Are you planning to upgrade from your two-wheeler to a four-wheeler? Or do you want to buy yourself another car to add to your collection? With the plethora of financing options available today, your dream of getting yourself a brand new car is easily achievable. Besides, banks also offer lucrative deals on their Car Loans too.

Looking for a Car Loan? Click here.

So, what exactly is a Car Loan? Also referred to as Auto Loan, it is a short to medium-term loan given to finance the purchase of a car. The car loan interest rates are quite affordable too. Well, you already knew that, right? But did you know that a Car Loan is a secured loan? Confused? Basically, the loan is given by the bank against the four-wheeler that you are purchasing. So, if you default on the loan repayments, you can bid goodbye to your new car.

Additional Reading: Most Popular Cars In India 2016

While it looks pretty easy for anyone to get a Car Loan, it is not the case. Banks usually look at a lot of factors before they sanction a Car Loan. And of the most important criterion they look at is your income. Your income has a direct influence on the fate of your Car Loan application.

While it is pretty easy for someone who earns a lot to get their Car Loan application approved, this may not be the case for those who aren’t. Not only will these low-income people face limitations, but they may find it hard to get their application approved as well. But, don’t you worry! We’re here to help you if you are finding it difficult to get yourself a Car Loan because of income issues.

Firstly, let us assume that the borrower is 25 years of age and has a monthly salary of Rs. 20,000.

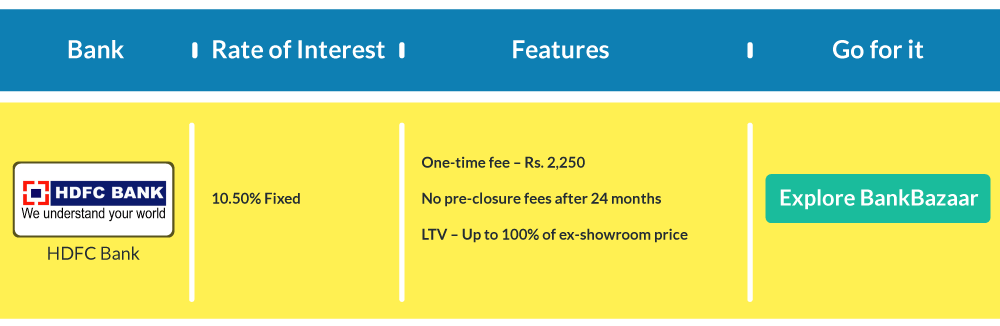

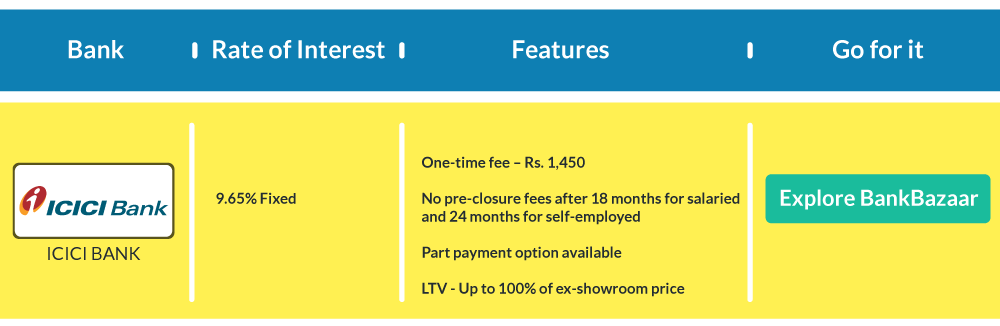

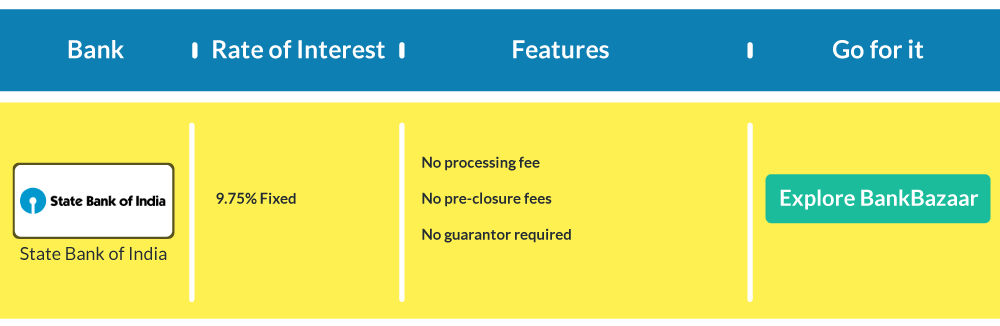

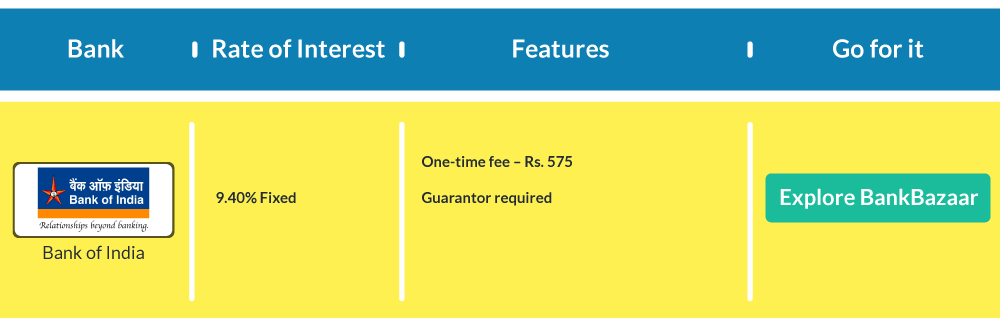

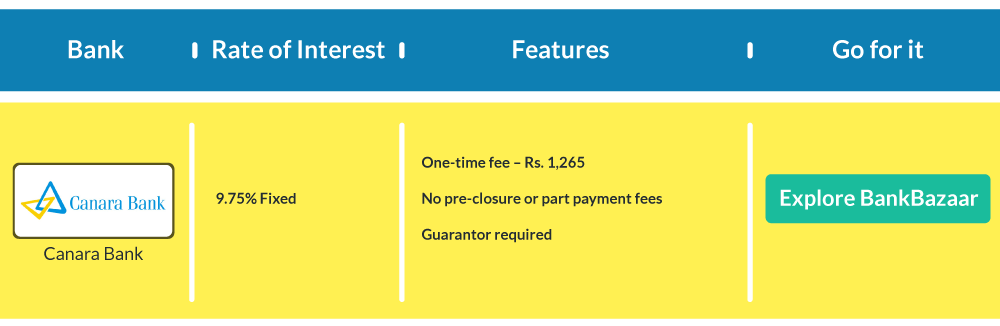

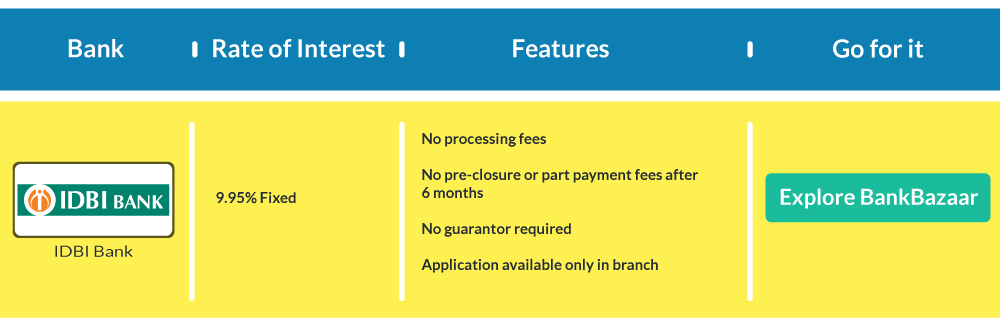

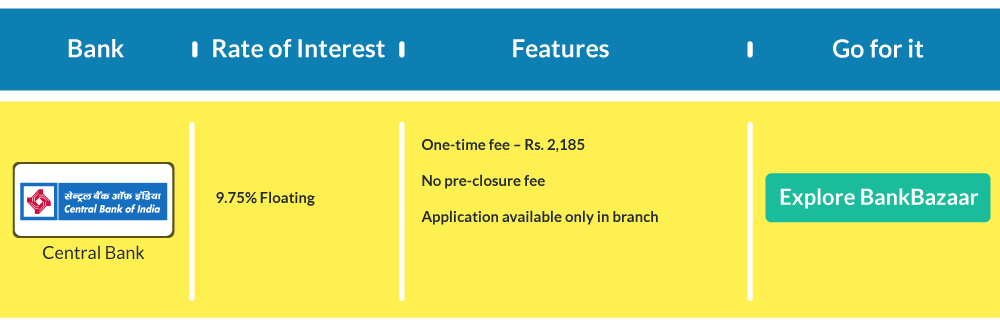

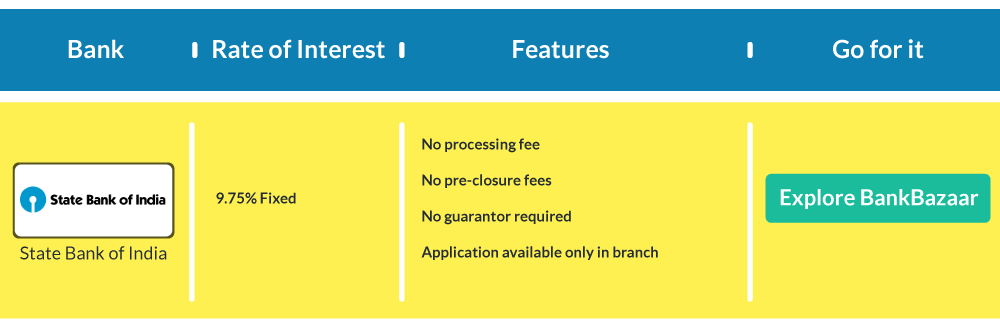

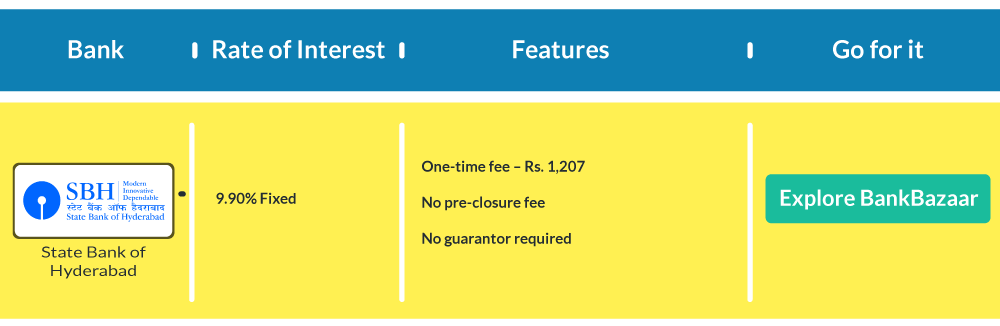

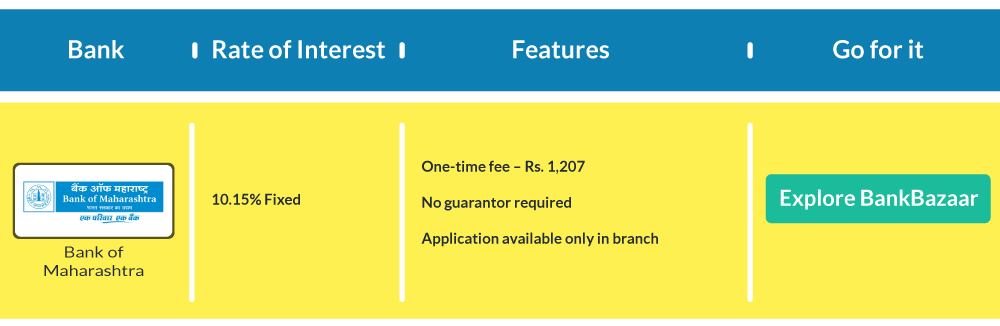

If you are looking to buy a Maruti Suzuki Alto, you can get a loan from either of these banks:

Loan Amount – Equal to INR 2.1 lakh; Tenure – 5 Years

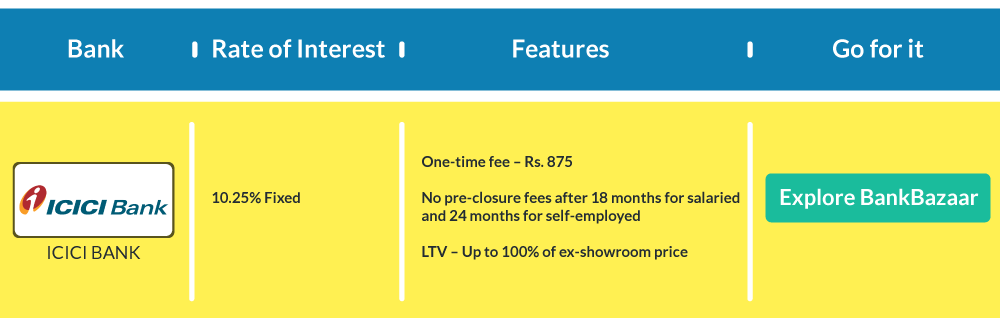

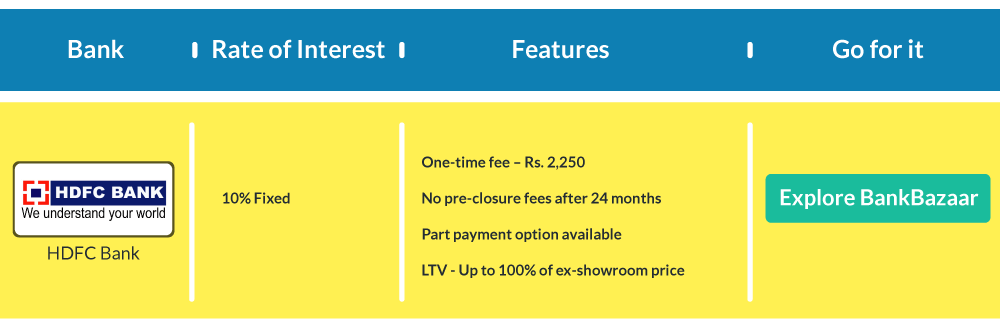

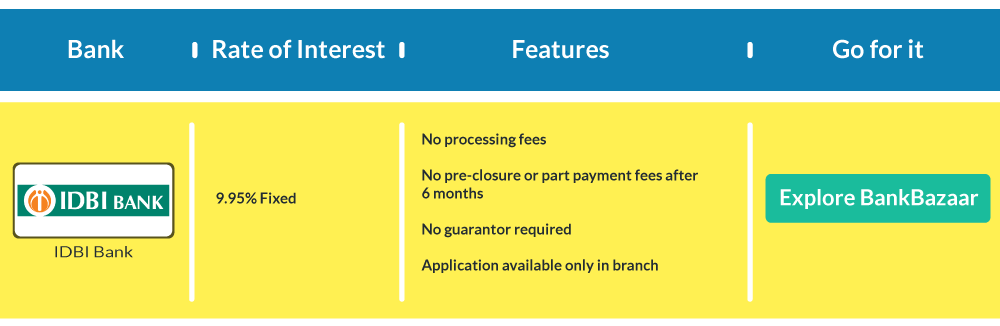

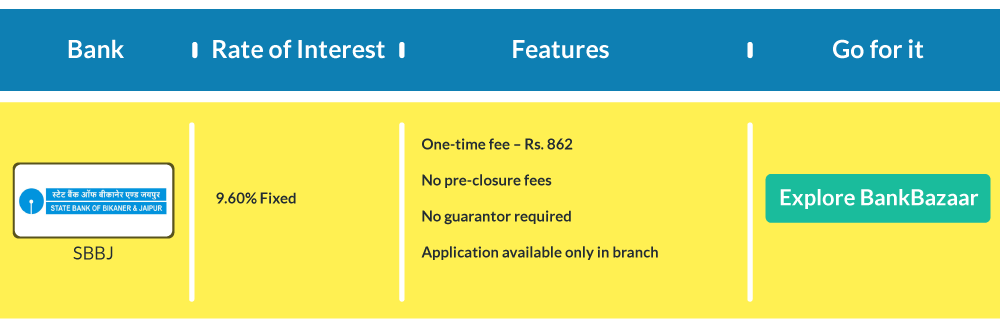

If you are looking to buy a Maruti Suzuki Swift Dzire, then you could get Car Loan offers from these banks:

Loan Amount – Equal to INR 4.4 lakh; Tenure – 5 Years

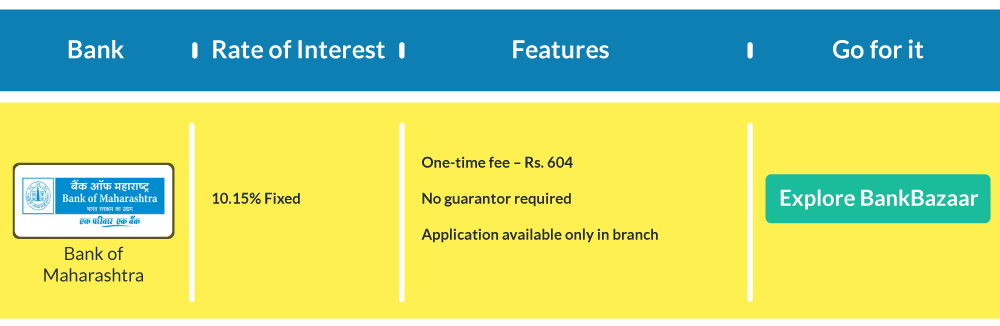

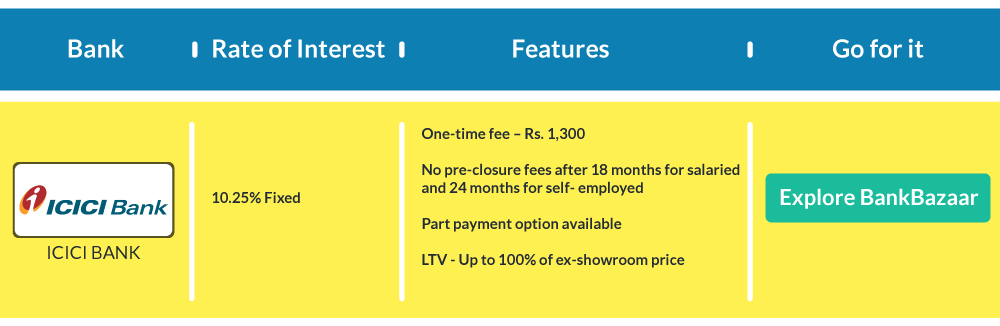

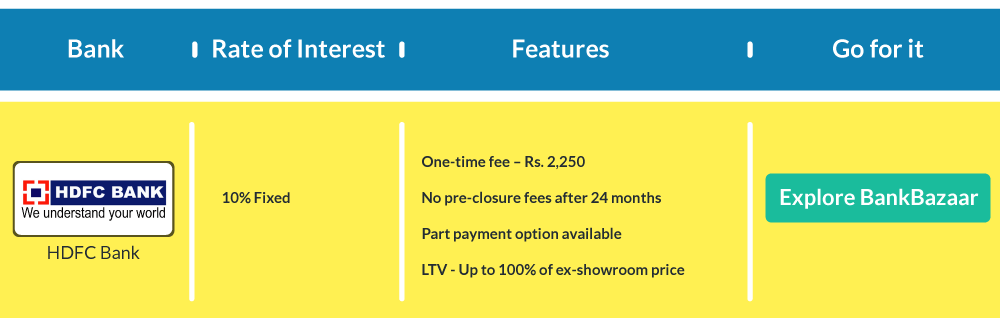

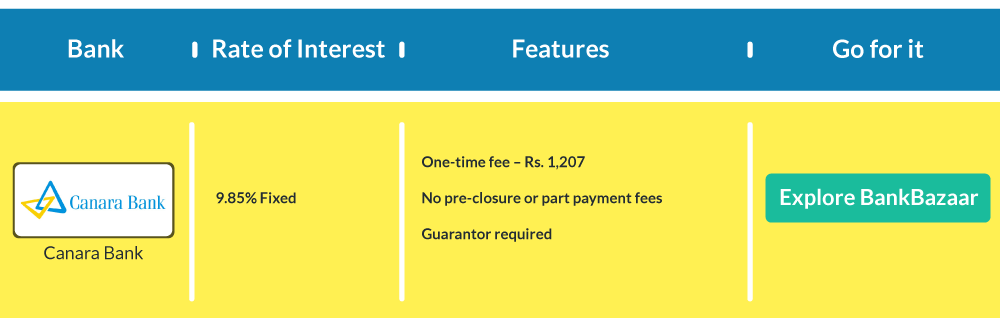

If you are looking to buy a Hyundai i10, then you could get Car Loan offers from these banks:

Loan Amount – Equal to INR 3.8 lakh; Tenure – 5 Years

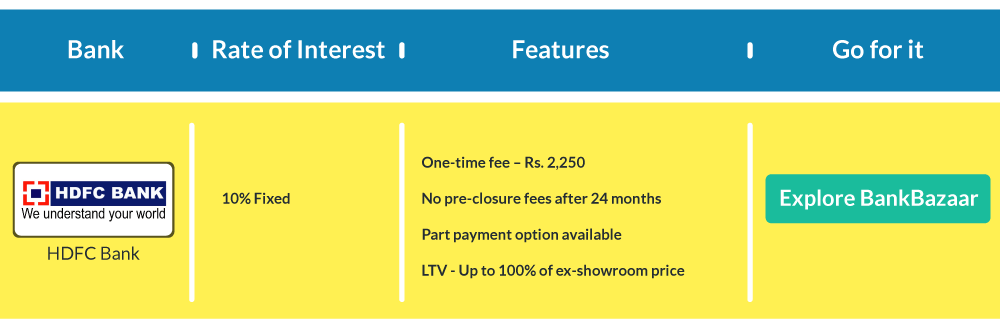

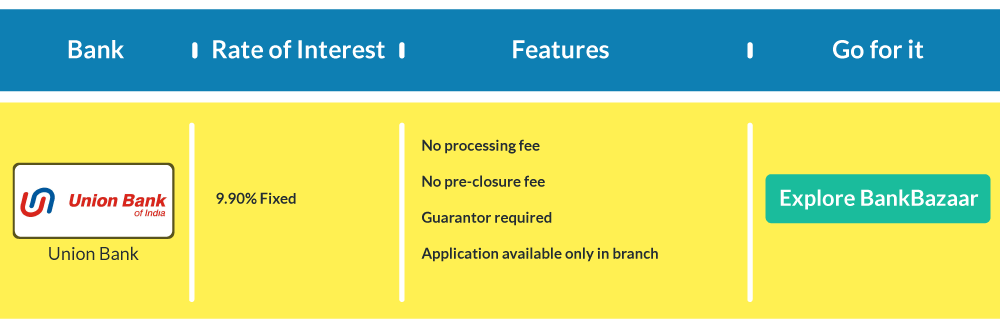

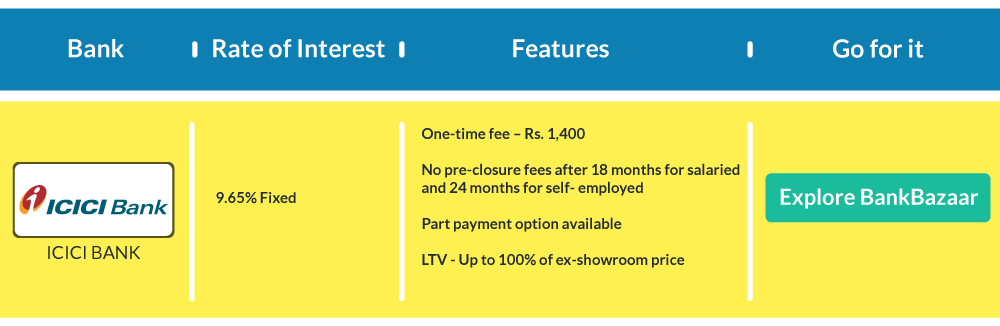

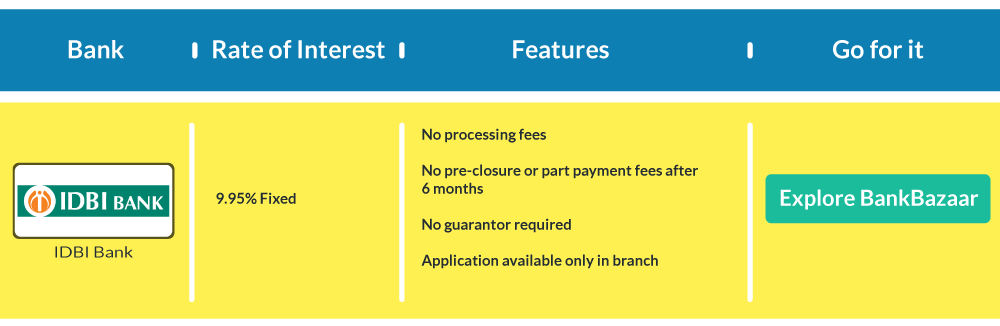

If you are looking to buy a Maruti Suzuki Swift, you can get a loan from either of these banks:

Loan Amount – Equal to INR 4.2 lakh; Tenure – 5 Years

Now that you know your options, you can approach any one of the above banks to get your loan approved. However, the loan amount, rate of interest, etc. differ between car models.

If you’re planning to buy any other car (than the above-mentioned four), you might as well check your eligibility and compare between different options here.

We also have banks offering loans for used cars. In case you are looking for any other financial product, be it loans, Credits Cards, Mutual Funds, or Insurance, let’s cut to the chase.

Use car lone Maruti swift

Hi JaiPrakash, You can check your eligibility for a Used Car Loan here. Cheers, Team BankBazaar