Ever taken out a Personal Loan only to realise it’s more expensive than you anticipated? Refinancing your loan could be your escape route. We’ll tell you all about it here.

Given the present circumstances that involve pay cuts and leave without pay for so many of us, it’s not unusual to find yourself neck-deep in debt. When more than 40-50% of your income goes towards servicing your Personal Loan obligations, it’s time to stop and think. If you’re looking for better terms, then you could consider refinancing your loan.

What is refinancing?

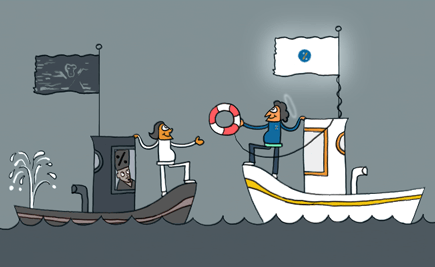

Refinancing is the process of replacing an existing loan with a new one under different terms. In short, the new loan pays off the current debt. However, the new loan should have better terms or features that improve your financial condition. The details depend on the type of loan as well as the lender, but the process typically looks like:

- You have an existing loan that you would like to improve in some way

- You find a lender with better loan terms and you apply for the new loan.

- The new loan pays off the existing debt completely.

- You make payments on the new loan until you pay it off or refinance.

Additional reading: Fixed Or Floating Interest Rate: Which Is Ideal For Your Home Loan Now?

Why should you consider refinancing?

Refinancing is time-consuming and expensive. Moreover, a new loan may not have the same attractive features that an existing loan offers. Despite this, there are several potential benefits to refinancing.

You save money

With refinancing, you get to save money on interest costs. For this to happen, you typically need to refinance into a loan with an interest rate that is lower than your existing interest rate. With long-term loans, you could save significantly on interest.

Lower payments

Refinancing can lead to lower monthly payments. This leads to easier cash flow management and frees up your budget for other monthly expenses. When you refinance, you restart the clock and extend the amount of time you’ll take to repay a loan.

Since your balance is most likely smaller than your original loan balance, and you have more time to repay, the new monthly payment should decrease. However, one caveat to note here is that simply extending the life of a loan would mean paying more for the loan over the long term.

Shorter loan term

Instead of extending repayment, you can also refinance into a shorter term loan. For instance, you might have a 30-year Home Loan, which can be refinanced into a 15-year Home Loan. This move might make sense if you want to make larger payments to get rid of your debt more quickly.

Consolidate debt

If you have multiple loans, refinancing might help to consolidate those loans into a single loan, especially if you can get a lower interest rate.

Change in financial status

Any increase or decrease in your income would affect your ability to service your Equated Monthly Instalments (EMIs). If you’ve faced a pay cut, refinancing your loan and replacing it with a longer tenure loan might be a smart move to reduce your EMIs.

Conversely, if your financial position has improved since the time you took the loan, refinancing your existing loan and reducing the tenure of your loan, could help you quickly pay off your debt even if the EMIs increase.

Additional reading: Applying For A Home Loan After 40? 5 Things You Should Know

What doesn’t change after refinancing?

When you refinance, there are some things that don’t change:

Debt

Even after refinancing, your loan balance doesn’t change. Unless you take on more debt while refinancing, you’ll still have the same amount of your loan balance.

Collateral

If your previous loan was taken against collateral, the collateral will still be at stake for the new loan. For instance, refinancing your Home Loan means you could still lose your home in foreclosure if you don’t make payments. Likewise, your car can be repossessed with most Car Loans.

Payments

Payments don’t disappear after refinancing. Your monthly payments might reduce, but just like any new loan, the payments are calculated according to the new loan balance, term, and interest rate.

Quick pointers

- If you’re considering refinancing, switch the loan during the early stages of its tenure.

- Gain clarity on processing fee, valuation fee and other charges that will be applicable in case you opt for a fresh loan.

- Make sure you maintain an impeccable record when it comes to your loan payments. This will improve your chances of getting an approval when refinancing your loan.

- Remember that your new bank/lender will treat your request for refinancing as a fresh application, which means you will have to go through all the regular procedures once again. This includes legal verification of your property credentials, credit appraisals etc.

Additional Reading: Home Loan Balance Transfer Or Refinancing: Which Is Better?

Now that you’re aware of what refinancing entails, carefully evaluate your position with respect to your existing loans and see if you get a better deal if you opt for refinancing.

At BankBazaar, we ensure that you get the best deals possible on Credit Cards and Personal Loans. Moreover, you can apply for one via a 100% contactless, online process. Why don’t you give us a try?