Are you unsure about having chosen the right investments? Is your portfolio giving you bad returns? Then, your portfolio might need a rejig. Here’s help.

Sampath Kumar is a highly successful software professional in Chennai and has hardly any time for investments. When Mutual Fund New Fund Offerings (NFO) were popular, he used to invest in them because his friends said they were cheap. “It’s just 10 bucks, yaar”, he heard his friends say. Now, he has more than 20 Mutual Fund investments and most of them are duds.

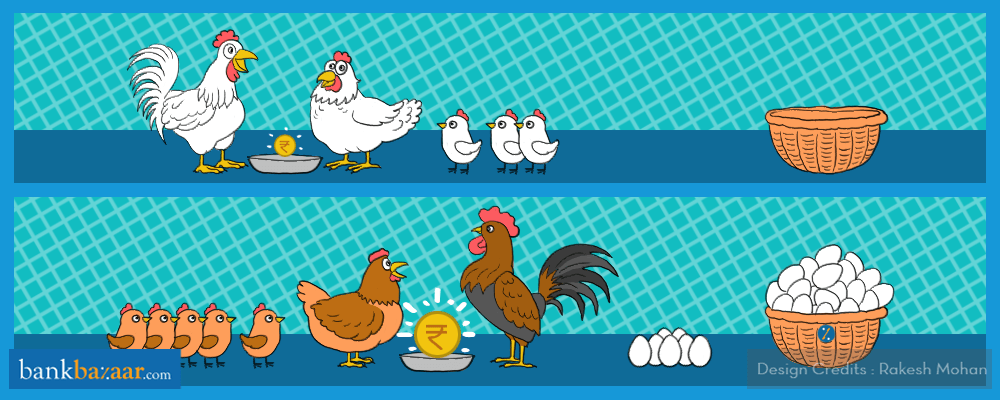

As might be obvious to you, being an investor can be a lot like being a parent. If you don’t keep a close watch on them when they are out there, they might get hurt badly. Just like you need the right balance to bring up children, you need to give the right amount of care to your investments so that you get the best out of them. You can’t buy them and forget them nor can you keep selling an investment every time prices fall.

And just like you need to correct your children when they go wrong, you need to rejig your financial portfolio when it is going in the wrong direction. Also, you need to find out if you have invested in the right financial products.

Additional Reading: Five Tips To Get The Best Returns From Mutual Funds

Why your portfolio might need a make-over

You probably already know Virat Kohli endorses several products. A newspaper recently reported that Kohli is a diversified investor who only goes in for investments he understands. In line with his knowledge, he has invested in many sports teams and a fitness chain. When it comes to other investments, it is said that he believes in getting professional advice. Following Kohli’s style of investing is what we would advise. Before that, you need to understand why your portfolio might need a makeover.

Performance

First and foremost, the performance. Just like in cricket, you are out of form if you don’t score much, and similarly, your portfolio is out of form if it isn’t giving you good returns. Not all your investments can maintain the pace that they start with initially (except for those stable investments such as bank Fixed Deposits).

For instance, a blue-chip stock that you bought many years ago may have lost its sheen due to bad management or a change in management. Similarly, the fund manager of your debt fund might not have been able to manage the constant change in bond yields and prices. So, the NAV might have fallen. If you have many such investments in your portfolio, your portfolio will be in a sorry state. You need to take a portfolio view of all your investments.

Additional Reading: How To Choose A Mutual Fund

While it is okay to have some under-performers in your portfolio, if some investments are weighing down on your portfolio returns, you might need to consider removing them. But keep in mind that as long as your portfolio (as a whole) is doing well, do not shuffle your portfolio too often. To ensure that your portfolio is running smoothly, you need to periodically take stock of the progress of your investments and replace the under-performers with potential winners.

Lifestyle changes

A portfolio makeover might be needed for other reasons too. One is the change in your lifestyle since you started investing. You may have tied the knot, or had kids, or got divorced. If your personal life has changed since the time you started investing, your portfolio might need a rejig. It’s because in these scenarios, your investment objectives change and you might need to reallocate your investments to match those objectives.

Risk profile and cash flow

Another reason why your portfolio might need a rejig is when your risk profile changes. For instance, if you are approaching retirement, you might want to invest in safer instruments as opposed to highly risky investments such as stocks. Another reason is your cash-flow. If your cash-flows change, you might need to change your portfolio.

For example, if you got a salary hike twice in one year (maybe from shifting to another job), you might have more cash in hand. In this case, you need to re-assess your portfolio and see if the cash-flow can be allocated to the right investments.

Once you know that your portfolio needs some tweaks, you must understand the scale of the rejig that is needed. If things are completely out of hand, your portfolio will need a complete makeover. If some of your investments have done well while others haven’t, all you need to do is some portfolio rebalancing. However, understand that the objective behind both rebalancing and a makeover is to ensure that you meet your financial goals by following the allocation that suits your risk appetite, financial situation, age, and lifestyle.

Also, you must be very careful when you evaluate underperformers. Just because an investment hasn’t given you the returns that you expected, it doesn’t mean it is an underperformer. You will need to compare its performance with its benchmark and peers. If it falls short on those counts, you can think about removing it from your portfolio. Remember that you also need to give your investments time to grow.

This is especially true for equity investments. You need to evaluate equity funds only after you have had them for three years. But isn’t that a long time? No. Equity investments perform well only in the long run. In case they fail to perform, you might have to bear the losses. That is why you need to choose your equity investment carefully and give it time for it to grow.

Additional Reading: How Mutual Funds Work

How to tweak your portfolio

There are a few things to be kept in mind while tweaking your investments. If you have little knowledge about investments, take the help of a financial expert. An expert will tell you which investments will suit your financial situation, your goals, your lifestyle and your risk appetite. You also need to take into account costs associated with investing. This might include redemption penalties, commissions (if you choose to invest through an agent) and of course, taxes.

If it is a costly affair to rejig your portfolio, try to weigh the pros and cons to see if a rejig is really required. You also need to ensure that you tweak your portfolio as quickly as you can to minimise losses from the underperformers.

Once you have assessed these crucial aspects, you might need to sell investments in some asset classes while buying investments from another asset classes, to keep things in line with your asset allocation. For instance, during a bull run, you can look at selling some overvalued or not-so-promising stocks and reinvest the money in safer investments. In some cases, to maintain the asset allocation, you might have to sell the underperformer and choose a winner.

If you have extra money, you can choose to invest in an underinvested asset class. When choosing investments you don’t have much knowledge about, you need to do thorough research before investing. If not, identify a financial expert who can help you. It is better to pay for financial advice and choose the right stocks rather than choosing duds and suffering huge losses.

Additional Reading: Portfolio Management Services VS Mutual Funds

Ensure that you have a good mix of all asset classes in your portfolio. If you are young, choose more growth assets such as equity and real estate. If you are approaching retirement, go for safer assets such as a Debt Fund or Fixed Deposit. Whatever your investment may be, assess it regularly and ensure that it is always on the path towards growth.