In recent times, whenever the monetary policy is to be announced, one sector which pays a close heed to it, is the real estate sector, hoping that the announcement comes in its favor.

However, like the last 10 times, this time too, when the policy was announced, it bought no cheers to the sector.

The Reserve Bank of India (RBI) raised the interest rates by a higher-than-expected 50 basis points today, stepping up its fight against persistently high inflation. The Reserve Bank of India increased the repo rate to 8%. The market had expected the hike to be around 25 basis points.

As per the RBI announcement

- Repo rate under the liquidity adjustment facility (LAF) is up by 50 basis points from 7.5% to 8.0 % with immediate effect.

- The reverse repo rate now stands at 7.0% with immediate effect.

- The Bank Rate has been retained at 6.0%.

- The cash reserve ratio (CRR) of scheduled banks has been retained at 6.0%

Annual headline inflation has accelerated to 9.44% in June. Inflation rate measured by the Wholesale Price Index (WPI) stood at 9.06% in May and at 10.55% in June last year. This is way ahead of the comfort zone of the government.

Real estate developers and home buyers will feel the pinch of higher interest rates, which could slow down home sales. Higher interest will push up monthly installments for home loans for existing as well as new home buyers. As per Jones LaSalle India, purchasing activity which had seen a drop during the last tranche of interest rate hikes will see a further drop in buyer interest now. Owing to the last 10 rate hikes by RBI, EMIs for housing loan have risen 25% to Rs 980 per Rs 1 lakh of borrowing, and consequently loan eligibility for homebuyers has declined 20%.

In last few quarters

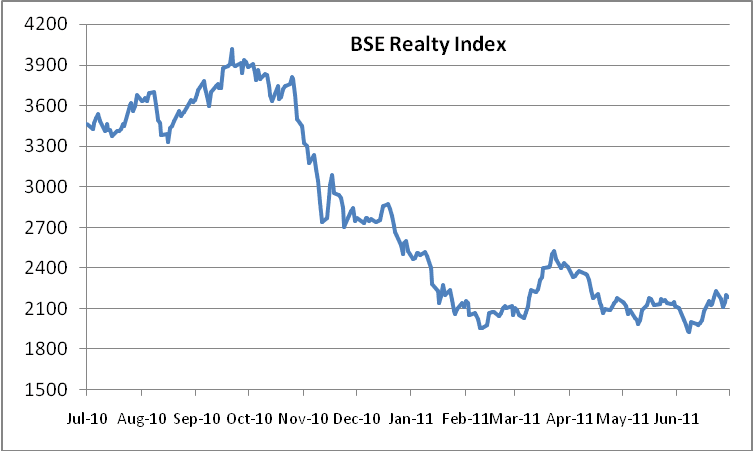

The real estate index has corrected nearly 37% over the last one year. The real estate market is hanging on a sword edge with multiple triggers slowing the market down.

Not only buyers, but even the real estate companies are also in troubled waters. Cost of funds for developers ranges anywhere in the range of 14.5% to 16%, depending on the credibility of the borrower. The rate hike is only making it more expensive. Also the banks have not been willing to lend to the real estate sector in the recent past. The Reserve Bank of India has laid out strict and tedious due diligence standards for banks in sanctioning loans to the real estate sector. The banks have to verify the documents, including cross verification with the local administration, to ensure that frauds are eliminated. RBI has also asked banks to independently verify the authenticity of chartered accountant certificate, property valuation certificate, legal certificate, guarantee/line of credit or any other third-party certification submitted by the borrower. This could delay loan sanctions at all levels and may lead a further blow to the real estate sector that is witnessing slowing sales and rising losses.

Selective lending, higher rates and stricter verifications have forced many developers to tap other sources of funds, which are much more expensive than bank lending.

The industry is facing a crunch and the fund gap over the next five years alone would be as high as US$ 70 billion. The RBI announcement, therefore, could be detrimental to the growth of the industry and economy.

Higher construction costs: The price rise of the key components -steel, cement, bricks and labour are causing worries for the real estate sector. There has been an 18% gross rise in construction cost over the last 2 years (2011 over 2009). As per DLF, steel and cement make 40% of cost of construction and civil costs (i.e. – steel, cement, labour) constitute around 70% of total costs. High global demand for commodities, higher production and transportation costs partly due to higher fuel prices has led to the rise in prices of commodities. Further, demand for skilled labour has led to the labour cost seeing a rise of 25% in the past decade.

While some developers believe that input costs have peaked or are close to peaking, some think that inflationary pressures could likely continue in the near term. This would cause margin erosions for few players, or delays in old projects, changes in product mix and one-time cost adjustments. Some developers have even indicating of passing the increases in costs on to customers, which may see some slowdown in sales.

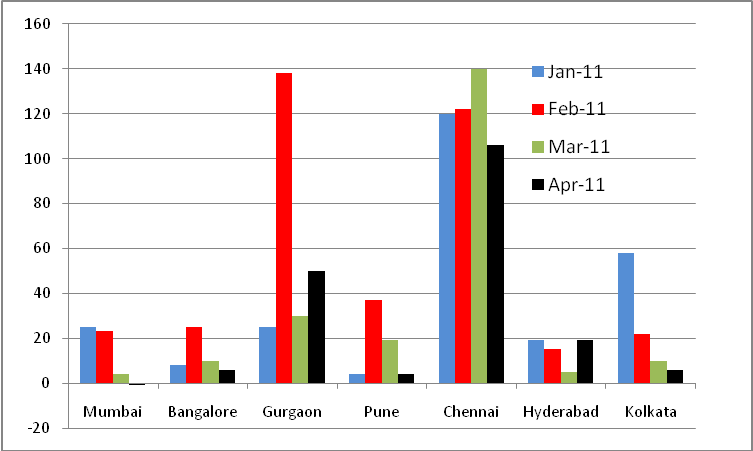

On the sales front, Mumbai, Bangalore, Pune and Kolkata witnessed a further slow down further, while Gurgaon and Chennai gained. Also the new launches were at slightly lower number across pan India. Launches declined to 13.5 mn sq. ft in March 2011 (from 21.5 mn sq. ft in February 2011) as cautious developers faced regulatory and funding hurdles

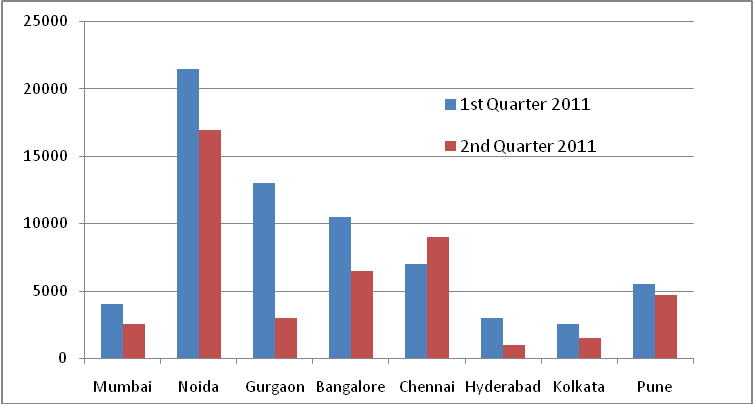

New Launches Trend in Major Cities (No of units)

Source JLLM REIS 2Q11 Data, Morgan Stanley Research

Residential volume growth trend across major Indian cities (YoY volume growth %)

Sources: HSBC Research

On the price front, the movement has been in a narrow range in the past few quarters as developers have held on and buyers have been playing a waiting game. The past few months have puzzled property buyers. On account of conflicting signals on realty prices, the buyers are confused as to wait for prices to fall or rush to buy before they appreciate. The trend of higher prices was followed by the correction in the market.

Now the question is whether this price fall going to continue or there will be an upsurge?

While in the current situation of tight liquidity conditions, increasing inventories, rising interest rates and construction costs, buyers may stand to gain as the real estate developers may have to opt for distress sale to improve their cash flows. However, rising interest rates (expected to go up further as inflation continues to remain high) may make the home loans expensive for the buyers. Even the rental yields are expected to rise as residential prices correct and owners compensate by increasing rental rates.

Hence, if you is looking to buy your first home or upgrade to a bigger house and are ready to invest in it for a long time horizon, then there is no right or wrong time. It may not be sensible idea to time the market to buy a house. However, just make sure that you are diligent in terms of getting the best price deals and proper documentation to have no further worries.

very good writeup!

while cities like delhi and mumabi are showing a marginal correction in 2011 due to the overheated prices cities like bvangalore and chennai are showing an upward movement mainly in high end luxury projects due to the groing base of it sector in these two places. needless to say hyderabad continues to slow down due to the political turmoil. so the best course for the buyers in chenai and bangalore mainly for the luxury section is to go for decisions.

This is an informative article , but note dear would be buyers , i too was on the hunt or look out to buy a property in the range of 25 to 30 lakhs in 2009.This was a time when there was a correction and prices in Mumbai had hit rock bottom .

However when you look at the other Cost Factors which include , Steel , cement , labour please note that this will just go on increasing and contribute towards the cost going up.

I used a simple calculation .1 IF YOU LIKE THE PLACE BUY IT .2. The Population in Mumbai and India is growing so no matter what , people will always want to buy. 3.Link the Money to be invested to Inflation , viz what will your buying power be lets say if you delay the purchase.

Its a Bold move to own ones own house , an indian dream , go live it….dont wait live Now..

In my opinion the cost of materials and labor do not and need not worry any person who is going to construct a new house.But one has to be very careful in selecting the right man for building your house.The MARGIN the builder takes when funds are going to be provided by you is very much on the high side and hence the total cost comes to a hefty amount.In my recent construction i found that the builder was greedy and cheated me to a great extent.I could not do anything excepting to curse the builder.He has done poor work and his margin was too much.When the funds are not borrowed by the builder from other sources and the client meets everything the construction cost should definitely be cheaper.In the name of rise in labor and material costs these builders( not even reputed) with the help of maistrys loot your money.

Reality develping companies must be bycotted by the general public ,They sell dreams than requirement of house.One should buy or build a small house for use than pomp and show.The need of permanent house is for not more than 30 years ,one 's childern grow ,on what job and where they will be settled no body knows .One have to sell ones built up house at lower price when one need money in old age .Do not overinvest in property it does not always rise ,it may fal and will fall in future badly ,becase of changing attitude of young indians .They are more mobile than present generation .Building of flyovers,new roads,bridges changes the price of your house or shop .With time,unused or rented property is bound to decay .Indian law is not in favour of landlords .Never think of buying a house as investment only ,this artificial demand have caused the prices of houses beyond reach .build only for need .Do not destroy agricultural land for profit ,you greedy buiders.Do not get befooled by pomp and show of riches you common man.

Prof.V.K.Khanna