Category Archives: UCN

Maintain A Good Credit Score To Be Financially Independent

How To Get A Credit Card If You Don’t Have A Job

Know Differences Between Corona Kavach Policy And Corona Rakshak Policy

12th Birthday Special: 12 Reasons Why BankBazaar Is A Great Place To Work

BankBazaar Aspiration Index 2020

12th Birthday Special: 12 Credit Cards Picked Just For You

12th Birthday Special: 12 Money Lessons For Pre-Teens

12th Birthday Special: From The Co-Founders – Things We’ve Learned At BankBazaar

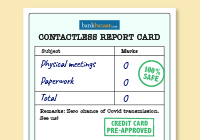

Full Marks For Safety: Zero-Contact Credit Cards Via BankBazaar

The results are out! Zero is a hero. Our fully digital process with zero physical paperwork and zero in-person meetings means zero chance of COVID transmission. With a 100% online, contactless KYC process only on BankBazaar.com, you don’t need to leave the safety of your home. This is the safest, quickest way to get a Credit Card.