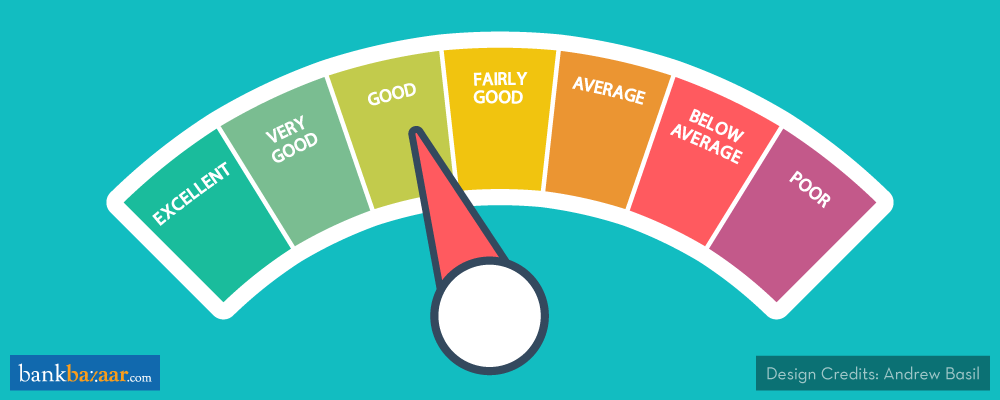

Just as pathological test results show your underlying health condition, your credit report indicates how financially healthy you are.

Your credit report is what lending institutions such as banks look at while determining if you’re worthy of a loan. It is a summation of your loan and Credit Card history, and it will reveal if you’ve been able to repay your loans in a timely fashion.

You may have a large income, money safe in the bank or locked in investments. But it’s your credit score and credit report that reveal how well you’ve managed to balance your responsibilities towards your lenders.

You may be late paying an EMI or be lax in settling a Credit Card balance. But your credit report remembers. Everything you do with your loan or Credit Card is continuously reported to credit research firms, who then compile this information into a report that would be shared with any lenders you approach for a fresh loan or Credit Card.

When they look at your credit report, here are some of the things they will understand about you:

Timeliness

Timely repayment of financial dues plays a significant role in the computation of your Credit Score. CIBIL, for example, gives timely repayment a weightage of 35% in the calculation of the CIBIL score. While a one-off case of delay in repayment may be ignored by the credit company, repeated delay in payment of Credit Card bills and loan EMIs impacts your Credit Score negatively. If you are making timely repayments towards your dues, you are understood to be committed to the repayment of your dues.

Trustworthiness

Occasionally, you may find it difficult to repay your debts in a timely fashion. But when a due date is missed multiple times, your intent to repay may be doubted. Timely repayment of your loan EMI or financial dues increases your trustworthiness, thus encouraging banks and financial institutions to consider you as an eligible borrower. Trustworthiness can even fetch you discounts on interest rates for loans.

Credit Hungriness

A credit report also reveals your credit utilisation ratio (CUR): the percentage of your available credit that you use. For example, if the credit limit on your card is Rs. 1,00,000 and if you spend Rs. 30,000, your CUR is 30%. The higher your CUR is, the more you’re revealed to be in need for credit. This remains the case even if you’re able to settle your credit card dues in a timely fashion. Therefore, a large dependence on a Credit Card, whatever be the reason, may reveal you to be credit-hungry.

If you haven’t seen your credit report yet, get a free one here. Take stock of where you stand with respect to your dues. If you find your Credit Score below the 750 mark, you should take steps to improve it.

BankBazaar is your one-stop shop for your personal finance needs! Visit our Maha March Bonanza to shop for a Personal Loan, Car Loan, Home Loan or Credit Card with free gift vouchers (T&C Apply)