Much has been said about men “taking charge” when it comes to their finances while women “take care”. However, experts believe that men can take a leaf from women’s playbook when it comes to managing their finances.

Women may be heading banks today but when it comes to the topic of finances and money management, the average woman is more often than not left out of the conversation. Banks these days are thinking of novel ways to woo their female customers and are coming up with a host of products from Credit Cards, Home Loans to Insurance plans that are designed specifically for women. No matter how much women these days may be reduced to just a target group for selling financial products by banking and financial companies, if reports are to be believed, there’s a lot that can be learnt from women when it comes to managing finances.

What Do The Studies Say?

In March 2016, student loan provider Sally Mae conducted a survey entitled-“Majoring in Money: How American College Students Manage Their Finances” in which 800 college students between the ages of 18 and 24 were polled regarding their money management skills and credit usage. Researchers discerned a clear pattern in the way men and women manage their money and found distinct differences in the way male and female colleagues manage money and use their Credit Cards. Here are a few takeaways from the survey:

- For women, saving is a priority-61% of female college students said they save money every month as opposed to 52% of men.

- Women are less likely than men to blow their money-66% said that they don’t spend more money than they have, while 52% of men said they did.

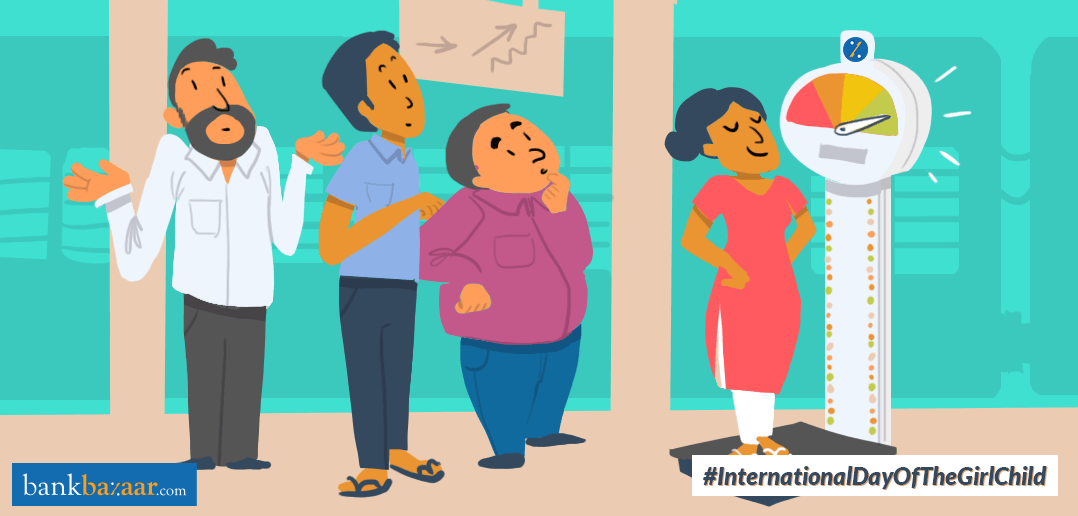

The findings of this research are in line with another study carried out by Experian. The analysis conducted in March 2016, found that the average Credit Score among women was 675, 5 points higher than that of men. The credit bureau also found that women carry 3.7% less debt and have 8.1% lower incidence of late mortgage payments.

Additional Reading: 4 Credit Cards For 4 Different Women

What Makes Women Better At Credit Management Than Men?

Experts believe that owing to their nesting instincts, women have a tendency to be conservative and this trickles down to their money and debt management. From a tender age, women are taught to preserve and an aversion to debt is hardwired into their DNA. Here are a few reasons why women are acing credit management:

-

Women care about details:

When Sandhya Shetty, a software professional from Bangalore found that her husband’s credit limit had dropped to almost half, she prodded him to check his credit report. Her husband had never checked his credit report before and was shocked to find that there were more than a couple of glaring errors on his credit report. Not only was his name spelt wrong, but crucial details like his PAN number was incorrect and accounts that were not his were showing up on his report. If Sandhya hadn’t nudged her husband to check his report, he would’ve held off on the matter and would have never known the terrible state his credit was in. As is evident, women tend to care about details. Whether it is keeping a track of their expenses or pulling up and reviewing their credit reports from time to time, much can be learnt from women when it comes to staying on top of their finances and nipping troubles before they flare up.

Additional Reading: PepsiCo CEO Indira Nooyi’s 5-Step Success Model to All Working Women and Men Alike

-

Women Are Less Impulsive:

Even during those occasional shopping sprees, women are more likely to have weighed in on the trade-off they would have to make for that shopping spree. They also are less likely to indulge in it if the money has been set aside for some well-thought-out purchase. Before making a big-ticket purchase, women are more likely to ask themselves-“If I buy this, what else will I not be able to buy?” They tend to slow down and “sleep on it” before making a large purchase that they may have to eventually repent for later.

Additional Reading: Getting a Divorce? Here’s How You Can Split The Assets

-

Women Are Motivated By Fear:

According to the Sallie Mae survey, men are more confident than women when it comes to their finances. Nearly one-third of them called their money management skills excellent compared to less than one-fifth of women who felt the same. Experts believe that since women are aware that they will outlive their spouses, the knowledge of this fact makes them extra careful with their credit and they try and prepare for a time when they will have to be financially self-sufficient from early on. Take the case of Kavita Hegde, a single mother and salon owner from Pune. Kavita has been working for the last 15 years and she has been planning for the last few months to purchase a house in her hometown-Mangalore. Kavita knows that there won’t be any co-borrower for her Home Loan and she will have to repay her debt all by herself before her retirement. This makes her extra careful with her credit since she’s aware that she doesn’t have a husband to fall back on if she ever defaults on her loan. Kavita limits her impulse purchases to the minimum and monitors her credit reports regularly.

Additional Reading: Why Women Shouldn’t Shy Away From Negotiating Their Salary

While habits like the ones mentioned above may come naturally to most women, there’s nothing about these habits that make them exclusive to women. Anyone can give them a go and make a habit out of these good practices. Thinking of giving your credit a makeover but don’t know where to start? Start by checking your Credit Score. It’s free and no matter how many times you check it, it will still be.