With the paperless revolution in full swing, BankBazaar in association with Economic Times recently hosted a conclave on Paperless Finance at Mumbai on 12th September 2017. The evening featured fascinating discussions on paperless finance with prominent industry leaders, who came together to provide insights on where paperless banking is headed and what’s in store in the years to come.

Paperless access via Aadhaar to financial products will transform India by ensuring financial inclusion of our entire population with easy access to credit, insurance, savings, and investments. The Government of India, through the development of Aadhaar, e-Sign & DigiLocker has created the ecosystem in which financial institutions can offer consumers access to financial products via their mobile phones.

The use of mobile technology for paperless financial access will drastically reduce

- Operational costs associated with physical branches, paper document pick-up, manual processing, and

- Risks associated with mis-selling, duplicate KYCs and fraudulent manipulation of paper documents leading to NPAs.

Mobile-based paperless access to financial products for every Indian will increase credit flow, further the growth of the insurance sector and increase participation in our securities markets. Data shows consumers, both rural and urban, are ready for and want paperless access to loans, Credit Cards, insurance and Mutual Funds versus prevalent physical KYC on-boarding processes.

This physical last mile is the last barrier blocking the disruptive power of paperless, and we need to create a platform to fast-track paperless finance with key stakeholders from across regulators and banking, insurance and investment professionals. Experiences in western markets suggest that volumes for digital issuance increase 8X when paperless replaces physical loan processes.

Additional Reading: All About The Paperless Initiative

The evening was headed by Keynote Speaker Amitabh Kant (CEO, NITI AAYOG) via live feed.

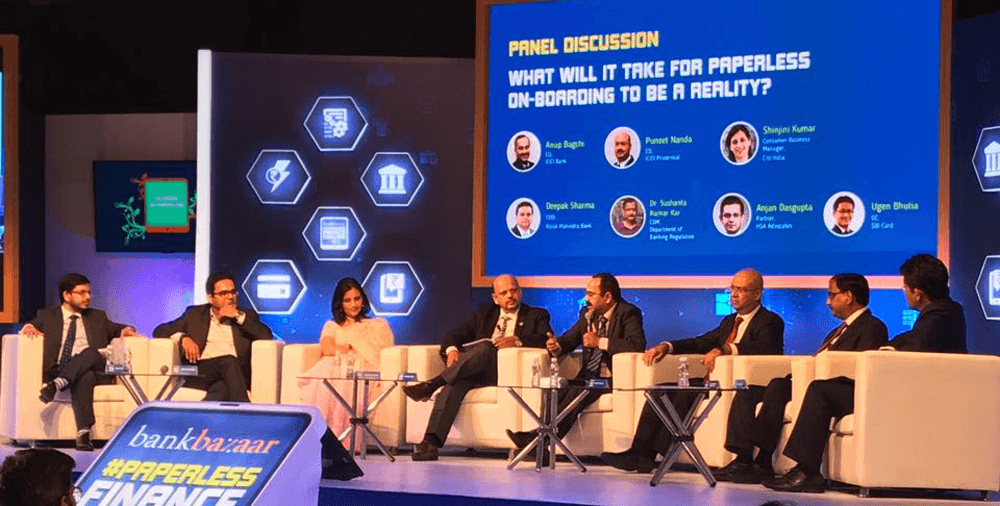

The key panelists at the event included:

Dr. Sushanta Kumar Kar – CGM, Dept. of Banking Regulation, RBI

Zarin Daruwala – CEO, Standard Chartered Bank

Vijay Jasuja – MD, CEO SBI Card

Manoj Adlakha – SVP & CEO, American Express

Rajesh Sud – EVC & MD, Max Life Insurance

Puneet Nanda – ED, ICICI Prudential

Anup Bagchi – ED, ICICI Bank

Anjan Dasgupta – Partner, HAS Advocates

Deepak Sharma, Chief Digital Officer, Kotak

Arvind Kapil – Country Head, Unsecured Loans, Home & Mortgage Loans, HDFC Bank

Jayesh H – Co-founder, JURIS Corp

Ugen Bhatia – GC, SBI Card

Shinjini Kumar – Consumer Business Manager, CITI India

Dr Sushanta Kumar Kar, CGM, Dept of Banking Regulation, RBI

Additional Reading: Cashless, Paperless Could Make India An Efficient Economy: Amitabh Kant

Key Highlights

One of the major highlights of the conclave was keynote speaker, Amitabh Kant’s call for several reforms with regards to paperless finance.

He stated that there should be a greater push for the adoption of Aadhaar-enabled electronic KYC for the opening of bank accounts, while also pushing for digital signatures and OTP authentication for Credit Card disbursals.

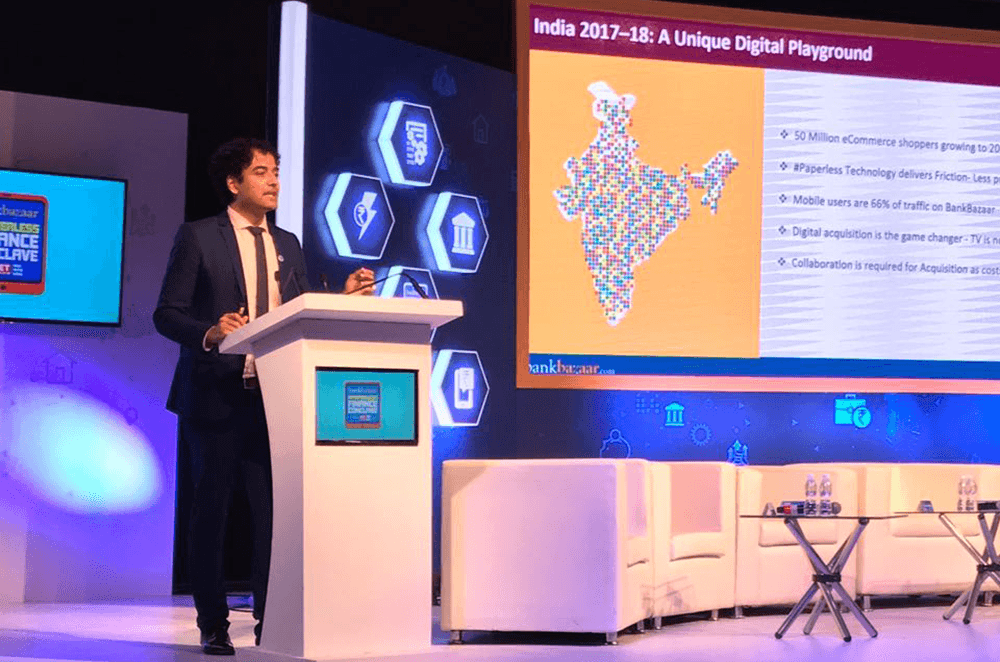

Adhil Shetty, CEO of Bankbazaar, pointed out that over the next year the number of eCommerce shoppers in India could grow drastically from 50 million to 200 million. He also stated that digital acquisition is a definite game changer with 66% of BankBazaar’s traffic coming from mobile users.

Panel Discussions

The panel discussions focused on what it would take for paperless on-boarding to become a reality and how access to paperless finance across the country could be a game changer for Indian citizens as well as the banking industry as a whole.

How Would Paperless Finance Impact India?

India today is digitally empowered. Internet connectivity and smartphone penetration has improved significantly while remarkable progress has been made in consumer awareness about online access to financial products.

Consumers are becoming increasingly mobile-centric and are likely to expect their financial services purchase experience matches all other experiences on a mobile device – paperless, convenient, and secure. This is the mobile Internet generation of consumers and they do not want to submit paperwork, visit a physical branch and meet sales agents. They are comfortable transacting 100% online via Aadhaar.

An amazing 60% of loan applicants on BankBazaar apply paperless when given the option to do so. Data from banks indicates that paperless applications have 300% higher conversions into disbursed accounts compared with online-cum-offline process. Banks benefit from lower costs and turnaround times due to higher conversions.

Paperless applicants have significantly lower NPAs than offline customers because a) there is no intermediary between customer and bank and b) electronic documents collected from source cannot be manipulated by the borrower.

Experiences in western markets such as the UK suggest that volumes for digital issuance increase 800% when paperless replaces physical loan processes. According to the ‘India Mobile Economy’ report, GSMA is of the view that around 330 million new mobile users will be added by 2020 in India, taking the total count to 500 million smartphones.

Additional Reading: NITI Aayog Pushes For Digitisation Of Finance

What Would It Take For Paperless On-Boarding To Become A Reality?

Paperless represents the largest cause of digital on-boarding of consumers for financial product purchases. No matter where they are in India, consumers should be able to access loans, cards, deposits, Mutual Funds and insurance from any financial institution on their mobile phones without a single shred of paper or the need for a physical meeting.

The biggest barrier to digital mobile access to financial products is friction in the offline process i.e. physical KYC and wet-signature collection. Moving from paper-centric processes to digital processes can help remove this barrier. Realising the dream of frictionless finance will depend on support from the regulators:

- Acceptance of e-Signature – The use of Aadhaar-based e-sign has not gained sufficient momentum in moving towards paperless digital transactions in spite of the Information Technology Act, Indian Evidence Act and the Negotiable Instruments Act recognising the same.

Early adopters leverage e-Sign to get customers to sign loan and card applications and loan agreements, but many financial institutions are yet to adopt e-Sign even though the Information Technology Act and Evidence Act allows for it.

Banks should use e-Sign to get the customer to electronically sign applications and agreements. An express clarification from RBI in this regard will clear the mist and assist in adoption of legally valid e-signatures in the banking domain.

An engaging chat on #Paperless by this panel on Tuesday night! Thanks for being there at the #BankBazaarPFC! @BankBazaar pic.twitter.com/p9WrVRYjHo

— Adhil Shetty (@adhilshetty) September 14, 2017

- OTP based e-KYC on-boarding – The e-KYC via OTP caps under the RBI amendment of December 8th 2016, should allow for increased limits that handle the average customer requirements on the internet today. The bank’s initial response to the circular on Aadhaar e-KYC via OTP has been muted because of the limited value of the transaction that is permissible.

The average loan size through the online digital mode is approximately Rs. 3 lakhs, which is higher than the allowable maximum of Rs. 60,000. The regulator may consider enhancing the limits for credit accounts based on second factor checks, including PAN validity alongside e-KYC via OTP. In addition, there needs to be clarity permitting the usage of OTP based e-KYC process for Credit Cards.

- C-KYC – If the current form of the C-KYC process is allowed to set in, it might require the bank to get the customer to physically complete a new C-KYC form and physically sign it. This type of new C-KYC physical form filing would derail and push back the paperless system and undo the good and successful work done towards paperless and presence-less on-boarding of customers.

The problem can be solved if the C-KYC form, which is to be filled in by the customer can be digitised so that banks can update the C-KYC database based on data collected as part of regular bank e-KYC via OTP process without the need to collect a new paper-based form.

In this regard, the support of the Ministry of Finance is required to digitise the C-KYC process based on existing e-KYC processes and give more weightage to the Aadhaar based OTP e-KYC process.

- E-NACH – The last leg of the loan disbursal process involves setting up repayment instructions for the loan. NPCI has released standard operating procedure (SOP) for E-NACH debit E-Mandates using e-Sign. There are only 11 banks live with NPCI E-NACH SOP.

It is important that all banks adopt this SOP so that the E-NACH mandate will be available to all loan applicants without multiple work flows. The paperless drive depends on the RBI encouraging all banks to adopt NPCI’s E-NACH Standard Operating Process to setup E-Mandates via e-Sign.

- Addition of issuers on the DigiLocker – DigiLocker today enables a secure customer consent-based sharing of documents from issuer to bank. A push is required from MEITY for addition of more issuers on the DigiLocker enabling users to share documents like income tax returns, TDS records, indirect tax challans, and banking transactions.

The addition of more issuers on DigiLocker will create a trusted paperless ecosystem enabling individuals and small businesses to share their data via paperless means in order to avail credit from the formal financial system.

Equally fascinating to listen to diverse points of view on #Paperless onboarding from this panel. #BankBazaarPFC @BankBazaar pic.twitter.com/TxY1nglCyn

— Adhil Shetty (@adhilshetty) September 14, 2017

- RBI Master Direction of KYC to be aligned with PMLA (Maintenance of Records) Second Amendment Rules, 2017– The RBI may deliberate on reviewing its KYC guidelines /directions to bring it in line with the PMLA requirement and should categorize Aadhaar OTP based e-KYC process coupled with PAN verification as complete “Customer Due Diligence’’ equivalent to Aadhaar biometric authentication and may also consider removing the limits imposed by the December 8th 2016 notification on account based relationships opened via Aadhaar OTP based e-kYC process.

This is a unique opportunity for the banks and Fintech and shows that the Indian consumer is ready to go completely paperless. The key is to provide an entirely digital on-boarding experience via mobile that meets customer expectations and the bank’s regulatory needs.

Additional Reading: Credit Cards With Paperless Approval

If you’re looking to join the paperless revolution, we have an incredible range of financial products that could be just what you’re looking for. Remember, the future is now!