Are you a responsible Credit Card user? If not, we must warn you that it’s extremely important to use your Credit Card wisely. Why, you ask? Well, it not only helps you stay debt free but also positively affects your Credit score. What’s more, you can live a stress-free life if you manage your Credit Card responsibly. So, here’s a list of pointers that can help you use your Credit Card responsibly.

Resist impulsive decisions

One of the biggest offenders when it comes to overspending on your Credit Cards is impulsive spending. Exercise restraint. Do not use your Credit Card indiscriminately as soon as you see a discount sale. Ending up in a debt spiral is easy. Be credit-wise. Draw up a personal budget for your Credit Card usage and stick to it. Shopping is fine, but don’t cross that limit. Make a list of what you intend to buy before you venture out. Stick to the list at any cost. Surprisingly, this works. Those ‘extra’ charges sometimes amount to a lot.

Get The Hint

If you don’t manage to pay the entire outstanding amount, you’re certainly overspending. If you’re able to pay off what you spend on your card every month, you’re managing just fine. Yes, it’s as simple as that! While paying the minimum amount due is considered ‘safe behaviour’, it gives a wrong impression of your borrowing habits. It will certainly reflect badly on your Credit Score.

Additional Reading: 4 Habits that can Hurt Your Credit Score

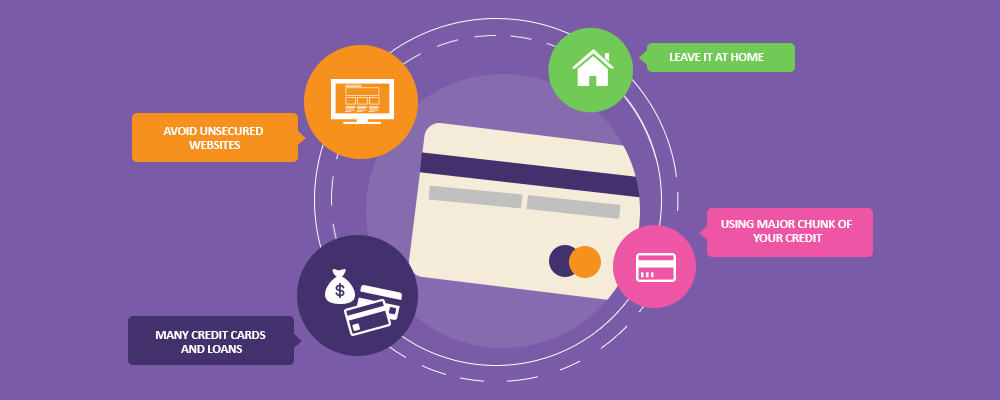

Avoid Unsecured Websites

Never carry out transactions on sites that are not secure. Stick to the websites you trust with beefed up security levels. We’re sure you don’t want to compromise your Credit Card details. And as always, prevention is better than cure. So avoid suspicious websites.

Leave It At Home

Leave your Credit Card at home. What you don’t have, you won’t miss. As simple as this advice might sound, it’s truly effective. Sometimes, resisting the urge to spend can be difficult, but if you aren’t carrying your Credit Card, you certainly won’t spend unnecessarily.

Using A Major Chunk Of Your Credit Limit

Using up more than 60% of your credit limit shows too much dependency on credit. This does hurt your Credit Score adversely. Keep a track of how much you spend, and make sure you don’t reach your credit limit.

Many Credit Cards And Loans

If you have a couple of loans and a few Credit Cards as well, this could spell trouble for your Credit Score. Having multiple Credit Cards is not bad, as long as you know how to manage them.

Confidence is a good thing. All set now, aren’t you? Now that you know where to tread (and where not to), take a look at our offers!