Established in 1956, LIC is, today, the largest insurance provider in India. Read on to know more about LIC.

What’s the first thing that comes to your mind when you hear the word ‘Insurance’? LIC, right? Well, for most us Indians, insurance is synonymous with LIC. Here’s everything you need to know.

A Brief History

Did you know that LIC was established in 1956? Well, it’s a fact! It was on the 19th of June, 1956, that the Indian Parliament passed the Life Insurance Corporation Act. And finally, on the 1st of September, 1956, LIC was established with the sole objective of spreading Life Insurance across the country at a reasonable cost.

After having started with just 5 zonal offices, around 212 branches, and 33 divisional offices, today LIC has 8 zonal offices, 113 divisional offices and about 2, 048 branches (fully computerised). It is the largest insurance provider in the country.

Additional Reading: Postal Life Insurance And Life Insurance Corporation Of India: What’s The Difference?

What is LIC?

Life Insurance Corporation of India, commonly known as LIC, is basically a state-owned insurance and investment company. LIC offers insurance plans, pension plans, unit plans, special plans and group schemes.

Learn more about the different plans that LIC offers

Eligibility

Salaried, self-employed individuals, professionals and business owners who are above the age of 18 and below the age of 60 can apply for an LIC insurance policy. The maximum policy term is 35 years.

How To Apply For An LIC Policy

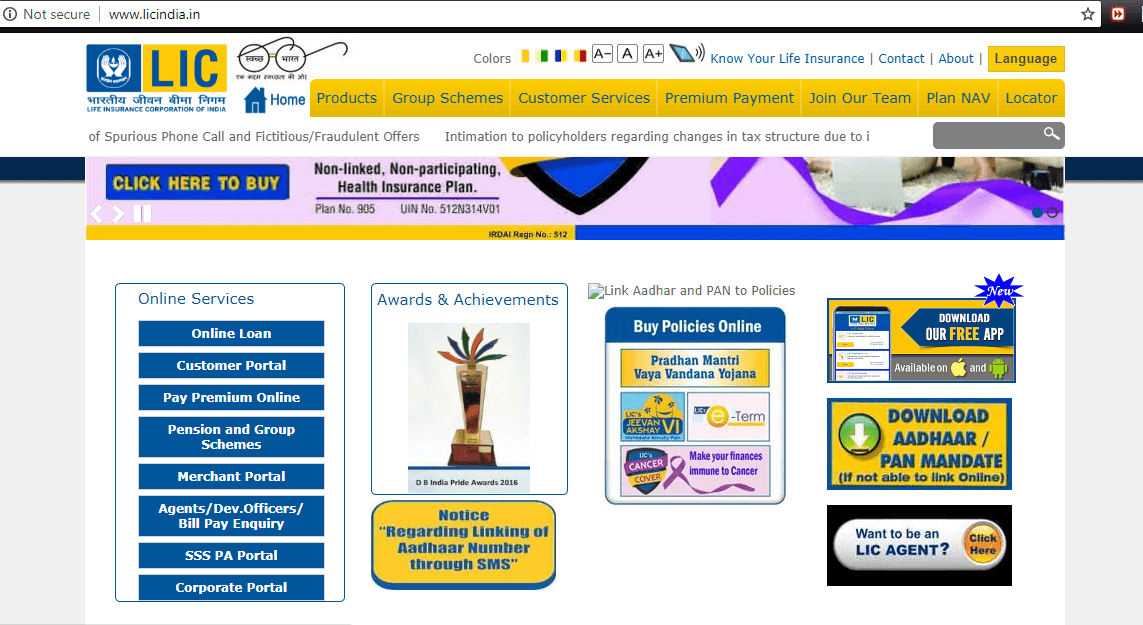

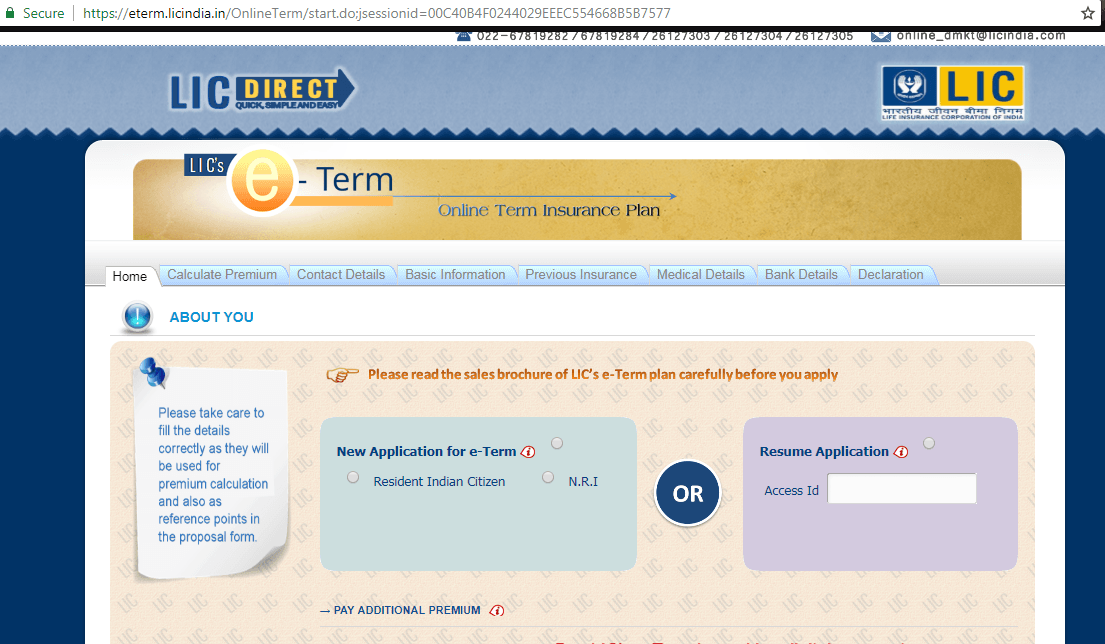

You can either buy an LIC policy through an agent or directly from any LIC branch. LIC also has four of their products available online. These are LIC’s e-Term policy, LIC’s Jeevan Akshay VI policy, LIC’s Cancer Cover and the Pradhan Mantri Vaya Vandana Yojana.

If you’re comfortable purchasing an LIC policy online, you can visit LIC’s official website, click on the ‘Buy Policies Online’ option, choose one of the four plans and click on the ‘Buy Online’ button.

You’ll have to key in a few details before the purchase is completed.

Documents Required For Getting An LIC Policy

You’ll be asked to submit the below documents while applying for an LIC policy:

- Income proof

- Identity proof

- Address proof

- Age proof

- PAN

How To Make Premium Payments

You can make your premium payments either at an LIC branch directly or online via the LIC website. Or you can pay via your agent or net banking/phone banking.

Making Premium Payment Online

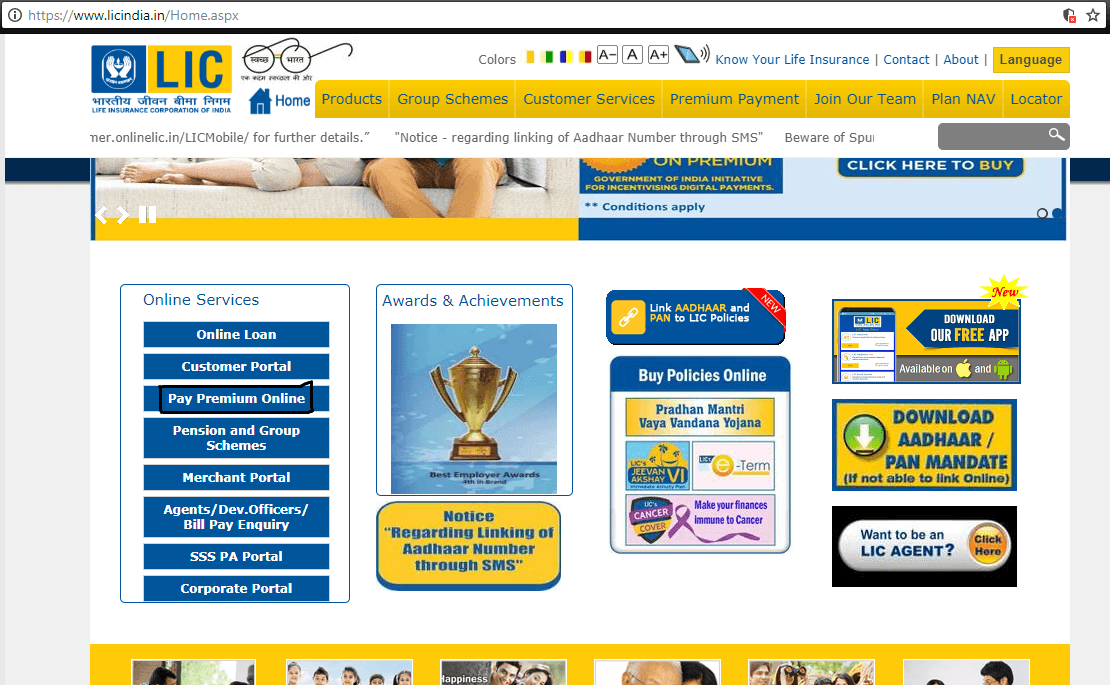

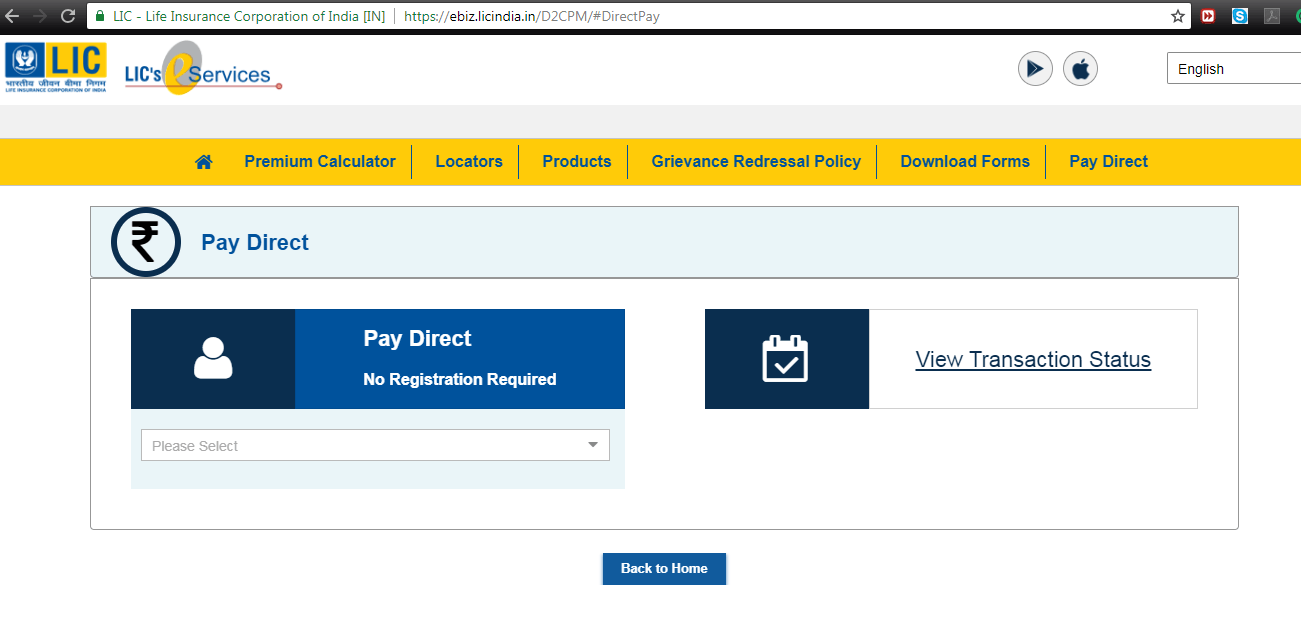

Online payments can be made online through the LIC website using net banking, Debit Card, Credit Card, BHIM or UPI. Here’s how to go about it:

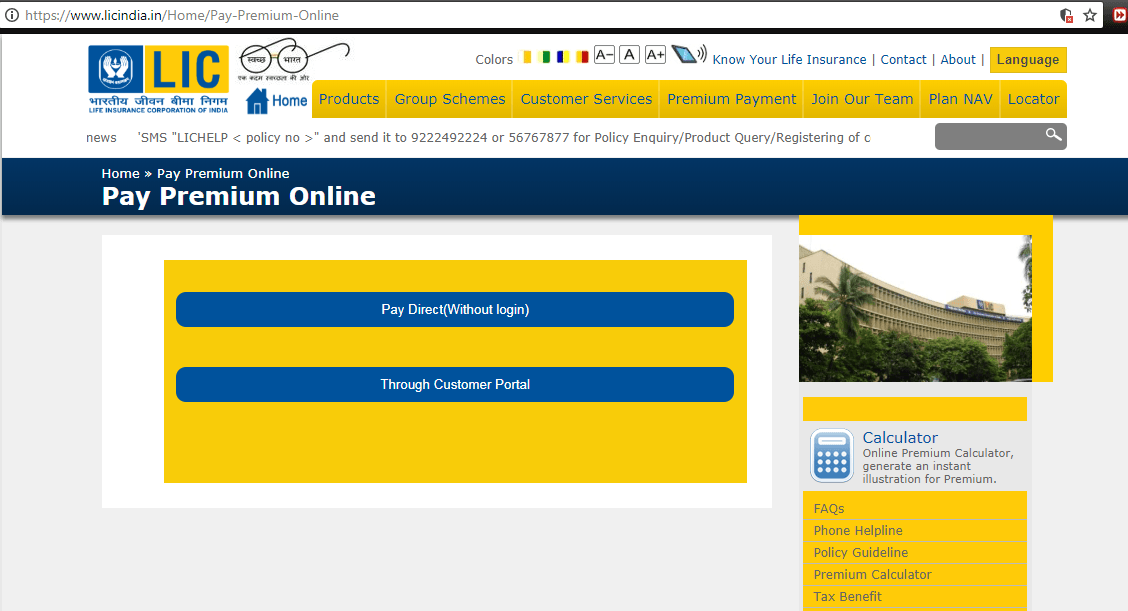

1) Visit LIC’s official website (https://www.licindia.in/Home.aspx)

2) Under Online Services, you’ll find the Pay Premium Online option

3) If you haven’t signed up, then choose Pay Direct (Without Login) option. Fill in the required details and pay your premium online

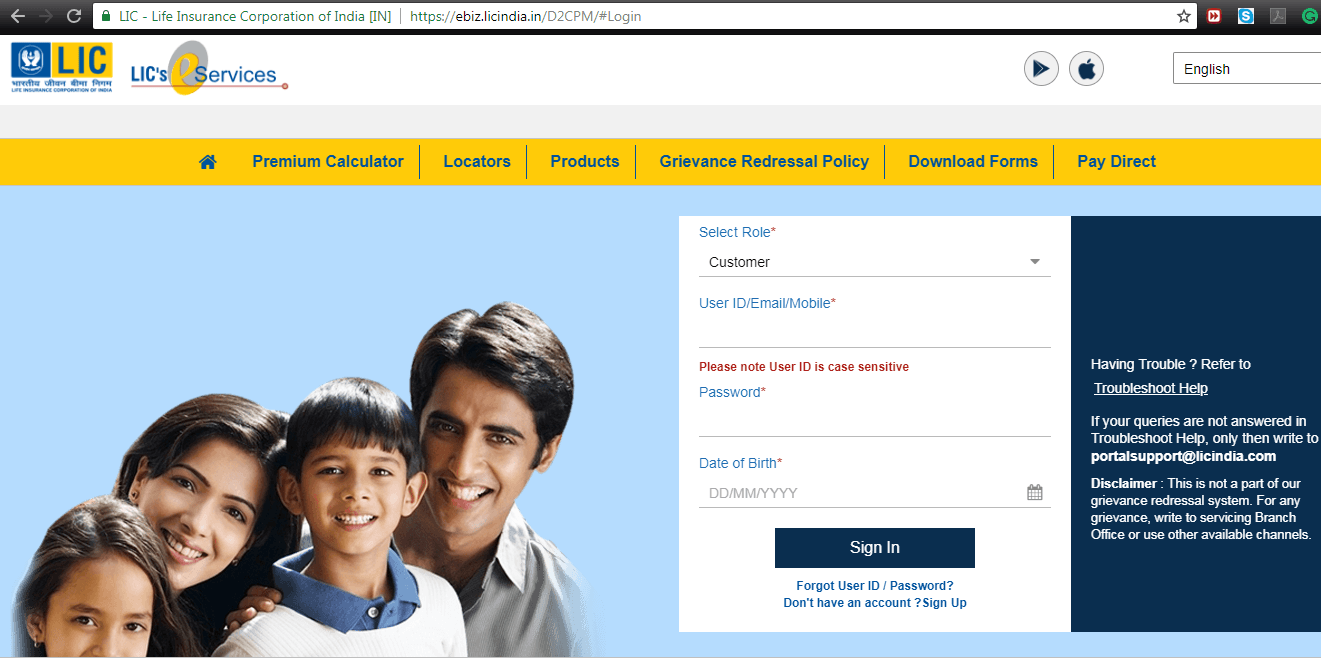

4) If you’ve signed up on the LIC portal, click the Through Customer Portal option, sign in and make the payment

You can also pay your LIC premiums online through authorised banks or authorised service providers such as BillDesk, BillJunction, and TimesofMoney. The latter option is available only in select cities.

Advantages Of Taking The Online Route

- You can make the payment anytime, anywhere, as long as you have access to a working Internet connection

- Payments/standing instructions can be made within the comfort of your office or home; no need to visit any LIC branch

- No need to wait in long queues to make payments

- Online payment facility is free of cost

- You can check your policy details and premium dues easily since everything is in one place

Making Premium Payment At LIC Branch

Visit a nearby LIC branch. Pay your premium amount by cash, cheque or demand draft at the cash counter.

Making Premium Payment Via Agent

You can pay your premium to your LIC agent in the form of a cheque. However, ensure that the cheque is drawn in the name of the insurance company and that you receive a receipt from them on receiving the payment.

LIC – Customer Service

In case of any doubts or queries regarding your LIC policy, you can always get in touch with them via SMS or phone (check the LIC website for area-wise phone numbers).

SMS LICHELP <policy number> to 9222492224 or SMS LICHELP <policy number> to 56767877 and an LIC executive will call you back to address your grievances.

Additional Reading: All About LIC’s New Bima Shree Plan

Haven’t taken a Life Insurance policy yet? Click below to compare between your options.