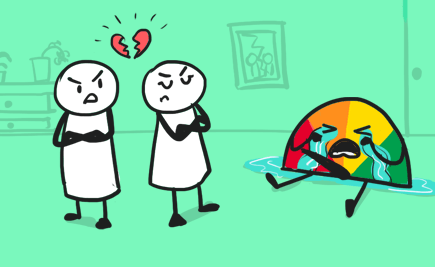

Divorce for many can be messy and can wreak havoc on your finances as a couple. Here’s how it can also pull down your Credit Score.

No matter how amicably things end, there’s nothing about divorce that can make the experience more palatable or less painful. From doing the rounds in courts to finalise your divorce, finding a new living arrangement and splitting finances that you’ve been taking care of together all these years – the process can be hard and long-drawn-out. Things might get even more complicated if there are children involved and you’re dealing with custody issues. Amidst the upheaval that a divorce will create in your personal lives, it’s but natural to lose track of whether your credit is in shape or not. Many of us may not be aware, but divorce impacts our Credit Score.

While divorce can’t directly hurt your Credit Score as it doesn’t dictate your creditworthiness, the consequences born of the divorce can cause it to plummet. Let’s take a look at the scenarios that can contribute towards bringing down your Credit Score:

-

Missed Payments On Your Loans:

Divorce can be messy and long-drawn-out. When both you and your partner are contributing to pay off the EMIs on your Credit Cards, loans, bills etc., losing one out of two household incomes can lead to missed payments on them. Your payment history plays a major role in determining your Credit Score and missed payments can cause a considerable drop in it.

-

Your Ex Doesn’t Pay Your Joint Bills:

Divorce can hurt your Credit Score if payments are missed on accounts like Home Loan, Credit Cards etc. that you jointly hold with your ex or soon-to-be-ex. If in the divorce proceedings, the judge has ruled that your ex is in charge of paying off the joint debt, it’s important that you ensure that this is being followed to the T. It is possible that your ex isn’t particularly worried about his/her credit or making payments on time – in this scenario, the lender will add the late payment to both your credit reports.

Despite what’s in your divorce agreement, if both your names are listed on the account, missed payments will affect both your credit history. The mature and adult thing to do here is to ensure that things end on an amicable note and you both hold up your end of the deal financially. If your ex doesn’t honour the divorce decree, you’ll need to make payments for bills that your spouse isn’t covering for, even if he/she’s responsible for it as per the divorce agreement. You can report this to the court later and recover the money, but it’ll be wise not to let it hurt your credit now.

Additional Reading: Getting a Divorce? Here’s How You Can Split The Assets

-

Your Ex Has Access To Your Credit Accounts:

While some divorces are amicable, some aren’t so and can end with pretty high-voltage drama. This can have serious consequences if your spouse has access to your credit accounts and acts out of rage and frustration and racks up debt to get back at you. Such a scenario is most likely when he/she’s an authorised user of your Credit Cards. This makes them not liable for payment and they can spend away without taking any responsibility for it. This will invariably end up in your credit report and hurt your Credit Score. The best way to tackle this problem is to remove your ex from all your accounts as soon as possible to eliminate any possibility of your ex racking up more debt for you than you can possibly pay off.

Additional Reading: Why You Should Have A Joint Account With Your Partner And An Independent Account

How To Protect Your Credit After Divorce?

It’s possible that your divorce has caused significant damage to your Credit Score, but is that the end? Surely not. You can still rebuild your credit after your divorce and in fact, take the precautionary measure of protecting it during your divorce.

Even if the divorce decree orders your spouse to continue making payments on your Credit Card or loan bills, you’re still equally responsible to ensure that these payments are made as promised to the lender. The lender is well within their right to report a late/missed payment on your accounts to a credit reporting company. If you and your spouse are co-borrowers on a loan, and your spouse refuses to pay, you will have to clear payments or the lender can take legal action against you.

You can take the following steps to shield your credit from the impact of divorce:

-

Closed Or Separate Joint Accounts:

Unless the divorce has ended on a messy note, after you’ve taken stock of all your debts, talk with your spouse and work out who should be responsible for paying off debts on each. You can check with your lenders and ask them to transfer debts to the person who would be responsible for paying them. Unless the creditor releases you from debt, you might still be responsible for paying existing balances.

-

Adjust Your Lifestyle To Your Income:

When you’re used to living on a dual income, it might be really hard at first to survive on your income alone. Take a look at your monthly outlay and analyse where all the outgo can be reduced to half – your phone bills, grocery bills, cable TV bills, maid expenses etc. If rent forms a size-able chunk of your income, you may want to move into a cheaper house. Create a budget to see what you can or cannot afford with your single income. Prioritise your expenses and pay off your outstanding on bills that have a direct impact on your Credit Score, like loans and Credit Cards.

-

Stay On Top Of Payments:

If your spouse is responsible for making payments on accounts that you both hold, keep track of the due dates and check if the payment has been made on time. If your spouse misses/makes a late payment, go ahead and make the payment yourself. You can inform the court later about this and have your ex repay you.

-

Remove Your Ex As An Authorised User:

Remove your spouse as an authorised user from accounts if you want to prevent them from racking up debts that the lenders won’t hold them responsible for.

Types Of Divorce:

Divorce can be of two types: one that is based on mutual consent and the other which has been contested. Depending on the kind of divorce, the scenarios will differ in the following ways:

| Mutual Consent Divorce | Vs | Contested Divorce |

| Section 13B of Hindu Marriage Act | Sections under which it is filed | Section 13 of Hindu Marriage Act |

| Filed jointly by husband and wife | Petition filed | Filed only by one spouse since the other does not consent |

| Husband, wife decide on maintenance, child custody, property and investments | Decision-making | Lawyers mediate on all these issues |

| No grounds required | Grounds | Grounds include cruelty, adultery, desertion, conversion, mental disorder, leprosy, venereal disease, renunciation, no resumption of cohabitation, and not heard to be alive. |

| Short duration (18-24 months) | Time taken | Time consuming (3-5 years) |

| Single, common lawyer | Lawyer | Separate divorce lawyers |

Cost Of Divorce:

While the court fee is as nominal as Rs. 15, a major portion of the cost involves the lawyer’s fees. Women can avail free legal services by getting an advocate from the legal aid cell. However, employing a private lawyer, on the other hand, can set you back by Rs. 10,000 – Rs. 1 lakh depending on the type of divorce and its duration. Lawyers can charge on the basis of each hearing or as a lumpsum or on an annual basis. Women also have the right to ask for litigation expenses from their husband via the court, but the court usually grants a lower amount than requested.

If you’re having trouble keeping a track of the outstanding on your credit accounts, here’s an easy way to do so. Just download the BankBazaar mobile app and you’ll get reminders of due dates for payments on the go. Just hit the link below and get started.