Inflation can eat up your money if you are not careful enough. We tell you how to get around this monster.

Interest rates are starting to fall once more. Bank Fixed Deposit rates are being cut. A one-year deposit will now earn you only about 7.5% whereas a year earlier you could easily get 8.5%. Also, there has been a significant fall in the interest rates in the bond market. AAA-rated bonds now yield 1.5% less than what they did a year ago. And what is making matters worse? Inflation, of course! India’s consumer price inflation is at 5%. This means that if you invested in a financial instrument that gives you 9%, your actual returns are only 4%. Wait! We are not done yet. Do you know the average for the Consumer Price Index (CPI) in India? It was 9% for 6 years from 2007 to 2013. From then on, it has averaged 6%. So, if you take a 10-year average it works out to 7.8%. This means that your real return will be a measly 1.2%!

According to the Reserve Bank of India’s database, the Indian household sector had about 89% of their money invested in traditional fixed-income instruments in 2015-16. These debt instruments include bank and corporate Fixed Deposits, Provident Fund, Post Office instruments, Government & corporate bonds. These instruments provide no more than 9% per annum presently. This means that most householders are generating either low or negative returns when you adjust the returns for inflation. Read on to find out how inflation affects your fixed-income investments and how to escape from the clutches of this monster.

Inflation won’t spare your wallet

In order to understand why inflation of 4% may not be great, we need to look at our neighbours. China’s annual inflation has fallen to 1.3%. Even Indonesia’s inflation is pretty low at 2.8%. Now, isn’t inflation high in India? The question is, would we receive significant respite from inflation in the near future? Not really! Inflation has already fallen quite a bit in the last 2 years, thanks to RBI’s former Governor Raghuram Rajan. There is hardly any room for inflation to fall below 4% in the near future. There are several risks to inflation and these risks will ensure that inflation doesn’t fall significantly. These risks to inflation include continuing quantitative easing by advanced economies putting pressure on commodity prices. When commodity prices rise, inflation will naturally go up. Another risk is that food inflation might remain high because of demand-supply mismatches. Food inflation forms a good part of consumer inflation and if this remains high, inflation will not ease. It remains to be seen if the fall if the fall in prices of pulses will remain so. The most important risk is money coming into India. Surging capital inflows and the subsequent increase in asset prices will only lead to higher inflation rather than lower inflation.

Additional Reading: 5 Tips To Get The Best Returns From Mutual Funds

Even if inflation falls below 4%, as expected, by the end of this fiscal, there will be an element of statistical-base effect of last year, and the numbers could convey a false sense of safety. What is base effect? If the inflation in the corresponding period of the previous year/month is too high, even a small fall will seem like a big fall in inflation. This false effect is known as base effect. This is because inflation is calculated based on rates of the previous year/month as a base. Going forward, food demand is expected to outpace supply for some time towards the end of the year. As a consequence, inflation may start to rise from next year.

Do you know the rise in your kid’s school fees is not included in the inflation figures quoted in the newspapers? Yes! It’s true. The price of the medical treatment that your parents just took isn’t either. If you didn’t know, some of the items from the services sectors, like health and education, are not captured by the inflation figures. However, these are the ones that have a tendency to rise much faster than the general price level. So, it becomes imperative that you be armed against inflation.

That single scoop of ice-cream still tastes the same, but you’re now getting a lot less than you did in 2008. How much do you think ice-cream will cost in #2028?

The iron hand of inflation

Inflation is especially hard on people who get their income from only fixed-income products. This is because income generated from fixed-income instruments remains the same throughout the entire life of the investment. So, the principal and the income of these investments are vulnerable to inflation.

Suppose your investment of Rs. 1,00,000 earns interest at 8% per annum. At the end of 4 years, the nominal value of your investment will be Rs. 1.36 lakhs. But assuming an inflation rate of 7%, your income will be worth only Rs.27,500. We are serious! So the real value of your investment would be Rs. 1,03,700. That means you hardly earned any returns on your hard-earned money.

Inflation also negatively impacts fixed-income investments in another way. As inflation rises, interest rates tend to stay the same. Inflation is closely watched before interest rates in the country are cut. If inflation is high, the RBI will think twice about cutting interest rates. As a result, bond prices drop, leading to lower total returns for existing bond investors. Total return is the sum of the interest income and gains/losses made while trading in the bond. Company bonds are the most traded and offer interest anywhere between 9% and 11%. Prices of these bonds do not fall as much as other bonds as they offer higher interest rates. But remember that prices of bonds issued by automakers, financial institutions, and real estate tend to rise as interest rates fall and they are the riskiest of all bonds.

Additional Reading: 4 Important Tips To Avoid Portfolio Overlap While Investing In Mutual Funds

In a fix?

Fixed-income investments give you the much-needed protection from big risks. But they are not the best investments in times of high inflation. Over the long-term, fixed-income investments will not be able to outperform riskier assets like equities. Over the last 3 years, BSE Sensex has delivered an annual return of 30.90% per year. What has your average bank Fixed Deposit yielded you? 10%? The average for the last 3 years is about 9%. Your Savings Account has always given negative real returns because it has always been at 4%. As you know, if inflation is higher than your investment return, then your money is actually losing its value.

With low returns comes the danger of not reaching your life goals. Suppose you are to retire in another 20 years and require a retirement corpus of Rs. 2 crores (inflation-adjusted). With an average return of 12%, the money you need to save every month will be about Rs. 20,000. But you will need to invest almost Rs. 34,000 every month if your portfolio earns an interest of just about 8% per year. Let’s take another example to see how inflation can change the whole picture. Suppose you and your spouse are in your early 30s and both of you are working. You both expect to retire at 60 years. You have already saved Rs. 6 lakhs towards your retirement. You expect a return of 8% on your investments. Let’s say your monthly expenses are Rs. 56,000. With average inflation at 4%, you will need Rs. 4.78 crore for retirement. For this, you need to save Rs. 5 lakhs every year or Rs. 42,000 every month. Now, what happens if inflation zooms to 7%? You will need Rs. 6.1 crore for your retirement. For this, you will need to save Rs. 6.6 lakhs every year. That comes down to Rs. 57,000 every month. Mind-boggling? That is why you need some smart strategies to counter inflation in the long run. Don’t worry! We have it all ready for you. Read on…

Smart Strategies

You want to give inflation the slip but don’t know how? Not to worry! Here are some strategies that could help you avoid this monstrous monster.

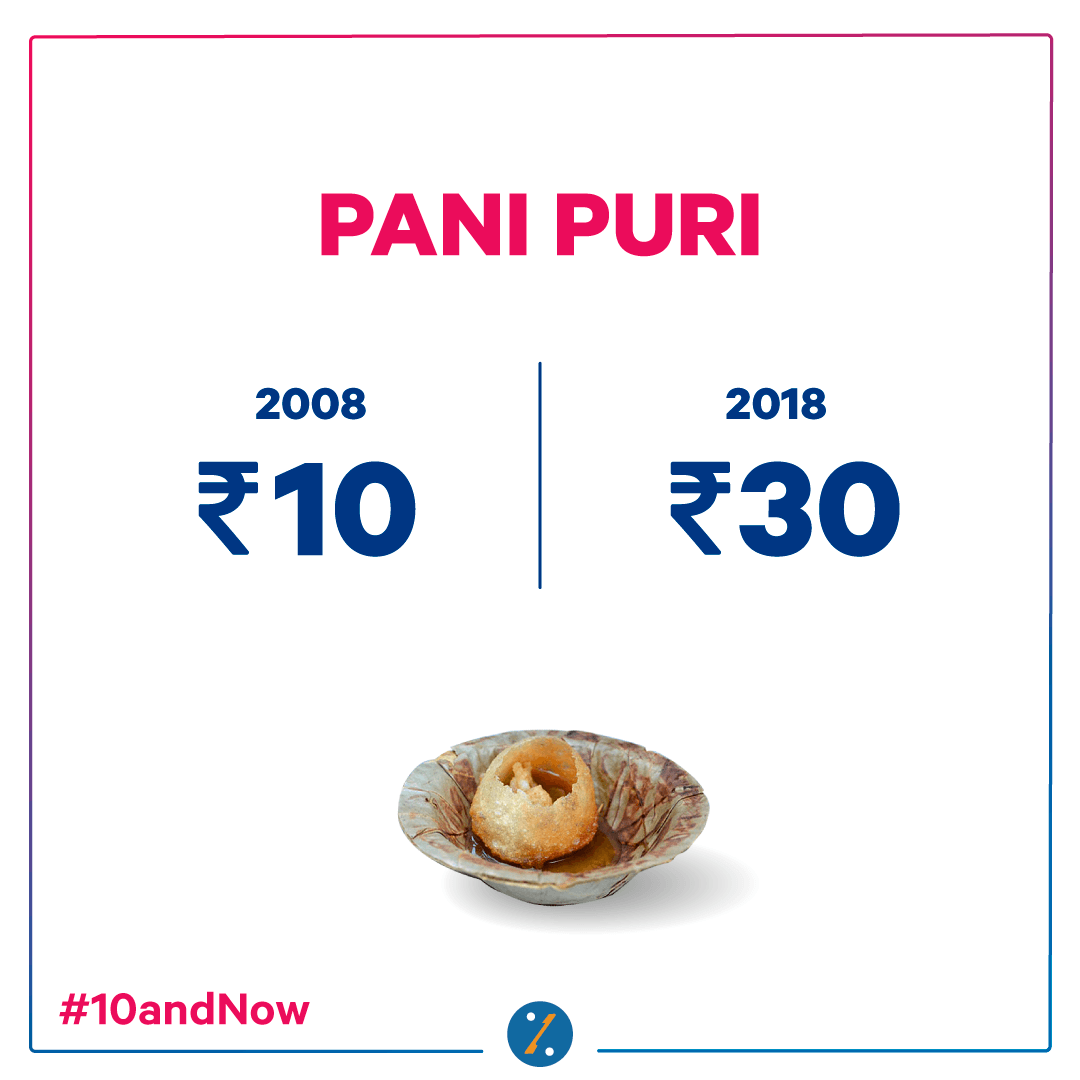

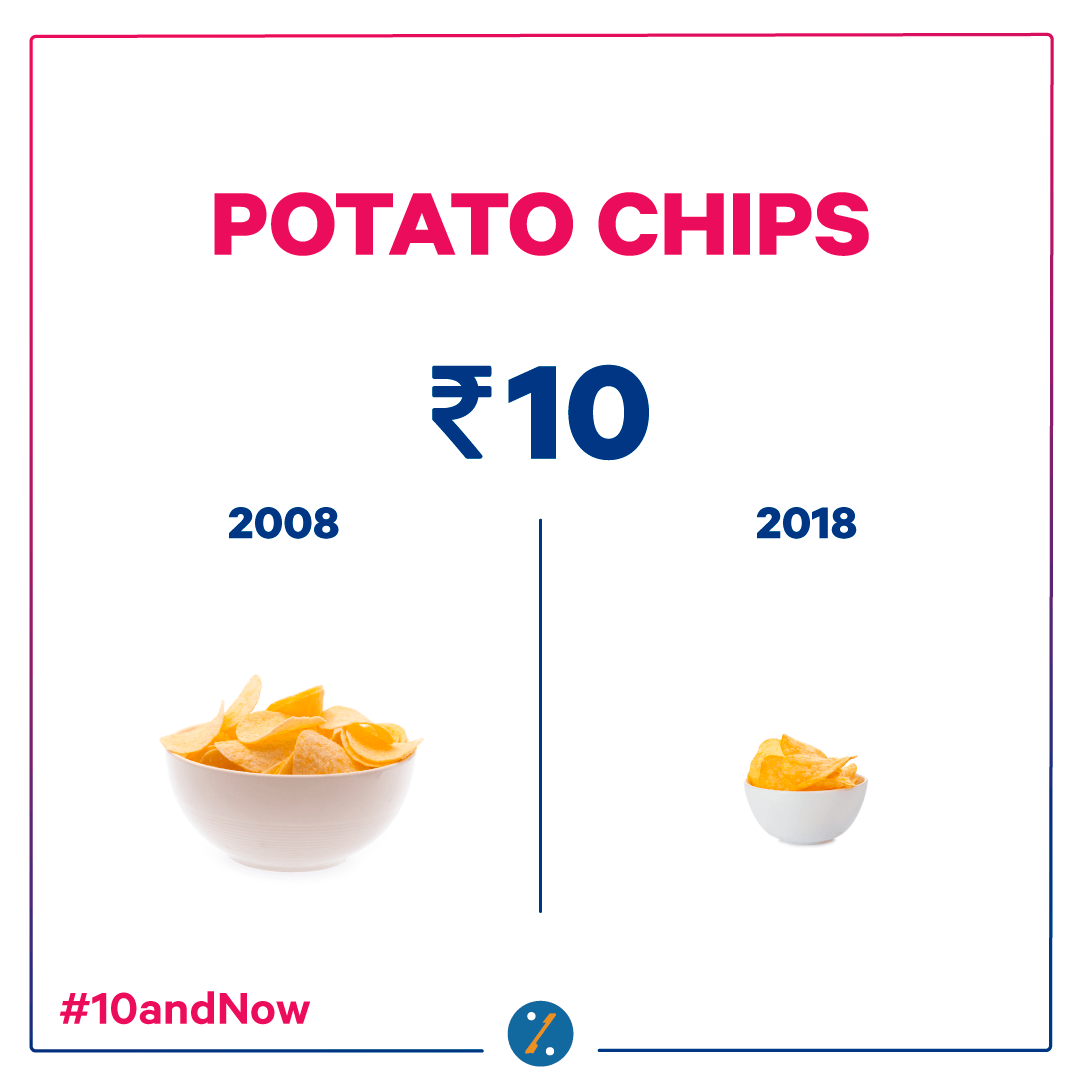

A lot has changed over the last 10 years. Just saving money may not be enough to afford your favorite things in 2028! How much do you think you’ll be paying for each of these 10 years from now?

Climb the ladder: ‘Laddering’ involves continuously reinvesting your money from maturing investments. For example, instead of investing your entire money, say, Rs 3 lakhs, in a 3-year deposit, you can break it up into 3 parts of Rs 1 lakh each. Then invest 1 lakh in a 1-year deposit, 1 lakh in a 2-year deposit, and 1 lakh in a 3-year deposit. After one year, the one-year deposit would mature and you need to invest it in a 3-year deposit. When the two-year deposit matures, you need to invest it in a three-year deposit to receive income in the fifth year. This way you will receive money every year from your investments. You could also use post-office instruments such as National Savings Certificates or Kisan Vikas Patras to create ladders. But note that these investments might not be as liquid as a bank Fixed Deposit. To keep up with inflation, you could increase the investment amount with every subsequent investment. How can someone who is retired take advantage of this strategy? Let’s consider an example. Sam is a retired army officer and has more than 60% of his money in post-office deposits. If he tries laddering, he will be able to create an income stream for his family. He can ladder his post office deposits to ensure liquidity. This will also help him cater to health emergencies.

Additional Reading: Market Crash! Should You Invest In Mutual Funds?

Sure-shot strategy: Long-term bonds with high coupon/interest rates provide the perfect avenue for making the most of falling interest rates. These bonds have a maturity of more than 3 years. You get higher returns as interest rates go down. This is because prices will rise as interest rates fall. You can sell them in the secondary market to make money. You can keep receiving income from them until they are sold. If you want low risks, it is best to stick to Government bonds. As the long-term bonds reach maturity, you can replace them with higher-yield bonds at that point in time.

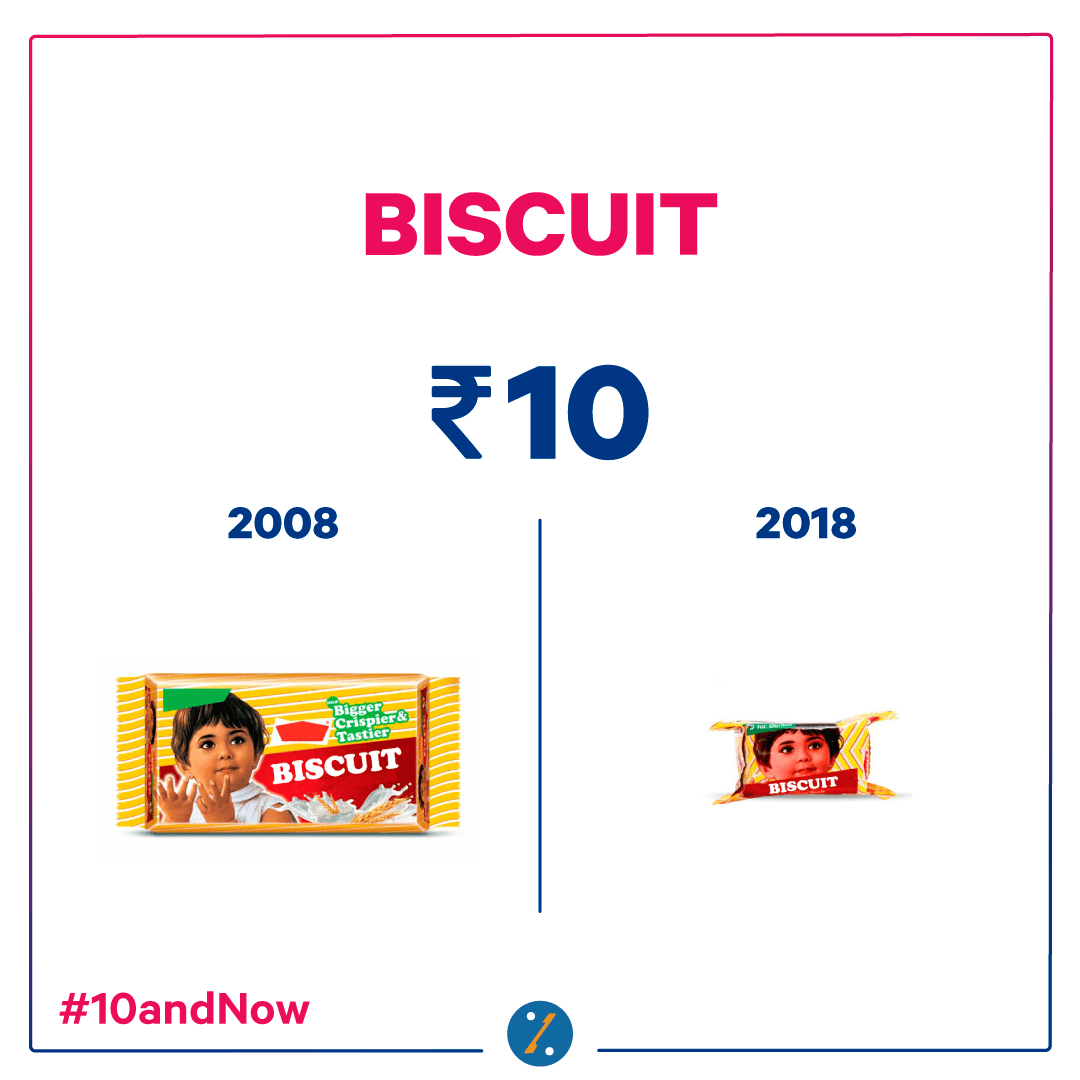

It still costs Rs. 10 but the number of biscuits in the pack have reduced over the last 10 years.

How much do you think you’ll have to pay for biscuits in 2028?

One can go for long-term Mutual Funds which invest in long-term debt instruments. Gilt funds invest in Government securities and bond funds invest in long-term bonds. In the past year, the best funds in the Gilt category have given an annual return of over 10%. The top fund in this category has returned 11%. What about bond funds? Dynamic bond funds have returned an average of over 9% in the past year. The top fund in this category has given a return of 10.10%. How can someone saving for a goal benefit from this strategy? Here’s an example. Mitra is a 34-year-old techie and has a goal of buying a car. Mitra wants to liquidate gold and Fixed Deposits to meet his goal which is 3 years away since he doesn’t like making risky investments such as stocks. Mitra can invest in these Mutual Funds to increase his returns.

Note that holding a debt fund for more than 3 years will give you great tax benefits. This is because long-term capital gains will accrue if you hold your debt fund for more than 3 years and indexation benefit is available for calculating long-term capital gains. You can also consider income funds. These are also debt Mutual Funds that invest in fixed-income financial products but aim to provide regular income to investors. This is best for retirees.

Wait and profit: As a bond approaches maturity, its yield falls while its price moves up. This fact can be used to make profits. How is that? Let us tell you. For instance, you buy a 2-year bond yielding 8%. After a year, its yield will fall to match that of a 1-year bond, which currently yields 7%. If you sell the bond at this juncture, you would get 8% interest plus capital gains. Why capital gains? Capital gains are because the price of the 8% bond would have risen in one year. In fact, prices rise quickly when interest rates fall. If interest rates fall between now and a year, you will benefit significantly. You can use a 6-month bond or a 2-year bond for this strategy.

Additional Reading: How You Can Maximise The Benefits Of A Home Loan

Convert comfortably: Go for convertible debentures. These are debentures that can be converted into shares after a period of time. Convert these to equity when interest rates fall. You could go for both partially and fully-convertible debentures. In partially-convertible debentures, you can convert only a part of your investment into shares. The conversion price is often much less than the market price of the share, resulting in significant capital appreciation when sold.

Grab the dividend: One can invest in preferred stocks that combine the benefits of debt and equity. Preference shares are those that receive payment preference over equity shares when the company declares a dividend or is wound up. They are not listed on stock exchanges and therefore are not subject to price fluctuations. Preference shareholders are entitled to a dividend every year, unlike equity shareholders who receive it only when com the company makes profits. Choose companies with a good dividend record.

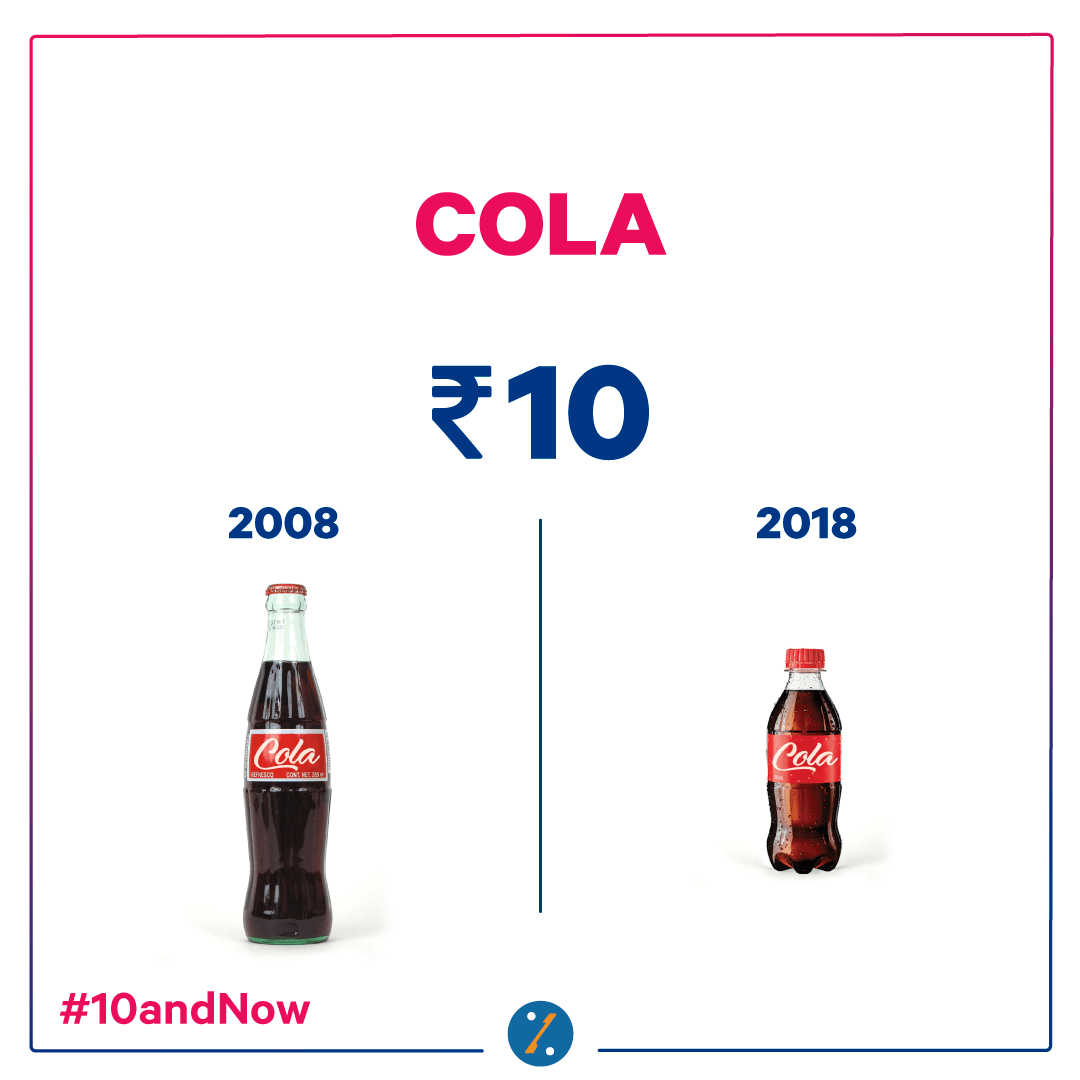

This timeless drink used to quench a lot more of your thirst 10 years ago than the smaller bottle does now. How much do you think it’s going to cost in 2028?

Take on more ‘calculated’ risks: Taking risks does not mean you need to invest in junk bonds. You could go for rated company deposits or corporate bonds which provide a higher return of over 11% even though the risks involved may be higher than traditional products. Riskier bonds/fixed-income instruments depend on the health of the issuer rather than interest rates. In a robust economy, these issuing companies tend to do well.

The ideal portfolio

While fixed-income investments pose little risk to principal, you should remember that it doesn’t protect you from these risks. One is that your assets will not be keeping pace with inflation. Number two is the risk of you outliving your assets. Therefore, investment in riskier assets becomes inevitable.

Also, you need to consider the inflation-adjusted return before creating your portfolio. Remember that the inflation rate to be used is not the same for all. The inflation rate will depend on one’s lifestyle and could range between 7% and 12%. If you have a fancy lifestyle, use a higher inflation rate.

Here is what your portfolio needs to counter inflation.

Parking emergency funds: Don’t let all of your emergency funds earn low returns in your savings account. There are better alternatives. The best way will be to keep 3 months of your salary in liquid funds. These are Mutual Funds that invest in short-term fixed-income securities with maturities of less than one year. The maturity usually ranges between three and six months. They are highly liquid and are available at a day’s notice. They earn much more than your bank Savings Account. According to guidelines laid down by the Securities Exchange Board of India (SEBI), liquid funds need to invest in 90-day instruments. This ensures that the funds are truly liquid. The average return on liquid funds was 7% last year. The top fund in this category has returned 8.32%. This is one of the best ways to counter inflation that might impact your emergency fund.

This popular munchie just doesn’t satisfy your hunger as much as it used to 10 years ago. What do you think will change by 2028?

Apart from this, you can hold at least 3-months’ worth expenses in your Fixed Deposit with an auto-sweep-in facility. This will ensure that you make good returns while your emergency fund remains liquid.

Additional Reading: Can Senior Citizens Get A Home Loan?

For the retired

Inflation has the most impact on the income of retirees. Why? Because they invest only in safe products such as bank Fixed Deposits and most of the time these investments don’t beat inflation. There is no point in investing in only one asset class. There are typically three asset classes. One is stocks, the other fixed-income and the third is cash. Retirees usually invest only in the latter two. Only a well-diversified portfolio can help you counter inflation during your retirement years. Does this mean no dumping of equities? Well, yes! Retirees can keep their exposure to equities through open-ended equity Mutual Funds that can be accessed anytime. Even though stock exposure might seem risky, investing in blue-chip stocks with a good dividend record will ensure that you get income during your retirement and also reap capital gains. There are some other asset classes such as commodities that can also be added to your retirement portfolio. Aren’t commodities risky? Not exactly! Commodities such as gold actually provide a hedge against inflation in the long run.

Here are some options that provide positive or high inflation-adjusted returns. Before investing in these options, it is best to lock in a portion of your money in schemes like the Senior Citizen Savings Scheme which provides a return of 8.3% per annum. This will ensure that you get regular income and your capital is preserved.

Monthly Income Plan (MIP) – MIPs are like any other Mutual Fund scheme except that they invest more in debt than equity. Profits are distributed by way of dividends at fixed periods of time like every month or every quarter. These dividends are tax-free but not guaranteed. MIPs have only about 10% to 20% exposure to equity. MIPs have the potential to deliver superior returns compared to traditional savings avenues. But do not invest a large amount because a market correction could wipe out the returns from the fixed-income portion of MIPs.

Gold – This precious metal offers higher returns when inflation peaks. When inflation rises, the rupee depreciates, making gold expensive. Since this is a riskier option, invest funds that you won’t need for a few years or income from dividend, interest or arrears. Invest through Gold Exchange Traded Funds which can be bought online through demat. Exchange Traded Funds are much like your Mutual Funds, that is, they invest in an asset class on your behalf. For gold exchange-traded funds, investments will be made in gold. However, Exchange Traded Funds are different from Mutual Funds in the sense that here they are listed and traded on stock exchanges. Consider this. The top 10 gold Exchange Traded Funds (ETFs) in India have returned 19% in the past year. The top fund in this category has returned 23%.

It’s just that little bit harder to satisfy your sweet tooth with Rs. 10 now because the size of the chocolate bar shrank with time.

You can even consider investing in gold through bars and coins if you have plans to give them to your grandchildren. You can easily buy a gram of gold every now and then so that you have enough to gift on occasions like your grandchild’s birthday or graduation. Shouldn’t you buy jewellery? That might be a wrong choice if an investment is your objective. Jewellery might go out of fashion, especially if your grandchildren are planning to use it. Also, jewellery has a low resale value due to the making charges and wastage you pay when you purchase jewelry. When you buy gold coins and bars they can be exchanged for jewellery when needed. Also, bars and coins do not have making or wastage charges. Another issue with jewellery is that when you want to exchange it for something new, you might need to go back to the same jeweller. But bars and coins are generally accepted by all jewellers. If you decide to invest in gold, restrict gold exposure to 5% of your portfolio. This is because commodities are volatile and high exposure after retirement could mean sleepless nights for you.

Additional Reading: Threats To Your Retirement Corpus

For those nearing their goals

People often invest with life goals in mind. Even though riskier investments may offer higher returns, it is best to shift to debt instruments when you are reaching your goals to preserve your capital. Ideally, 2 to 3 years prior to reaching a goal, one should shift to debt. It is risky not because equity markets can go haywire and you could lose all your capital gains. So, booking your gains at the right time and moving to debt is extremely crucial. But given the high inflation, one cannot park funds in the savings account. Here is what you can do.

Systematic withdrawal plan (SWP): When you are invested in equities through a Mutual Fund or ULIP you could opt for an SWP. SWP allows you to take your money out of a Mutual Fund investment periodically (monthly, quarterly). This will sequentially reduce your equity exposure by regular partial withdrawal of your corpus. You are usually given the option to either withdraw a fixed amount or only the capital gains you made on the fund. In order to initiate an SWP for your fund, you need to give details such as withdrawal frequency, date of first withdrawal and delivery instructions for the proceeds. Once you give all the details, your withdrawals will be processed automatically. Some Mutual Fund houses need you to maintain a minimum account balance of Rs. 25,000 to Rs. 30,000 in order to avail this facility. The minimum withdrawal amount might be pegged at Rs. 1000. Check with your fund house for the details. When you opt for an SWP, consider taxation for the same. Note that for equity Mutual Funds, long-term capital gains are nil. So, SWP is ideal if you have invested in an equity Mutual Fund. Note that you cannot have a Systematic Investment Plan (SIP) and an SWP on the same fund. So, you can do an SWP only for funds in which you are done investing.

Short-term debt funds: Short-term debt funds are considered to have low to medium risk as they remain invested in fixed-income debt instruments and mostly would give you better returns than a Savings Account or a Fixed Deposit. Rather than transferring the entire corpus to short-term debt funds, you may choose systematic transfer plans (STP) offered by Mutual Funds and ULIPs to gradually switch from equities. Under an STP, an amount you specify is transferred from one Mutual Fund scheme to another scheme of your choice, at regular intervals. These transfers can be weekly, monthly or quarterly. You can consider moving from an equity fund to a debt fund gradually. Suppose you want to transfer funds from scheme A to B and the amount that you want to transfer is Rs. 10,000. The Mutual Fund will reduce the number of units that equals Rs. 10,000 from A and use it to buy the units of scheme B at the prevailing Net Asset Value (NAV) of scheme B. So, you are buying fund B using proceeds from fund A. This is the perfect method wherein you could gradually come out of equities completely by the time you reach your goal. You need to choose the timing well so that you have made the right gains and you will be able to move all the capital to safety by the time you need the money.

Additional Reading: Your Way To Retirement

Taming inflation might not be in your hands but you can definitely stop it from eating into your income and your life.