Why are liquid funds more lucrative than a savings account? They not only provide easy access to your cash, but at the same time give higher interest rates than a savings account. Read on to know more.

The COVID-19 situation has taught us the importance of saving money, hasn’t it? Whether it was a personal experience or hearing about the experiences of others, we’ve all learned the importance of having enough funds stocked up in case of an emergency situation such as a medical emergency of an unexpected loss of job.

That said, time and again, we’ve always stressed on the fact that becoming financially independent is one of the first steps to achieving success in life. And, to become financially independent and also to be prepared for life’s curve balls, we need to start saving.

When it comes to saving money, there are a number of investment options from the very old piggy bank to those provided by financial institutions. Out of these options, opening a savings account is the most popular choice of the majority. The reason for the continued popularity of savings accounts is that it is risk-free and easily accessible.

Most of us usually park most of our cash in savings accounts, not giving much value to the other investment instruments. However, the main disadvantage of a savings account is its low-yielding nature. Interest rates offered by savings accounts aren’t as lucrative as the other options.

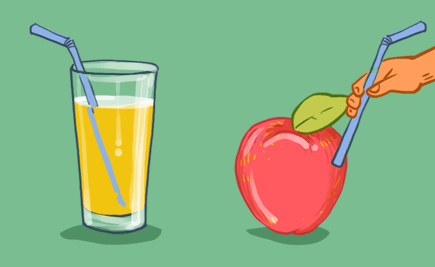

Now you might say that your cash is safe in a savings account and you can access it easily, so you’re better off with a savings account. But what if we tell you about a liquid fund which not only provides easy access to your cash, but at the same time gives a higher interest rate than a savings account. Sounds interesting, right?

What? You want to know more? Okay!

Additional Reading: Liquid Fund Options beyond a Savings Account

What is a Liquid Fund?

A safe option for investing with less volatility and low risk of losing capital. A liquid fund is basically a type of mutual fund which invests in mostly money market instruments such as government securities, treasury bills, commercial papers and such. These assets usually have a low maturity period, so they easily cater to the redemption demands from the investors.

What are its benefits?

- A liquid fund does not have a lock-in period. You can redeem your cash whenever you need it.

- If you place a request for withdrawal, your request will be processed within 24 hours. The withdrawal cut-off time on a business day is 2 PM. So, if you place your request at 2 PM, your money will be credited in your account by 10 AM on the next business day.

- Since a liquid fund primarily invests in fixed-income assets with short maturity periods, their interest rate risks are relatively low as compared to other debt funds.

- Liquid funds are no-load funds, so you don’t have to worry about entry loads and exit loads. So, the cost of investing is nil and so is the penalty for withdrawal.

Liquid funds are touted as one of the best short-term investment options during high inflation periods. You can expect your liquid fund investments to yield good returns when inflation is high. However, the returns may not vary significantly from fund to fund. This is because most of the liquid funds are invested in similar underlying securities.

So, while buying a liquid fund, returns shouldn’t be the only factor that you consider. Other factors such as the credit quality of the underlying asset, the fund house’s track record and the fund’s size should be given equal importance.

Liquid funds are also offered in different plans. These are growth plans, daily dividend plans, weekly dividend plans and monthly dividend plans. As an investor, you have the freedom to choose any plan that is convenient and suits your liquidity needs.

Now that you know about liquid funds, do you think that investing in a liquid fund is a better option than having a savings account? Let us know your thoughts by posting a comment below.