We have put together a helpful list of Credit Cards for anyone earning less than Rs. 20,000 per month. If you fit the bill, you’ll surely find a card for yourself here.

Who wouldn’t want the number of benefits that come with a Credit Card? Credit Cards can come in handy anytime you need them (provided you use them wisely and pay your bills on time, every time). The present trend is to go paperless and cashless. That’s where a Credit Card trumps cash. And you also get benefits such as reward points, discount vouchers, cashback and freebies along with your card.

We have put together a helpful list of Credit Cards for anyone earning less than Rs. 20,000 a month. In case you earn more than Rs. 20,000 but less than Rs. 25,000 a month, we have options for you too.

Let’s assume the Credit Card applicant is aged 21 years.

Additional Reading: Dining Out Gets Rewarding With These Credit Cards

For a salary range of Rs. 15,000 to Rs. 20,000 a month:

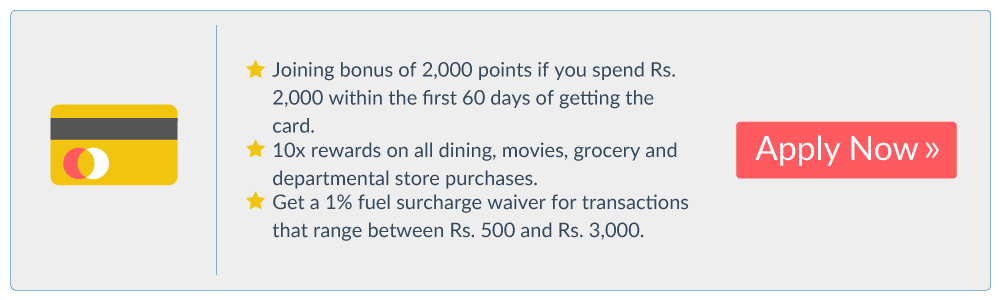

This card comes with a joining bonus of 2,000 points. You just need to spend Rs. 2,000 within the first 60 days of getting the card and you will get the bonus. That’s an easy milestone, isn’t it? You also get 10x rewards on all the dining, movies, grocery and departmental store spends. For all other spends, you will get 1 reward point for every Rs. 100 that is spent.

The best part? You can redeem those reward points against your Credit Card outstanding. Now, how cool is that? Want goodies for those points? Then, you can redeem them for gifts from the SBI Rewards catalogue.

Want more? You also get a 1% fuel surcharge waiver for transactions between Rs. 500 and Rs. 3,000. Spent Rs. 90,000 using the card during the year? Your renewal fee will be reversed. If you are applying for this card with BankBazaar, you can choose the paperless application process for faster approval.

Click here to check your eligibility for this card.

Are you a shopping addict? Then, this card is for you. You get an Amazon gift voucher worth Rs. 500 as joining bonus along with the card.

Just like the SBI Simply Save card, you get 10x reward points for your online spends with exclusive online partners such as Amazon, BookMyShow, Cleartrip and Zoomcar. For all other online spends, you get 5x reward points.

What about purchases made offline? Well, you get 1 reward point for every Rs. 100 spent offline. Want more? Spend Rs. 1 lakh a year using your card and your annual fee will be waived. You also get an e-voucher worth Rs. 2,000. BankBazaar allows you to choose the paperless application process if you are applying for this card with us.

Click here to check your eligibility for this card.

Additional Reading: 6 Best Credit Cards For Movie Buffs

Love train journeys? Then, you should check out this card. You can get up to 10% cashback as reward points for your ticket spends on the Indian Railway Catering and Tourism Corporation (IRCTC) website. This is valid for all AC coach ticket bookings including AC Chair Car.

What else? The 1.8% transaction charge on all the train tickets that you book using the IRCTC website will be waived. Just like the SBI Simply Save card, you get a 1% fuel surcharge waiver for transactions that between Rs. 500 and Rs. 3,000.

Want more? Get 350 activation bonus points if you spend Rs. 500 using the card in the first 45 days of getting your card. For all other non-fuel retail spends, you can get 1 reward point for every Rs. 125 spent. You can earn Rs. 100 on your first ATM withdrawal within 30 days of getting the card. You can also get free train tickets using the reward points. If you are applying for this card with BankBazaar, you can choose the paperless application process for faster approvals.

Click here to check your eligibility for this card.

For a salary between Rs. 20,000 – Rs. 25,000 per month:

Do you love to travel? Then check out the benefits this card has to offer.

You get Yatra gift vouchers worth Rs. 8,250 as a joining bonus. Love airport lounges? Get exclusive access to domestic MasterCard airport lounges. Want more? Get an instant discount of Rs. 1,000 on domestic flight bookings. Going abroad? Get an instant discount of Rs. 4,000 on international flights. You also get a flat 20% discount on domestic hotel bookings.

What about other spends such as groceries purchases, dining and movies? You get 6x reward points for every Rs. 100 spent on those too. For all other spends, the card will give you 1 reward point for every Rs. 100 spent. BankBazaar allows you to choose the paperless application process if you are applying for this card with us.

Click here to check your eligibility for this card.

Additional Reading: Top 5 Credit Cards For Airport Lounge Access

You can’t stop shopping for clothes? Then, you should surely consider this card. You get a free Fashion @ Big Bazaar (FBB) gift voucher worth Rs. 500 as a joining bonus. You can redeem this for items from the fashion segment at Big Bazaar stores or FBB stores.

The best part? Get 10% off on FBB merchandise all through the year. There is no cap on the value of discount that you can get. This card supports contactless payment too. You have to simply wave the card at a secure card reader and your transaction will be done. What else? You get 10x reward points on all spends at Big Bazaar, FBB stores and also dining spends. Just like the IRCTC SBI Platinum card, you get a 1% fuel surcharge waiver for transactions between Rs. 500 and Rs. 3,000. If you are applying for this card with BankBazaar, you can choose the paperless application process for faster approvals.

Click here to check your eligibility for this card.

If you have found your match among these Credit Card options, don’t wait any longer! Get a card today and enjoy the perks that come with going cashless. Didn’t like any of these? There are plenty more for you to choose from.