There are many additions to the new Income Tax Return forms for the Assessment Year 2019-20. All the details you need are right here.

It’s not going to be easy hiding anything from the Income Tax department. Every year disclosure requirements are getting added. This means you may have to declare all your assets such as Fixed Deposits, Home and equities in your Income Tax Return (ITR) form. Here’s what’s in store for 2019-20.

The New Forms

The Income Tax department has come up with new ITR forms. This is for taxes applicable for Financial Year (FY) 2018-19 and Assessment Year (AY) 2019-20. The main changes include providing details such as whether your house property is self-occupied, let-out or deemed to be let-out, days of residency in India, details of unlisted shareholdings and directorship in a company. The changes are different for various forms. Let’s look at the latest ITR forms and the changes.

Additional Reading: File ITR And Submit ITR-V Online Through Your Bank Account

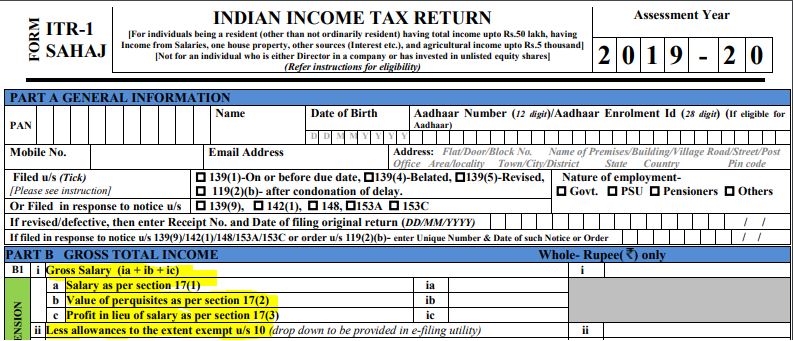

ITR-1

You can use ITR-1 only if your salary income is up to Rs. 50 lakhs, you have one house property and have income such as interest income. Earlier those who worked as a director in a company or held unlisted shares filed ITR-1 or ITR-4. However, now you cannot use these forms if you have invested in unlisted equity shares or if you are a director in a company.

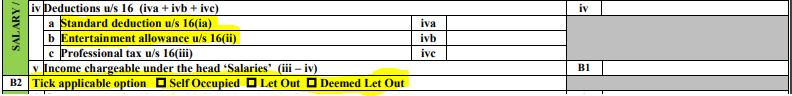

The main change in the form is that you now have to provide a break-up of your salary. You also have to declare the value of perquisites provided by your employer and profits in lieu of salary. You also need to provide details of allowances that are exempt from tax. This will be allowances like House Rent Allowance (HRA).

You can now claim a standard deduction of Rs. 40,000 using this ITR form and entertainment allowance. And if you are holding a house property, you have to specify whether it is self-occupied, let-out or deemed to be let-out.

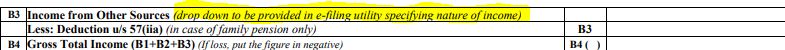

Another addition is that earlier you had to provide only the income from other sources. Now you will have to specify the nature of income that you receive from sources other than salary. This will include interest from bank deposits.

If you got capital gains from the sale of any immovable property in the relevant FY, you have to report it in the ITR form along with details such as the name of the buyer, their PAN, percentage of share sold and sale price.

Additional Reading: Here Are Some Unusual Ways Salaried Individuals Can Save Income Tax

ITR-2

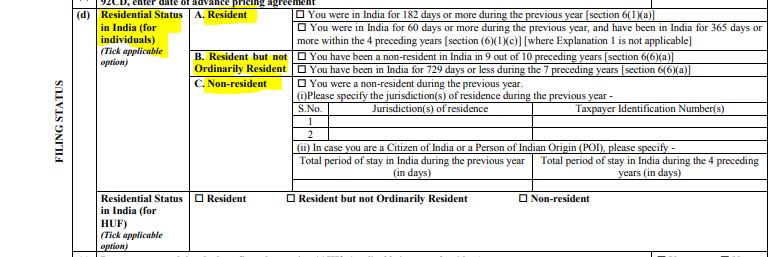

This form is for individuals and Hindu Undivided Families (HUF) who don’t have income from profits or gains from business or profession.

The main change in this form is that the taxpayer has to provide the status of their residency. That is, they have to specify whether their status for the FY was a resident, resident but ordinarily resident or non-resident. Residents are those who have been in India for 182 days or more in the relevant FY. In the case of non-residents, the jurisdiction of residence has to be provided.

If you worked as a director in a company in the relevant FY, you have to provide details such as the name of the company, your PAN and Director Identification Number (DIN).

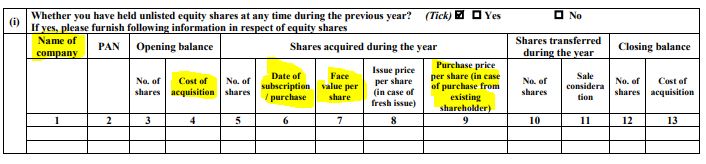

If you have invested in unlisted equity shares, then you have to provide the details in this ITR form. You will be required to give details such as the name of the company in which you hold shares, the cost of acquisition, date of purchase, the face value of the share and purchase price.

When using tax deduction under 80G, you will have to specify whether the contribution was made by cash or other modes.

Additional Reading: All About Income Tax Filing

ITR-4

If you have a cumulative income of up to Rs. 50 lakhs and are resident or ordinarily resident, you can use this form.

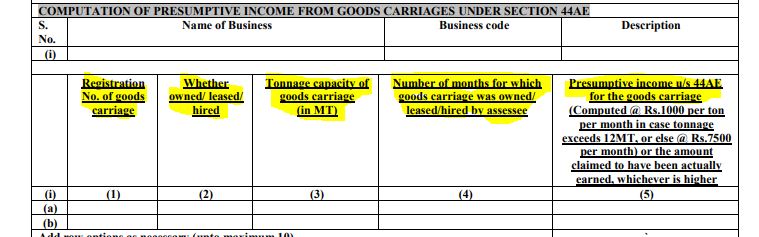

The main change in this form is that if you have a business of hiring and leasing goods and have opted for presumptive taxation scheme, you will have to provide details such as your registration number, whether the goods are owned/hired/leased and tonnage capacity.

One important change that applies to all taxpayers is that if you are over 80 years of age and file ITR-1/ITR-4, you can use the paper filing facility. Rest of the taxpayers have to mandatorily file their ITR electronically. If you have an income of up to Rs. 5 lakhs and want refunds, you will have to file ITR in the e-format. This will be applicable for ITRs starting from FY 2018-19.

Yet to start planning your taxes? Just invest in any of the tax-saver Fixed Deposits available on BankBazaar.com.