There may come a point during the course of your life when taking out a big-money loan becomes something of a priority in order to acquire certain things of necessity, such as a house or a car. Before doing so, however, it is imperative to understand the huge role your Credit Score plays in proving your credit worthiness.

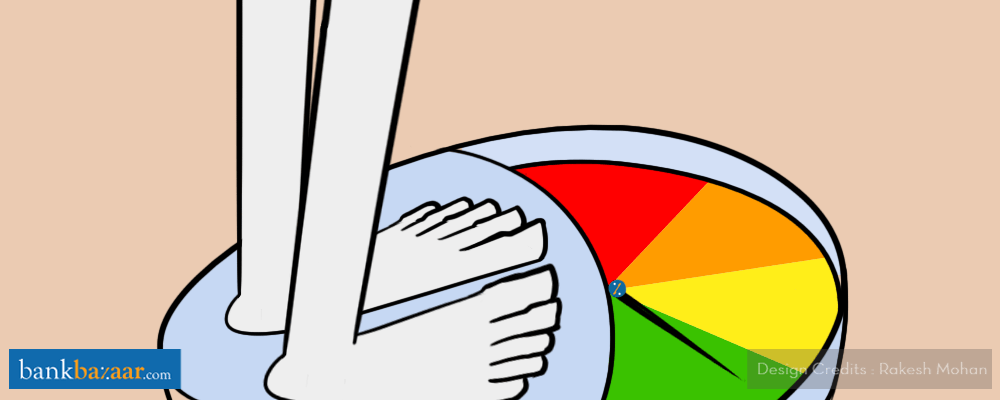

A Credit Score is a three-digit numerical representation or summary of a person’s entire credit history and is generated from the information in your Credit Report. These scores range between 300-900 points and take into account any information relating to the person’s creditworthiness. While most banks have their own cut-off values, a score of 750 or above is generally deemed good enough to obtain a loan, while anything less than that could make the process a bit more difficult.

Additional Reading: What Your Credit Report Says About You

Credit Report

To truly understand what your Credit Score really entails, it is necessary to delve into your Credit Report. Remember, the more impressive your Credit Report is, the higher your Credit Score will be and vice versa.

Additional Reading: How To Read Your CIBIL Report

Payment History

Probably the biggest component in determining your Credit Score is your past record, especially when it comes to making payments on your loan EMIs and Credit Card bills. In a nutshell, if you have a history of making timely payments and have shown sound financial management on a consistent basis, then this will be reflected by a high Credit Score. On the flipside, a credit history littered with late payments, collections, financial negligence or insolvency will most certainly be reflected by a low Credit Score.

Additional Reading: Is Your Credit Score Getting You Down?

Unserviced Debt

Banks and lenders place huge importance on how much you owe before they decide to grant you a loan. Credit Scores can be negatively impacted by the amount of unserviced debt you have acquired and could prove to be a major stumbling block when applying for a loan. This could be in the form of amounts that you owe on Credit Cards, mortgages or any other loans you have taken in the past. Regular payments of loan instalments as well as maintaining a low Credit Card balance can show you in a positive light in the eyes of lenders and keep your Credit Score up.

Additional Reading: How To Repay Your Debts Using The Snowball Method

Duration

Credit Scores also take into consideration the duration of your credit history. It is always to your benefit to have built up a long history of credit usage and as long as it isn’t dotted with account mismanagement. While it takes a while to build up a substantial credit history, it can certainly contribute to raising your Credit Score to more-than-satisfactory levels.

Additional Reading: How To Maintain A Good Credit History

New Accounts

Although not as large a factor as some of the others mentioned previously, the number of new accounts you have opened might affect your Credit Score as well. Opening new accounts while already under financial strain makes you a credit risk, which may put off banks and lenders when the time comes to approach them for loans. It is important to keep in mind that any new account you open creates a credit inquiry on your Credit Report by the financial institution. Too many of these in a short period of time will inevitably bring down your Credit Score.

However, keep in mind that you can make any number of soft enquiries (I.e. enquiries made yourself) without affecting your score in the least.

Credit Mix

Alternatively, your Credit Score also reflects whether you have a good mix of various categories of credit. While it may not make a massive difference to your Credit Score, it can be beneficial to have multiple accounts under different classifications such as mortgages, Credit Cards, etc., as long as they are managed with a good degree of stability and competence.

While there certainly are more factors that go into formulating a Credit Score, a good Credit Score usually ticks all the boxes above, and will go a long way towards proving your credit worthiness to potential lenders.

If you’re wondering what your Credit Score is, you’re in luck. You can check it for free on BankBazaar.