You have read a zillion articles on budgeting and know where to channel your funds. But you stop short with regard to how much. And, while you contemplate this, your money walks out of your bank slowly, yet steadily. Looks like your task of budgeting has been postponed to another month once again.

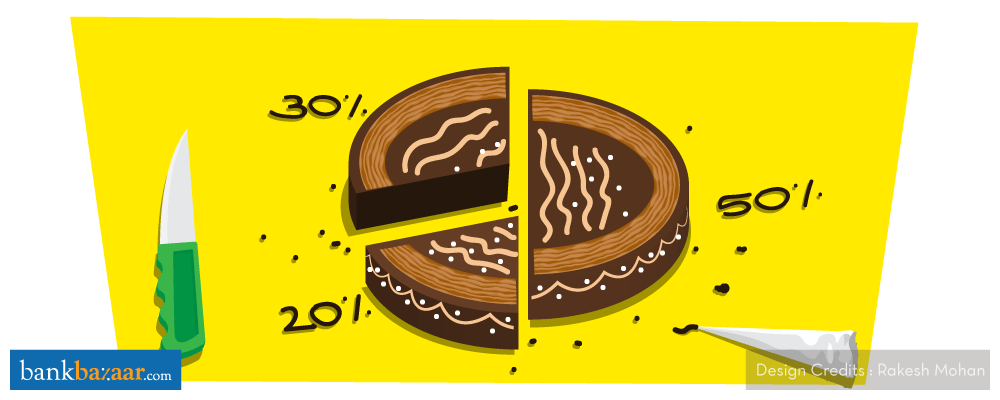

Allow us to help you stem this delay and your sheer lack of determination. Here’s introducing you to the 50-20-30 rule of budgeting.

Before we begin, a friendly reminder. Consider your in-hand salary when dividing your stockpile.

What’s the 50?

The ‘50’ is for all your recurring expenses. That is, 50% of your salary should be used for your utilities. For example, your rent, utility bills, groceries, and every other thing you need (need, not want) to live a comfortable (comfortable, not luxurious) life. We’ll get to the luxury bit later. 50 is not enough? Look at your expenses again. Maybe you buy more groceries than you need. Cut down on non-essential items if your monthly expenses are spilling over the 50 mark. We know this is already hard, but you also need to add your Loan EMIs, Credit Card bills, and all other dues to this bracket. Yes dear, the loans too. It’s all very well if you don’t owe anyone anything, but if you are planning to take on a loan, well, just consider the Line of Control drawn thick at number 50. Use your ingenuity and skill to stay within this box. You’ll reap good rewards. For one, you will be able to leave your luxury ‘20’ section uncompromised.

Additional Reading: 4 Ways To Track Your Credit Card Expenses

Now the 20s

It’s luxury time! After the strict 50s, you need to unwind. Go to the spa, catch a movie, or treat yourself to a weekend getaway. Use this 20 section to experience and buy all that makes you happy. 20% of your salary goes into the luxury box. After all, you need something to keep yourself motivated for your 50s and 30s. Note that approaching the 20s last will ensure that you don’t overspend. You will be aware of exactly how deep your pockets are. Another job of the 20s is to work as your buffer during a financial crisis. If you fall on hard times, you can channel funds from this block to the 50 or the 30 unit. When you learn to manage your money within the 50s, and your 30s look healthy, you can treat yourself by extending your 20s bracket. But don’t get carried away or do it too often. It won’t bode well in the long run.

Additional Reading: How To Be A Responsible Credit Card User

On To The 30s

The deal with this section is, you funnel all your savings here. About 30% of your salary goes into the savings box. Is 30 enough? Well, one mistake people often make while saving is straining their liquidity. Saving is good, but you need to have enough cash to deal with emergencies and daily expenditure. So, the 30s is all about what you save. You can factor your Provident Fund and emergency fund into it as well. You can also count your retirement plan savings in this category.

Additional Reading: How To Get Started On Your Savings

Now that we have broken it down, it’s all pretty simple. While this division of 50-20-30 might work magic for some, it might not work so well for others. Consider your goals and plans first. You can always tweak the ratio according to your financial situation. However, it would be prudent of you to not make your 20s section any bigger. Should the need arise, make sure you borrow from this particular section instead of the other two. Remember, your savings and investments will add to your purchasing power in the long run.