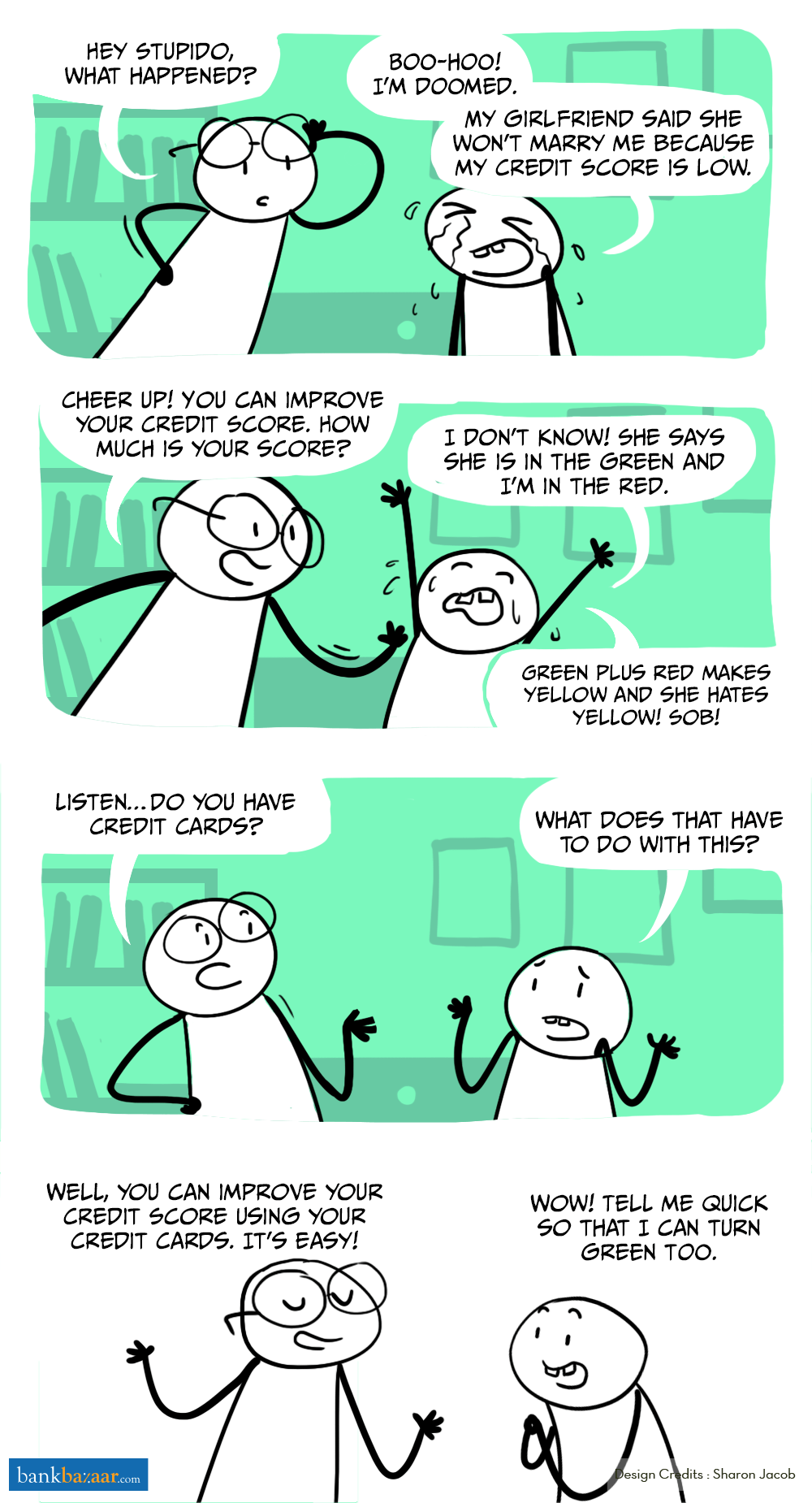

Your Credit Score is nothing to write home about? Don’t worry! Rupeedo will tell you how to improve your score using your Credit Cards.

‘Credit Score’ is a word that you hear every time you apply for a loan. It is a crucial factor which helps determine your eligibility for a loan and could also have bearing on the prospective interest rate. Your Credit Score can decide the kind of loans and cards you can get, the interest rates on those and whether you can opt for a loan extension. Here is how you can use your Credit Card to improve your Credit Score over time.

- Get new Credit Cards but not all at once – Contrary to popular belief, having a number of Credit Cards doesn’t affect your Credit Score unless you start running huge outstanding balances on those cards. Every card helps you build your credit history. Timely payment for every card would mean a better Credit Score for you. However, do not apply for many Credit Cards at the same time. This would not only affect your Credit Score but might also lead to your application getting rejected. Allow for some time to pass between applications so that it doesn’t look like you are a Credit Card guzzler.

- Stick to a 10-30% utilization – Credit bureaus look at how you are utilizing your credit. So, use only part of your credit limit. For instance, if your credit limit is Rs.1,00,000, use just Rs.20,000-30,000 a month on it. This would make you look like someone who uses credit in a responsible manner. This is where multiple cards help. You can split your spending across cards.

Additional Reading: 4 Extremely Simple Ways To Ace Your Credit Score

- Pay on time, every time – It is extremely important that you pay your outstanding balances on time every time. Every time you miss your Credit Card payment, it hits your Credit Score. And every time you repay on time it improves your Credit Score.

- Rein in add-on cards – You cannot possibly control spending limits on your add-on cards if you give it to family members who don’t live with you. Also, the credit limit for your Credit Card would include that of your add-on cards. If the ones who use your add-on cards spend recklessly, it will affect your Credit Score.

- Don’t close old cards – Typically the older your repayment history the better would be your Credit Score. So, do not close your old cards. Instead, you can use them to pay routine bills such as your electricity bill or phone bill so that your repayment history remains intact.

- Choose the right cards – It is important that you choose a card that suits your needs and your lifestyle. This will help you stick to your budgets and also ensure that you are not stuck with big balances. For instance, suppose you are going for a co-branded Credit Card that offers 10% cashback on online shopping if you spend Rs.10,000 a month. You might be tempted to overspend on your card and buy things that you don’t need just to get that cashback. It is better that you choose a card that has offers for online shopping but doesn’t have any conditions attached.

Additional Reading: Popular Co-Branded Credit Cards In India

- Apply only when you are eligible – This is an unknown factor for many. Any rejections on your Credit Card application could affect your Credit Score. This is why it is important to choose cards that you are eligible for. This is where BankBazaar helps. Based on your inputs (such as your salary, existing cards, their credit limits, etc.), BankBazaar can provide you with the cards that you would be eligible for. This minimises the risk of your application getting rejected. Also, note that your Credit Score determines what kind of card you are eligible for and what interest rates could be offered on the card.

In case you want to spend more on your card, here’s how to do it smartly.

- Raise your credit limit – You could ask your bank to increase the credit limit on your present card. This way your credit utilization will remain stable even if you want to charge more to your Credit Card.

So, using your Credit Card wisely has triple benefits: One is that your Credit Score improves; secondly, you don’t get caught in a debt trap and the third is that you become eligible for better offers on financial products in future. So, go ahead apply for that card but don’t go overboard.

Hi I paid total my credit card bill amount 1year before but still my civil is not increased. Could you please help us these regard.

Thanks..

Raghavendra

Hi Raghavendra,

It takes time to improve a Credit Score. Check out this blog post for tips on how to improve your Credit Score.

Cheers,

Team BankBazaar

HEY

MY CIBIL SCORE IS 521 AS SHOWING ONLINE… HOW CAN I APPLY FOR A CARD OR LOAN……

Dear Rohit,

We suggest that you take steps to improve your Credit Score before applying for a Credit Card or Loan. Please check these links for tips to improve your Credit Score – How To Improve Your Credit Score Quickly and Tips To Improve Your Credit Score.

Cheers,

Team BankBazaar