Applying for a Life Insurance Policy sure does come with its own challenges. There are a plethora of questions that you would probably want your Insurance agent to help you with. Some of them could be silly, some maybe downright embarrassing. But, do not shy away from asking them anyway.

These questions could help you evaluate the right policy in the market.

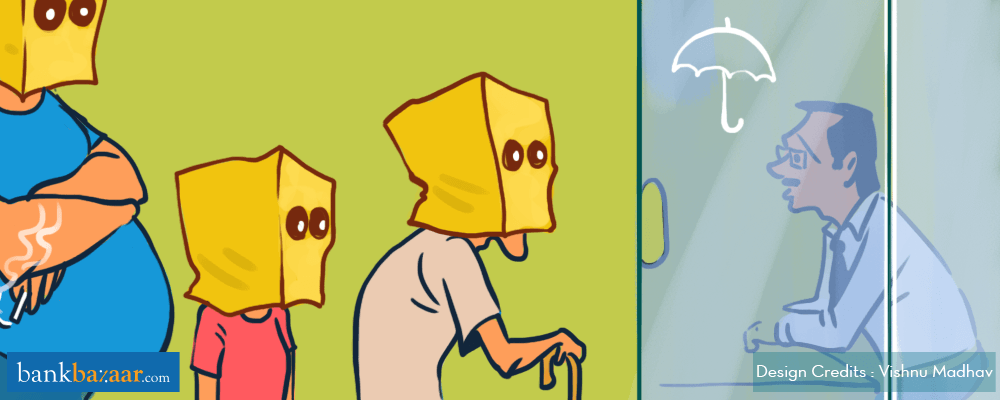

- “Am I too overweight to be getting a Life Insurance Policy?”

No. Not really. While applying for a policy, you will have to undertake a medical examination that will probably check your blood group, your height and yes, your weight! If you are a little overweight or need to shed more than a couple kilos, you might be charged a higher premium, but at least you’re covered in case of an emergency.

Additional Reading: Live (Relatively) Long And Prosper

- “Am I too young for a Life Insurance Policy?”

You’re never too young for anything. There is a common misconception that you don’t need Insurance if you are in your early 20s. In case of an unfortunate accident, you could end up exposing your family to potentially large financial risks. In fact, the younger you are, the cheaper your Life Insurance premium is.

While the opposite is true for older applicants, it is for that very same reason you should think of getting Life Insurance. It could get difficult to find Insurance cover once you’ve crossed retirement age and the premiums get expensive, but there are several whole Life Insurance covers that can protect you till you’ve kicked the bucket.

Additional Reading: Your Guide To Accidental Death And Disability Riders

- “I smoke. I have an alcohol problem. I am bipolar. Will this become public knowledge if I apply for a Life Insurance Policy?”

Insurance agents are prohibited from exposing personal details of a customer. They would probably get into trouble if they made any of your details public. It is always advisable to reveal your accurate medical history while opting for a Life Insurance Policy. Your application could be denied if you lied on your application.

Getting a Life Insurance policy means discussing intimate details of your life with the agent.

Take your time judging the Insurance agent. Ask him any question you can think of because a good agent will always take the time to break every component down and simplify it for you before selling you a policy.

Additional Reading: How To Judge A Life Insurance Agent

What To Consider Before Getting a Life Insurance Policy?

There are many Life Insurance policies in the market, but not all of them are perfect for you. Here are a few pointers to consider before getting a Life Insurance Policy.

- Why get a Life Insurance Policy

Every Life Insurance Policy has different cover terms and offers various benefits. Understanding why you are getting the policy, and at what point in life, should help you pick the right one. You could avail some amazing tax benefits on term Life Insurance Policies as they are exempt from tax under Section 80 C of the Income Tax Act.

- Compare policies

Talk to an expert or an agent about policies. Do not jump at the first good one that comes your way. There are different types of Term Insurance plans that you could choose from. Weigh out the pros and cons of each policy carefully and let an agent help you with the complexities.

- Understanding premium payments

It is important to understand how much you are going to have to pay as premium. Will you be able to afford it? How much would you have to pay? If the premium increases, would you still be able to handle the payments?

- Sifting through paperwork

Read your Insurance Policy carefully. This includes every little clause, like how much the benefits add up to and the effect of the interest rate on the paid premiums.

- Renewing the policy

Make sure to renew your policy at regular intervals and keep abreast of market conditions and their effect on your Insurance policy. You also have the option of switching Insurance providers if you are not happy with your current insurer.

Applying for Life Insurance has become easier than ever. Want a hassle-free experience? We suggest you apply online. Want to compare products? Click on the link below.