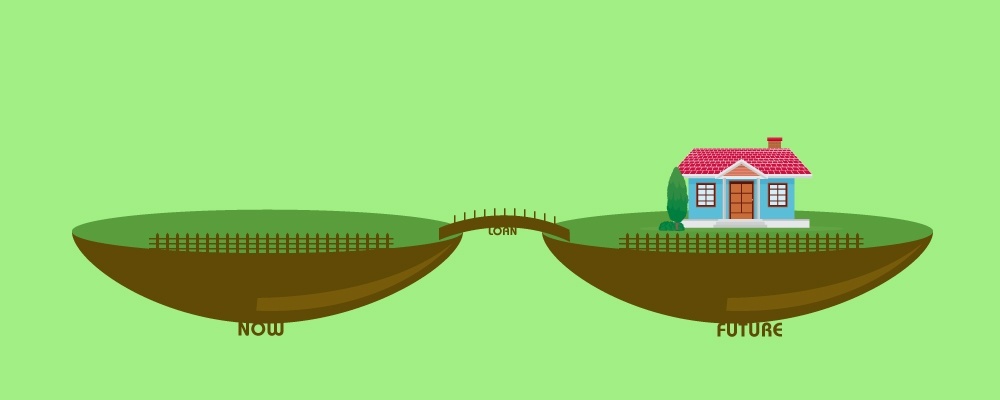

Planning to build your dream home and have found the perfect plot? But finances seem a little tight to manage all the expenses? Well, it’s time to stop worrying about the expenses and focus completely on constructing that dream home. How, you ask? Composite Loans are the answer to your financial problems in this situation. Here’s everything you need to know!

What is a Composite Loan?

A Composite Loan can be availed by an individual to cover the cost of buying a plot and constructing a house on it. It’s a type of Home Loan for those who wish to buy a land and build a house.

A Composite Loan is generally disbursed in instalments, known as tranches. The first tranche is disbursed to buy a plot. The next tranche is released as per the progress of construction. Generally, the disbursal procedure involves four tranches. Each tranche is released after reaching a certain stage of construction.

Loan Amount

Banks generally fund 50 % to 80 % of the market value of the plot. The amount varies from bank to bank and it depends on the following factors: Borrower’s repayment capacity, Property location, Borrower’s age, Income and sources of income (rental income, interest on investments), among others.

Interest Rate

The interest rates on Composite Loans vary according to the bank. Also, if the construction isn’t completed as per the estimated time, you may have to pay extra interest or the bank may recall the loan.

Tenure and Term

The tenure for a Composite Loan usually ranges between 1 to 20 years. The term doesn’t extend beyond the retirement age or 60 years, whichever is earlier. The tenure can extend up to 65 years for a self-employed individual.

Documentation required for a Composite Loan

The documentation required to avail a Composite Loan is similar to documents required for a Home Loan. You will require the documents mentioned below:

- KYC (Know Your Customer) Documents: ID proof (Passport, PAN Card, Voter ID Card, Driving license, Ration card), Address Proof (Utility Bill, Ration Card, Letter from Employer).

- Proof of Income Documents: Bank statements, Salary Slips, Form 16

- Property Related Documents: Own contribution proof, Sanction plan of property, allotment letter, among others

Closure of Loan

Floating rate Home Loans are exempted from prepayment charges as per the Reserve Bank of India guidelines. However, different banks have different rules for prepayment of the loan.

Bank guidelines for sanctioning the loan

You have to do the following for sanctioning the loan:

- You have to provide the cost estimate for the construction of the house.

- The estimate provided by you has to be validated either by an architect or a chartered accountant.

There you have it. Everything you need to know about Composite Loans. If you happen to be on the lookout for a Home Loan, well you’ve come to the right place. We’ve got a range of fantastic offers just for you.