“There are four things every person has more than they know- sins, debt, years and foes.” – Persian Proverb

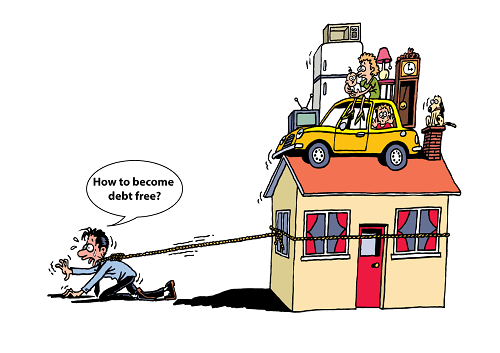

You may owe different kind of debts/ loans: Credit Card outstanding payment, a loan from a friend/ relative, a car loan, a mortgage loan or a personal loan from a Bank. At the same time, you may have personal financial goals that you wish to attain within a defined timeline like buying a swanky car, planning an exotic holiday etc. But, achieving your personal financial goals may conflict with your existing debt. Until you repay the complete debt or become debt free, you may not start saving comfortably for your goals.

Having a debt acts as a hurdle in your way to meeting your personal financial goals. But at the same time, without a debt/ loan, achieving your financial goals might not be possible, like, you may not be able to afford a home without taking a home loan. Since, availing a loan is unavoidable at times, you have to shell out extra money in the form of interest on loan to repay the cost of funds over a period of time. You could have used that extra money (that you are paying as interest) to meet your other goals. Let us find out ways that can help you to get out of this debt trap as early as possible and can further help you to build sufficient savings to meet your other financial goals.

Any loan, be it a loan on your credit card or a home loan, can become less costly if you reduce the time to repay that loan (i.e. repay your loan before time). And that can be possible if you start getting additional income from any source or if you start managing your existing funds better. Now, let us make a fool proof plan to get out of the debt by managing your existing income in a better way. Following are some of the steps that can help you to become debt free earlier than scheduled:

1. Make a realistic Budget & follow it strictly: You need to be disciplined when it comes to following your own rules. First, set up a time based goal to prepay your debt. To do that, plan- how are you going to save extra money from your existing income? The best way to do that is to make a monthly household budget and follow it. The key is to ensure that you make a realistic budget. Following is a sample format that can help you in making your monthly budget:

| Budget | Actual | Variance | |

| Income I | Rs. 50,000 | Rs. 50,000 | 0 |

| Income II | Rs. 65,000 | Rs. 65,000 | 0 |

| Other Income, if any | 0 | 0 | |

| Total Monthly Income | 1,15,000 | 1,15,000 | 0 |

| Expenses | Budget | Actual | Variance |

| Fixed Expenses: | (in Rs.) | (in Rs.) | (in Rs.) |

| Home Loan EMI / Rent Expense | 25,000.00 | 25,000.00 | 0.00 |

| Any other Loan Payment(s) | 3,000.00 | 3,000.00 | 0.00 |

| Insurance – Car | 416.67 | 416.67 | 0.00 |

| Insurance – Life | 2,500.00 | 2,500.00 | 0.00 |

| Insurance – Medical | 1,666.67 | 1,666.67 | 0.00 |

| Childcare – school fee etc. | 4,000.00 | 4,000.00 | 0.00 |

| Other Fixed Exp. | |||

| Other Fixed Exp. | |||

| Total Fixed Expenses | 36,583.33 | 36,583.33 | 0.00 |

| Semi Variable Expenses: | (in Rs.) | (in Rs.) | (in Rs.) |

| Electricity Expense | 700.00 | 850.00 | -150.00 |

| Gas Expense | 560.00 | 560.00 | 0.00 |

| Telephone Expense | 1,000.00 | 1,800.00 | -800.00 |

| Cable Television Expense | 500.00 | 500.00 | 0.00 |

| Internet Expense | 1,200.00 | 1,200.00 | 0.00 |

| Food (Groceries) | 3,500.00 | 3,800.00 | -300.00 |

| Food (Dining Out) | 2,000.00 | 2,800.00 | -800.00 |

| Petrol | 5,000.00 | 4,600.00 | 400.00 |

| Pet Supplies, if any | 2,500.00 | 2,400.00 | 100.00 |

| Medical / Childcare | 1,000.00 | 1,200.00 | -200.00 |

| Other Semi Variable Exp. | |||

| Other Semi Variable Exp. | |||

| Total Semi Variable Expenses | 17,960.00 | 19,710.00 | -1,750 |

| Highly Variable Expenses: | (in Rs.) | (in Rs.) | (in Rs.) |

| Entertainment | 1,000.00 | 1,200.00 | -200.00 |

| Gifts | 1,000.00 | 1,200.00 | -200.00 |

| Shopping | 2,000.00 | 1,800.00 | 200.00 |

| Miscellaneous | 3,000.00 | 3,600.00 | -600.00 |

| Other Highly Variable Exp. | |||

| Other Highly Variable Exp. | |||

| Total Highly Variable Expenses | 7,000.00 | 7,800.00 | -800.00 |

| Total Expenses | 61,543.33 | 64,093.33 | -2,550 |

| Net Income | 53,456.67 | 50,906.67 | -2,550 |

c

Note: The above budget is an indication of a monthly household budget for an Indian family with two earning members. Please apply it as per your actual household income and expenses.

2. Identify the areas to save:

Once you make your monthly household budget, you will get to know your potential to save money every month. Always ensure to check the variations in your budget each month so that you can plan efficiently for your next month’s budget. You can also identify the areas where you can save money each month. For example, in the budget shown above, you can completely control the highly variable expenses and can control the semi-variable cost up to an extent.

| Tip 1: Never spend your money before you have earnedTip 2: For increasing your savings, do a “Need” vs. Want” analysis. And you might wish to discontinue or postpone spending on your “wants” until you meet your financial goals.. |

c3. Start Paying Debt:

After you have identified the maximum savings that you can do each month, you can now plan to repay all your loans. Suppose you have multiple loans like loan on Credit Cards, a home loan and a personal loan. Then you can start repaying the loans that have maximum interest rate first. This is called “Laddering Approach” wherein you pay the most expensive (one with maximum rate of interest) loan first. The sooner you repay higher rate loan, the more you can save. Another criteria is to repay the loan with lowest balance first i.e. you start with repaying the loan that has the lowest balance outstanding first. This is called the “Reverse Laddering Approach” and it helps boosting your confidence to become debt free. It can be challenging for you to prepay your loan but remember- Momentum is the key to achieving your goal.

4. Avoid further debts:

While you are already in a debt, avoid taking further loans. Using a credit card is also like getting a loan. It is not free money. Every time you transact on your credit card, you are borrowing money until you pay it back later—either that month or over a period of months. If you choose to pay the money back over time, the credit card company adds interest (which is extremely high) to your account that you must pay along with the purchase amount. While using plastic money, you don’t realize how much you are spending and eventually your credit card bills exceed your planned expenses. You should be disciplined enough not to overspend. If possible, it is better to restrict using your Credit Cards until you pay off your loans.

| “Some debts are fun when you are acquiring them, but none are fun when you set about retiring them” – Ogden Nash. |

The above points can help you get out of the debt and build wealth. However, it requires a lot of commitment and self-discipline. The key to achieving your financial goals is to keep your calm and keep working on it!