If you’re in a financial crunch and are considering taking out a Personal Loan, here are some dos and don’ts that you should follow to make the most of it.

Probably the scariest thing about financial emergencies is that they come unannounced. While having an emergency fund earmarked for such instances is the wisest thing to do, sometimes depending on the nature of the financial emergency, you might still not have enough saved up. Thanks to Credit Cards and Personal Loans, you can still meet this requirement.

Since they’re unsecured loans, one of the biggest advantages of Personal Loans is that they can be used to meet any financial requirement – whether its’ renovating your home, a medical emergency or funding higher studies. To top it off, you don’t need to pledge any collateral to take out the loan. Let’s take a look at some of the dos and don’ts that you need to follow when taking out a Personal Loan.

Do Know Why You’re Getting The Personal Loan:

Unlike Home Loans or Car Loans that are specifically designed to meet a requirement, Personal Loans can be used to meet any financial need. There are mainly two reasons to get a Personal Loan-use it to either get out of debt or for funding a requirement-like higher education or renovating your home. While using a Personal Loan to get out of debt might seem counterintuitive, it’s actually not. Compared to Credit Cards that have an average interest rate of 25% p.a., Personal Loans have much lower interest rates that start as low as 10.99%. This makes them a far more manageable alternative to Credit Card debt.

Additional Reading: Should I get a Credit Card or a Personal Loan?

Do Shop For The Lowest Interest Rates:

The thumb rule to follow when taking out a Personal Loan is to clearly define why you need it. This way you can carefully draw up a repayment schedule and stick to it to pay off your debts. However, before you settle on one, remember to shop around and compare interest rates. A small difference in interest rates can save you hundreds and thousands of rupees over the tenure of your loan.

Additional Reading: Can You Get A Personal Loan With A Low Credit Score?

Do Read The Fine Print:

There’s probably nothing as important as reading the fine print before making up your mind about a Personal Loan. Read up on crucial details like required repayment schedule, maximum loan tenure, any income cut-off criteria, and how long it might take to get approval for your loan.

Also, watch out for any processing fees. Some loans offer incredibly low-interest rates as part of various promotions but make up for it in high processing fees.

Do Take Advantage Of Promotions:

Applying on an aggregator for a Personal Loan can give you access to exclusive and sometimes better rates that aren’t usually available on the bank’s website. Moreover, on an aggregator like BankBazaar, you get to compare interest rates across lenders and settle on an offer that you’re eligible for, thereby ruling out the possibility of your loan getting rejected. To sweeten the deal, aggregators throw in other goodies like welcome gifts in the form of cash discounts or cash vouchers. Take advantage of these to get the most out of your Personal Loan.

Additional Reading: Things You Should Know Before Co-Signing A Loan For Someone Else

Don’t Skip Loan Repayments:

While applying for a loan will not negatively impact your Credit Score, if you default on a loan, this will certainly tank your Credit Score. With a poor Credit Score, it might become more difficult for you to access other crucial loans in the future. Before you sign on the dotted line for the loan, use a Personal Loan EMI calculator to get an idea of your expected monthly repayment. Check if you will be able to afford these repayments every month. If not, consider extending your loan tenure or reducing your loan amount.

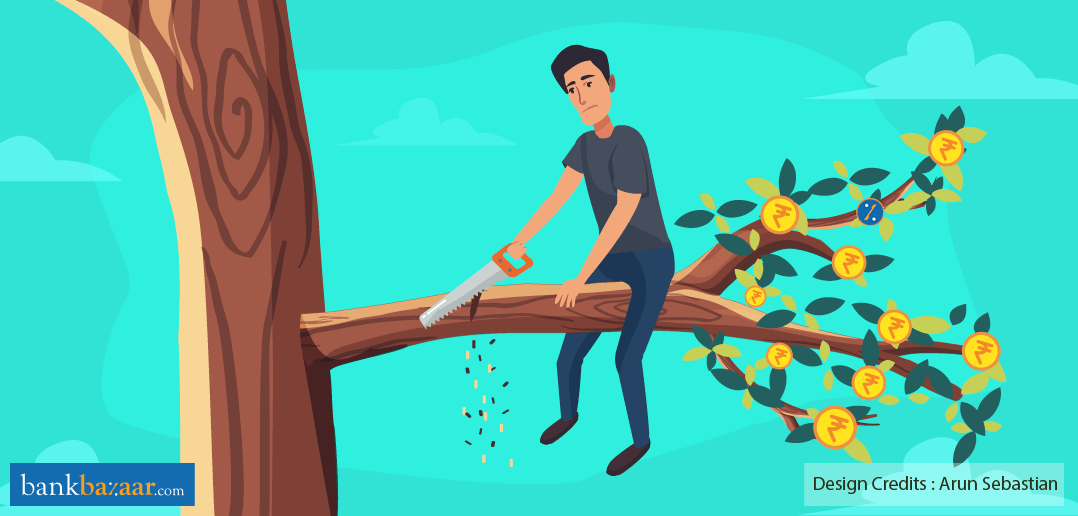

Don’t Use Personal Loans For Non-Essential Spending:

While Personal Loans because of their unsecured nature and low interest-rates are a useful and manageable financial tool, don’t just take one out because you can. Avoid getting one on a whim or to fund your excesses.

Try to get a sense of your financial habits and spending pattern before you sign up for a Personal Loan. While it can help you meet your needs during a financial emergency, it involves a monetary commitment and the discipline of regular repayments.

If you’re sure up for it, why don’t you explore Personal Loans offers that you may be eligible for? Rates start at just 10.50%.