Did you recently get a tax due message from the Income Tax Department which left you like a cat on a hot tin roof? Are you still wondering what could have gone wrong and what you can do about it? Don’t worry, here’s help!

Why is there a tax amount due?

No one wants to see a tax due message when they’re filing their return. But that’s nothing to be apprehensive about; there’s always a reason behind tax being due. Many a time, income for which TDS hasn’t been deducted is missed when your total income is declared. These are few examples which might help you spot the error:

- If you are a salaried employee, your employer is liable to cut tax based on deductions and income information that you provide them with. If you failed to disclose your income from other sources say, rental income, then you will need to pay additional tax on that extra income.

- Working on a freelance basis in addition to your regular job? There is a possibility that you forgot to mention that extra income in your return. These incomes could easily drive you to a higher Income Tax slab.

For example, if your salary income is Rs. 5, 50,000 for the year and you received Rs. 50,000 for a freelancing project, you would fall in the 20% tax slab.

Recently changed your job? Well, you might have overlooked submitting investment proofs to your current employer and so tax will be due. If your current employer does not deduct this tax, you will need to pay the amount due.

- Interest from bank deposits is taxed just like your salary income. Your annual interest income from a bank deposit may be lower than Rs. 10,000 and as a result, the bank may not have deducted tax. You need to add this to your income from other sources while filing your returns.

- Did you redeem money from a Mutual Fund in the year 2015-16? Check if you have had a capital gain. If so, do take this into account when filing your taxes and add it to your total income if the gain is short-term (less than one year) or calculate the profits to compute tax.

Additional Reading: How To Calculate Capital Gains

- It’s also possible that your TDS is not being reflected as per your Form 26AS. Make sure all your deductions are reflecting accurately in the return.

Download your form 26AS and make sure that each of the TDS entries appears in your return. Or, you could have simply made a mistake while filing the income tax return. Check your entries again.

Additional Reading: 10 Income Tax Rules That Will Change From 1st April 2017

What You Can Do?

On receiving a tax due notice, first and foremost, pay the due tax immediately as it may attract interest at the rate of 1% per month or a penalty equal to the outstanding tax.

Here’s a step-by-step guide to help you pay the outstanding tax online:

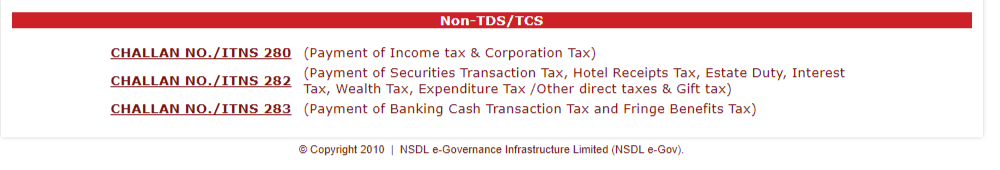

- Select Challan 280: Simply go to the tax information network of the Income Tax Department and select Challan 280.

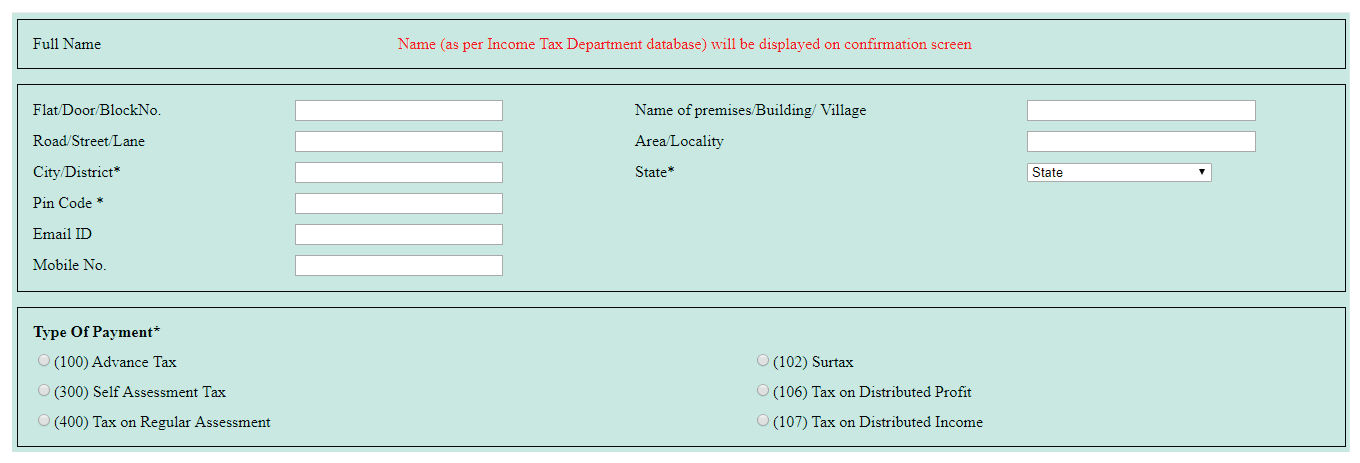

- Enter Personal Details: Enter your personal details such as the address of the taxpayer, type of payment (Choose “(100) Advance tax” if you are paying taxes during the financial year. Pick “(400) Tax on regular assessment” if you get a demand notice from the Tax Department).

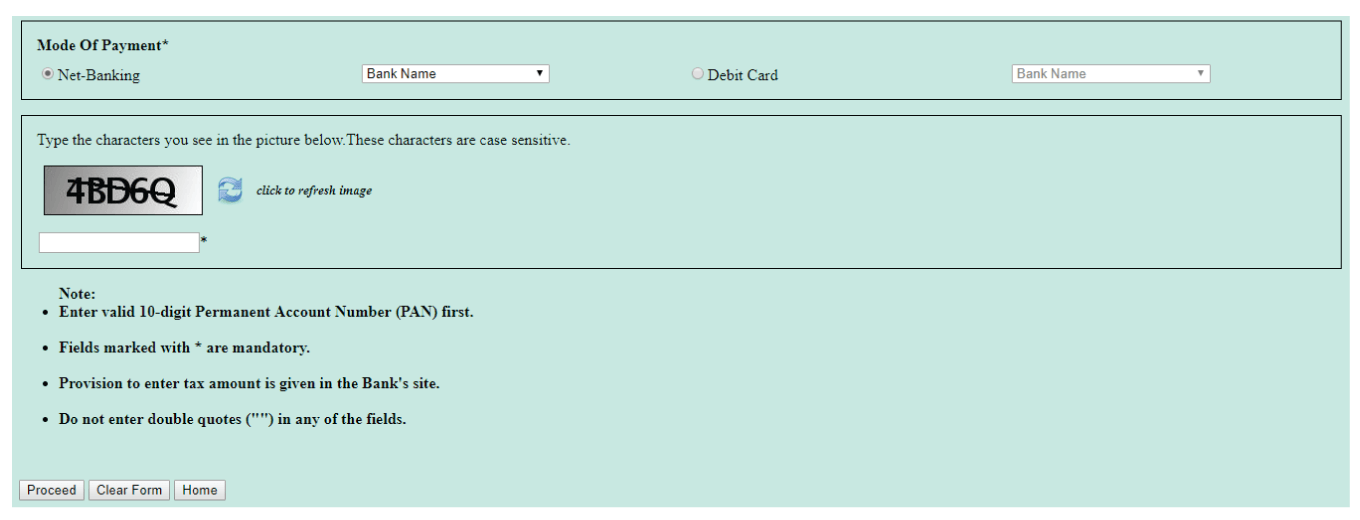

- Double Check: You will automatically be redirected to the net banking page. Cross-check the information and enter the income tax amount to be paid in the income tax field.

- Transaction Process: Your bank will process the transaction online by debiting your bank account, and once successful, it will create an acknowledgment specifying the Challan Identification Number (CIN). You will be able to see details about your payment on the taxpayer’s counterfoil.

- Verify Receipt: Finally, you can verify the challan using the CIN in receipt online through your Form 26AS.

Additional reading: How To Correct Mistakes In Your Income Tax Return

With these handy tips, file your Income Tax Returns like a pro. Want to save on your taxes? You can get a load of tax benefits with a Home Loan!