Managing your finances are equally important as earning money is. Let us see how we can make the most of out of our existing funds by following these best financial habits:

Save less but save regularly:

There is famous proverb “Many a little makes a mickle” means many small amounts accumulate to make a large amount. Financial experts believe that saving small amount regularly contributes heavily to building wealth. The easiest way to do that is to set it and forget it i.e. you can set up monthly/ standing instruction for an amount that is easy to pay for many years. By doing this, a particular amount will certainly get contributed each month to your savings/ recurring account. Soon you will realize that small contribution each month can pile up to big chunk of money.

The best time for contributing to your savings is immediately after your salary gets credited to your account each month. You can link your monthly contribution with your financial goals also and aim to achieve the same within a targeted time.

You can achieve your financial goals by continuous monitoring. The best way is to:

Plan -> Manage -> Invest -> Analyse

Understand the benefit of compounding:

Money makes money. You can work towards achieving your financial goals on a faster pace when you take benefit of compounding i.e. when you get interest on your interest income. In India, many investment plans are available that provide return basis compound interest. One of the famous investment is towards PPF that not only provides safe return but it also provides compound interest income that is tax free. It is always advisable to keep your money invested rather than keeping it unused in a locker or in a low interest bearing savings account.

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” ― Albert Einstein

Start Early:

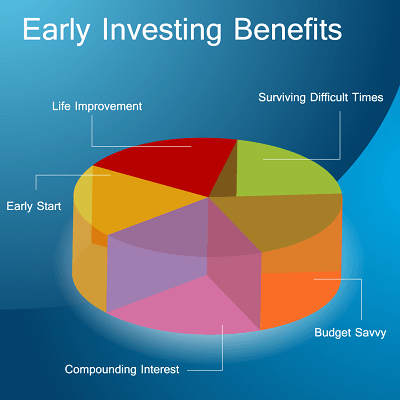

You need to start saving and investing earlier in your careers to let the math of compounding work its magic. The mantra of achieving financial success is to save and invest regularly, ideally monthly. There are several benefits associated with starting early in your career to save. You can improve your lifestyle in the long run, survive difficult times by building an emergency or a contingency fund, and inculcate the habit of making budget and following it every month. The best thing about starting to save early is you can get maximum benefit of compounding.

Improve your financial knowledge:

Improving your financial literacy helps you to understand various options available in the market and enable to you cherry-pick the best option that works for you. Being well versed with financial products not only gives to confidence but it also saves your time, money and effort involved in seeking financial advice.

Understand your investment options:

Just saving your money is not enough! You need to invest your funds to increase your profit. You can explore various investment opportunities based on several factors like short-term vs. long term investing, highly liquid vs. lesser liquid etc.

Some of the short-term investments are Savings Bank Account, Money Market Funds, and Bank Fixed Deposits. And some of the long-term investments are Post office savings, Public Provident Fund, Company Fixed Deposits, Bonds & debentures, Mutual Funds, Life Insurance policies and Equity shares. You can explore all these investment opportunities and the return on each Investment type to select the best option for you.

Select the investment as per your risk appetite:

You should always compare risk vs. the returns before investing. As we know, equity exposes you to risk but maximizes your returns. Whereas the debt funds are safer to invest but provide lesser returns in comparison to other equity funds. The financial advisers, however suggest you to understand your risk taking ability and then with a calculated risk, you should take your investment decision. Financial experts also suggest that diversification is the best tool for reducing your risk without compromising on the returns.

Consultation for financial planning:

If you are not confident on your decision of investment or are not well versed with the nitty-gritties of the market, then there is no harm in consulting a financial adviser who can do financial planning for your funds. There are certified financial consultants who can plan, manage and invest funds on your behalf for a pre-defined fees. You can also approach your bank for financial consultation who can provide you a dedicated adviser to manage your funds efficiently and can also do financial planning on your behalf.

Always keep a back-up:

Sometimes, for maximizing the returns, some people do not care to keep a reserve of their funds for any emergency requirement. This practice is highly discouraged by the financial experts. One of the best financial habits is to keep a back-up and always be ready with your contingency/ emergency funds. You should never be out of cash at any point of time, as, you never know when you are going to need it the most.

Retirement planning:

As emphasized in the earlier points, you should start early for your retirement planning also. The best way is to start it- set it and forget it! PPF is one of the best retirement plans available in India as it uses the power of compounding. It also provides tax free and safe returns on your investment.

Keep yourself insured:

Insurance is a necessity and helps you to fight with any odds in life in case of sudden demise of any of your family members. Financial planners always insist on taking an appropriate life cover that can cover your future income till your retirement age. Read more on how much life cover you should take in my article on “Term Insurance- necessity!”

Following and inculcating these financial habits can help you in meeting your financial goals well in time and can help you attain financial success.