Want to make informed investment decisions to ensure financial stability for a long time to come? Here’s what you need to know.

Just as our outlooks, hairlines, and waistlines change as we age, so does our financial environment. To ensure financial stability, our investment choices must change as we pass through different stages of life. We’ll give you a breakdown of the various life stages and dwell on the best investments plans for each phase.

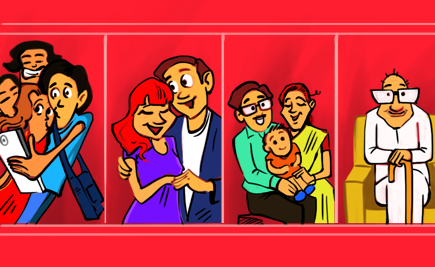

Different life stages. You know them, right?

- Single

- Married

- Married with children

- Retired

Factors That Impact Investments

The following factors have an impact on your investments.

- Your income – Can you invest without money? Of course not! Unless you’re getting money from a job or other sources, you won’t be able to make investments.

- Age matters – The younger you are the more risk you’ll be able to take with your investments because you’ll have fewer responsibilities.

- Savings – The day you start earning money should also be the day you start saving. You should follow a strict savings regime.

- Market trends – Most investments are market linked. Read up about the markets before you start investing.

What stage are you at?

Let’s give you an understanding of investments at various life stages.

The Bachelor Years

These are the years where you have freedom, money and time on your side. However, a little planning can go a long way in helping you in the long run. This is the right time to kickstart investments for your retirement. Although you have many years to go before you become a senior citizen, you can always start building a fund for it, even if it is a small start.

As someone enjoying your first income, keep the following factors in mind when you plan your investments:

- No financial dependents – Most unmarried, earning individuals have no dependents. They spend most of their income on themselves.

- Age is on your side – You have fewer responsibilities when you are young, hence you can make investments with moderate to high market risks.

- Long-term investments – You can safely make long-term investments of 10 to 15 + years.

- How much to invest – You can invest as much as up to 60-70% of your income.

- Ideal investments – The ideal investments at this early stage in your life would be Unit-Linked Insurance Plans, Bonds, Mutual Funds, Public Provident Fund, Life Insurance and Stocks.

Additional Reading: First Job? How To Save Smartly

The Married Years

Getting married is a big step in everyone’s life. It is usually a time where your income needs to not just cover you but also secure the requirements of your dependant. Of course, today’s generation has sprouted a refreshingly large number of couples where the husband and wife both are equal bread-earners. This progressive trend is redefining our definitions of dependants. A very welcome change, indeed!

However, there are some things you can still keep in mind when it comes to investing during these years of your life:

- Financial dependents – Now you don’t only have yourself to look after; you and your spouse need to invest collectively.

- Increased expenses – With two people in the picture, there is an unavoidable increase in the expenses.

- Medium-risk investments – Your investment strategy will need to be altered to suit your new life. You’ll need to focus on finding investments that have medium risks along with medium returns.

- Need monetary liquidity for expenses – You will need to have an increased degree of financial liquidity to be able to tide over emergencies.

- How much to invest – As a married person, since you need to cater to added financial responsibilities, you can consider investing between 30-50% of your income.

- Ideal investments – The ideal investments for you at this stage in your life would be Real Estate, Health Insurance, Debt instruments, Mutual Fund and Equities.

The Parent Years

Post-marriage, when children come onto the scene, these factors need to be given some thought:

- More financial dependents – Now it’s not only you and your spouse that you need to worry about. You have children to take care of too. Welcome to parenthood!

- High expenses and fewer savings – The expenses: savings ratio sees a significant change now that you have become a parent. As the expenses increase, the amount you can put into your savings naturally decrease.

- Low-risk investments with low returns – You’re going to be increasingly risk-averse and will prefer investments that have lower risks. Be prepared to settle for lower returns from these investments.

- How much to invest – At this stage in your life you should be able to comfortably invest 30% of your income taking into consideration your new responsibilities and financial commitments.

- Ideal investments – The ideal investments for you now would be Life Insurance, Health Insurance, Gold, Child Plans, Recurring Deposits, Pension Plans and Unit-Linked Insurance Plans.

The Interim Phase

Your financial state at this stage is purely dependent on how you’ve managed your investment in the earlier stages discussed here.

If all is good, you should be raking in a comfortably pay and your savings should be up to speed. When all is good, the best thing to do is not disturb your stability. Continue to maintain the same balance of your financial factors and you should be quite sorted. It helps to still be critical about your expenses even though you can afford them.

The Retired Years

Now, your focus shifts to kicking back and letting all your earlier hard work cover you for the next few years. After all, your retirement years are meant to be for putting your feet up and not stressing about finances, right?

- Reap investments – At this stage, you should be in a position to sit back and reap the rewards of your investments.

- Liquid funds to cover expenses – You will need liquid funds to cover your day-to-day and monthly expenses.

- Investments with low risk – Your risk appetite would most probably be low considering your advancing age. You wouldn’t want to constantly watch markets fluctuating during your retirement, would you?

- Short-term investments – Any investments you consider during retirement should have short tenures.

- How much to invest – In your retirement years, you can consider investing 20% of your income.

- Ideal investments – A few perfect retirement investments would be Senior Citizen Savings Schemes and Fixed Deposits.

Additional Reading: Investing In Your Golden Years

So, there you have it! Your comprehensive guide to making investments at various life stages. Time to get cracking!