The Pradhan Mantri Awas Yojana (PMAY), also known as the Housing for All 2022 Scheme, has garnered widespread attention. Read on to know all about it.

The Pradhan Mantri Awas Yojana (PMAY), also known as the Housing for All 2022 Scheme, has garnered widespread attention due to the array of benefits it provides. PMAY was launched on 1st June 2015 by Prime Minister Narendra Modi and aims to provide affordable housing to the urban poor by the calendar year 2022.

As part of this scheme, the government is building affordable houses using eco-friendly construction material and the allocation of the same will take place based on strict eligibility criteria. This will ensure transparency and availability of the scheme to the right populace. Eligible individuals can buy a house under the PMAY scheme by availing loans at subsidised rates via the Credit-Linked Subsidy Scheme.

-

Overview of the PMAY scheme

- Beneficiaries can avail loans at a subsidised interest rate of 6.5% for a term of 15 years.

- Ground floor preference will be given to differently abled and senior citizens.

- Construction of houses will happen using sustainable and eco-friendly technologies.

- The construction will take place in 3 phases and will cover 4041 statutory towns (urban locations).

- Preference will be given to 500 Class I cities.

- The credit linked subsidy can be availed from stage 1

Additional Reading: Does It Make Sense To Opt For A Joint Home Loan?

-

Features of the PMAY scheme

The scheme has been designed to include all sections of the society. The plan is split into two halves – PMAY Urban and PMAY Rural, and each half has its own range of benefits and features which were crafted keeping the target audience in mind.

For example, PMAY Rural is focussed specifically on the people residing in rural areas, whereas the urban component is directed towards people living in cities. Here’s a look at the features.

-

‘In-Situ’ Slum Rehabilitation

This component is meant for citizens residing in the slums. They can select this to get a grant of Rs. 1 lakh from the government and use it for the construction of an all-weather house.

-

Beneficiary Led Construction

This component is designed to provide assistance to those families that belong to the Economically Weaker Section (EWS) category (more on this later in the article) who would like to either construct a new house or enhance an existing one.

However, the beneficiary must own land. In this case, the central assistance of Rs. 1.5 lakhs will be provided to the recipient for the construction or enhancement of the house.

-

Affordable Housing in Partnership

This component offers central assistance of Rs. 1.5 lakhs for the construction of a new house, provided the beneficiary does not own land/house and cannot afford to build one with the help of a Home Loan. This financial assistance will be provided to houses that are being built in partnerships with the help of States/Union Territories.

-

Credit Linked Subsidy Scheme

This component is for those citizens who can afford to construct/purchase/enhance a house with the help of a Home Loan. A subsidy will be provided on the interest component of the Home Loan EMI provided the eligibility criteria are met. The maximum subsidy that can be availed is Rs. 2.67 lakhs and one can apply for it at all the major banks.

Additional Reading: 5 Ways A Joint Home Loan Works To Your Advantage

3. Eligibility criteria for the PMAY scheme

Who will be eligible for the PMAY scheme and what criteria is the government considering for house allocation and loan services?

The government will draw a list of beneficiaries based on the Socio-Economic and Caste Census of 2011 (SECC 2011). This list will be further built on after consultation with the village panchayats and tehsils. Doing so will ensure that only deserving individuals get the benefit of the PMAY scheme and the house allocation process stays transparent.

- One of the criteria to get benefits under the PMAY scheme includes having an annual household income of between Rs. 6 lakhs and Rs. 18 lakhs. An applicant can include the income of the spouse to the total household income to make the cut.

- All women who hold Indian citizenship can apply for the scheme and no other criteria will be considered for them.

- Beneficiaries can apply for the PMAY scheme only to buy or construct a new house. The scheme cannot be availed for building on an existing house. If an individual already owns a house then he/she will not be eligible for the scheme.

- No member of the beneficiary’s family should own a ‘pucca’ house in any part of the country.

- Others who can apply for this scheme include individuals belonging to the low income group (LIC), economically weaker sections (EWG) of the society and scheduled tribes and castes.

Individuals who can avail housing facilities under the PMAY scheme have been categorised into six groups. The following table talks about the eligibility criteria for each group.

Groups |

Eligibility Criteria |

| Economically Weaker Section (EWS) | Individuals whose household income is under Rs. 3 lakhs. Applicants under this section will have to provide relevant income proof. |

| Light Income Group (LIG) | Individuals with an annual household income of between Rs. 3 lakhs and Rs. 6 lakhs. Applicants under this section will have to provide relevant income proof. |

| Medium Income Group (MIG1) | Individuals whose annual household income is below Rs. 12 lakhs. Applicants from this category can avail loans of up to Rs. 9 lakhs for the construction of a house. |

| Medium Income Group (MIG2) | Individuals whose annual household income falls between Rs. 12 lakhs and Rs. 18 lakhs. Applicants from this category can avail loans of up to Rs. 12 lakhs for construction of a house. |

| Minorities | SC/ST/OBC come in this group. Applicants will have to provide relevant income and caste certificates. |

| Women | Women belonging to EWS/LIG categories will be considered eligible for the PMAY scheme. |

Click here to know about the subsidy available on loans for different amounts under each category.

Additional Reading: Want To Take A Home Loan? Here Are The Latest Interest Rates

4. Eligibility criteria for getting a subsidy under the PMAY scheme

The Ministry of Housing and Urban Poverty Alleviation has partnered with some leading banks to help provide loans under PMAY at a subsidised rate. While the banks offer PMAY applicants loans at cheap rates, the government pays the banks the balance interest rate on behalf of the applicant.

Click here to check out the list of banks and other financial institutions that offer loans under the PMAY scheme.

-

How to Apply for PM Awas Yojana Online

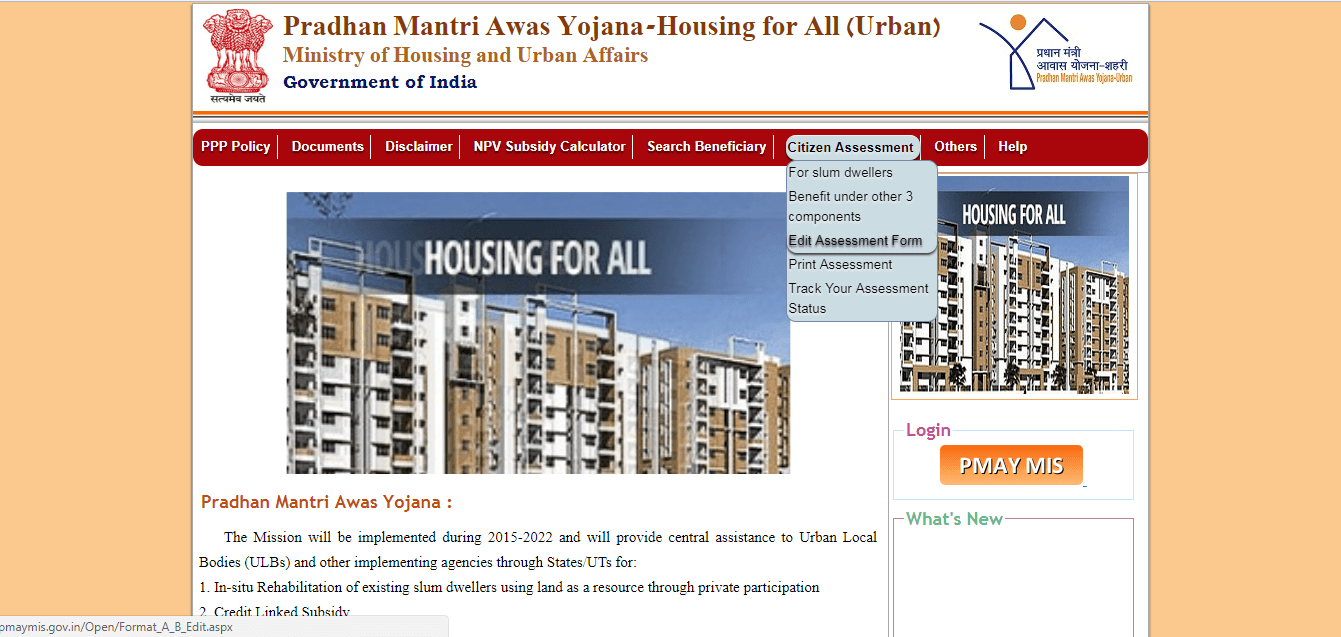

- Visit the PM Awas Yojana official website (http://pmaymis.gov.in/)

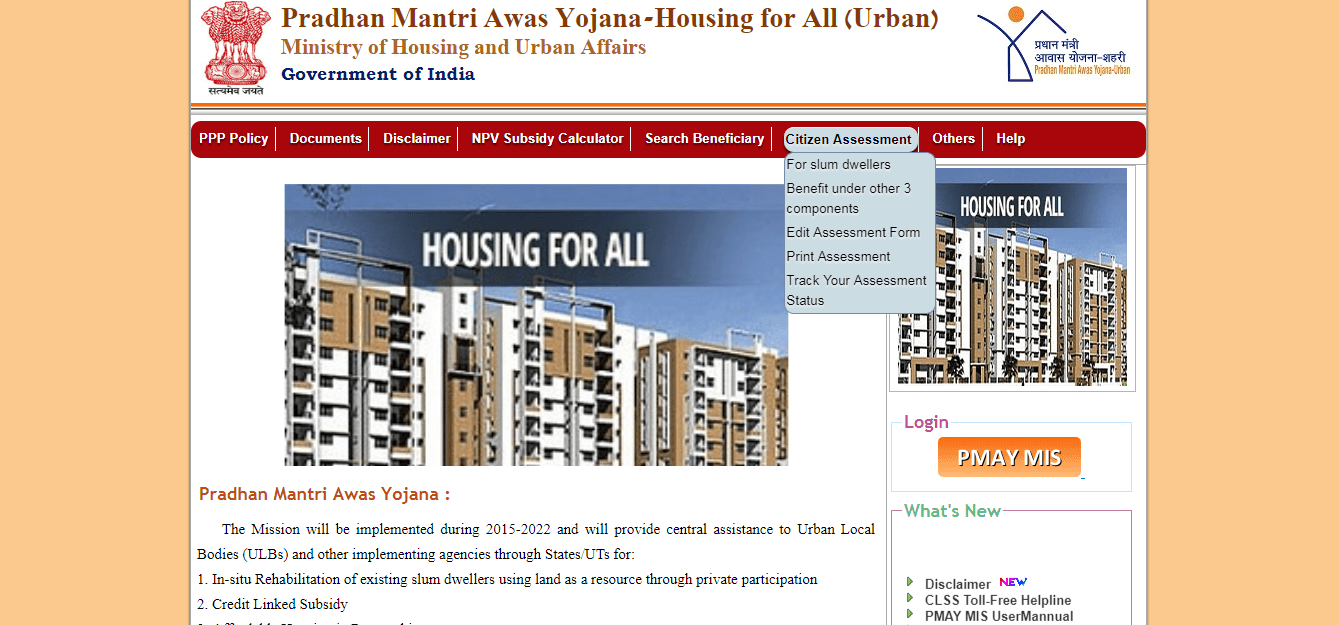

- Click ‘Citizen Assessment’ on the menu bar and pick the correct option from the drop-down menu.

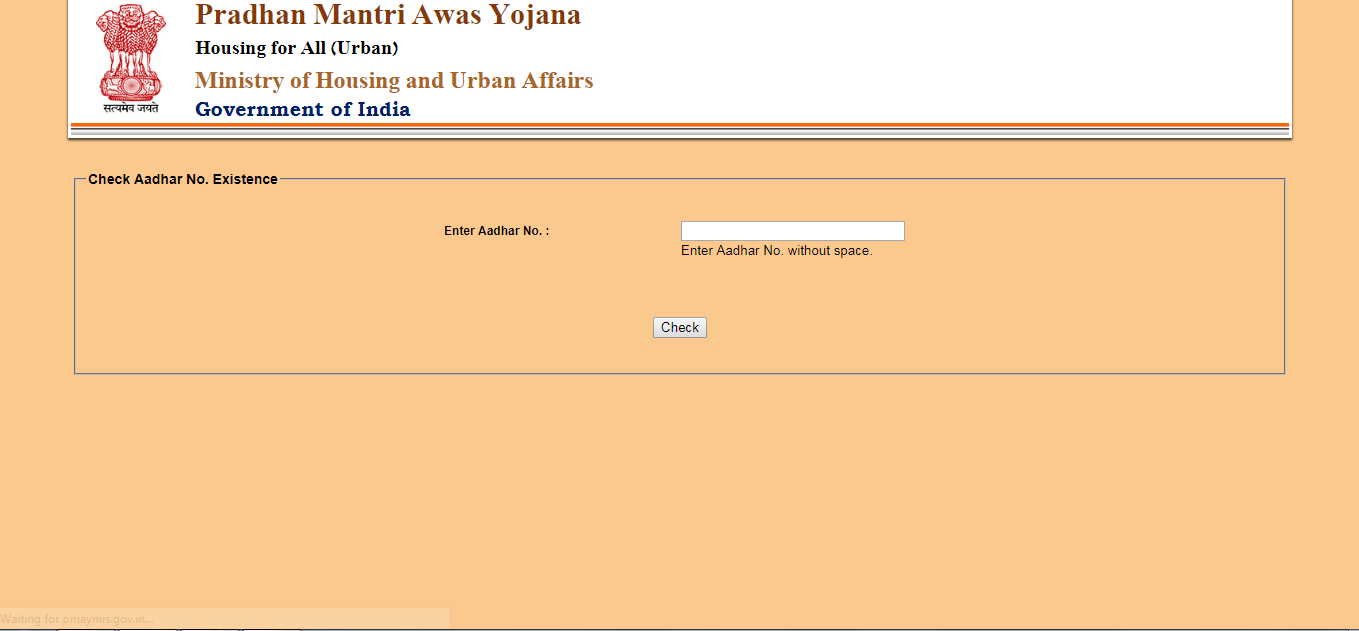

- Enter your 12-digit Aadhaar card number.

- After you enter your Aadhaar number, you’ll be redirected to the application page.

- Fill in your personal details, income details, current residential address and your bank account details in the application page.

- Once you punch in the information, select the ‘I am aware of’ option at the end of the page and click ‘Save’.

- Once you click ‘Save’ you will get a system generated application number. Note down this number for future reference.

- Next, download and print the filled application form.

- Submit the form at your nearest CSC office centres or financial institution/banks along with the required documents.

Before you apply for the PMAY scheme you need to run a few checks to know whether you are eligible for the scheme or not. You can find that out by submitting your BPL certificates to the lending institution, who will then notify you regarding your eligibility status. Another way to do this is by looking up your name online on the PMAY website. The list is frequently updated.

Additional Reading: How You Can Maximise The Benefits Of A Home Loan

6. How to Edit Your Details After Submitting Application for PMAY

Follow the following steps to fix errors in your PMAY application.

- Visit the PM Awas Yojana official website (http://pmaymis.gov.in/).

- Hover over ‘Citizen Assessment’ on the menu bar and click ‘edit assessment form’.

- You can edit your application details from here.

The PMAY is a progressive, populist scheme that will help millions get a house of their own. Upon completion, this scheme will serve as a great model for other developing countries to follow.

Additional Reading: Can Senior Citizens Get A Home Loan?

Even if you don’t qualify for the PMAY scheme, you dream to get a house of your own can take flight. Just pick one of the many Home Loan deals we have on offer.