pro Tip: Check your Experian Credit Score for FREE! Don’t worry, checking your score by yourself won’t impact it.

Too many hard enquiries in your credit report cause a dip in your Credit Score and portray you as desperate for money. If you notice unfamiliar hard enquiries in your report, that were not originally made by you, understand that someone has made applications for credit in your name. If you spot such enquiries, make sure to set a fraud alert.

Some Credit Card providers also provide the option of opting for real-time transaction notifications and alerts sent to your smartphone. Keep monitoring your credit report regularly and check if any fraudulent accounts appear in your report.

Additional Reading: Now You Can Insure Yourself From Cyber Frauds!

Receiving frequent calls about accounts that you haven’t opened

This is one of the most alarming signs of identity theft. By the time you start receiving calls from debt collectors, multiple accounts may have been opened in your name without your knowledge.

If you receive such a call, inform the collection agencies that this debt isn’t yours.

Your next step should be to get a copy of your credit report to see if other such accounts have been opened in your name, in which case, set up a fraud alert or credit freeze to prevent unauthorized accounts in the future.

Additional Reading: 4 Things You Must Check In Your Credit Report

Failing to receive mail or notifications associated with your Credit Card

This is quite easy to overlook. You may not be someone who regularly tracks his message alerts or reads his/her mail too often. However, remember that identity thieves can change the address so that your mail is rerouted to another address.

In case your Credit Card bills suddenly stop arriving, immediately call your card issuer to confirm and check if your billing statements are being sent to the correct address you’ve specified.

Another sign of identity theft is unexpected rejection by insurance companies or suddenly being charged a significantly higher rate than before.

Such rejections are particularly suspicious if you usually have a good Credit Score. Keep reviewing your Credit Score from time to time and take a closer look at your credit reports.

Additional Reading: 7 Ways To Protect Yourself From Credit Card Theft While Travelling

Presently, with data breaches having turned fairly commonplace, it’s crucial that you take the necessary measures to prevent unwanted people from gaining access to your private information and credit. With these tips in your kitty, you’re off to a good start!

If you’re looking for financial products such as Personal Loans, a second Credit Card, Fixed Deposits, Education Loan or a Two-Wheeler Loans among others, be sure to check us out. We’ve got everything finance-related under one roof.