EPF or Employee Provident Fund is one of the most popular retirement schemes in India. It’s government-backed, provides decent returns and ensures that you stick to a disciplined investment plan.

Here’s everything you need to know.

What is EPF?

EPF (Employee Provident Fund) is a contributory retirement savings scheme provided by the Government of India. The scheme aims to provide social security to people in their sunset years, irrespective of whether they are entitled to a pension or not.

Under the EPF scheme, an employee is required to contribute a certain amount towards the scheme and an equal contribution is made by the employer. The employee gets a lump sum amount including self and employer contribution with interest on both, on retirement.

Is contribution to the EPF mandatory?

For those who earn a basic salary of up to Rs. 15,000, contributing to the EPF scheme is mandatory. Contributions are voluntary if you earn more than Rs. 15,000 a month.

However, it is highly advisable to make contributions towards the EPF scheme as it not only provides retirement benefits but also instils a sense of financial discipline.

The mandatory contribution towards the EPF account is 12 percent of an employee’s basic salary which is credited to his/her salary account. The employer also contributes the same amount. Of that 12 percent, 3.7 percent goes towards the Provident Fund component and the remaining 8.33 percent goes towards pension.

What happens to my EPF account when I change my job?

If you plan to switch jobs, the EPF balance can easily be transferred from one employer to another. The current balance will continue to stay, with additional contributions made by the new employer.

On the other hand, if you plan to quit your job, you can withdraw money from your EPF account. To settle your EPF dues, just fill out form 19 with your correct details and get it attested by the employer for quicker claim settlement.

Additional Reading: Automatic PF Transfer On Job Change

What is the current interest rate on EPF for FY 2017-18?

EPF is a defined benefit scheme, where the interest rate is set every financial year by the central government. For the year 2017-18, the interest rate is 8.65 percent.

Do keep in mind that if your account remains inactive and you don’t make contributions for at least three years, the money in your EPF account will cease to earn any interest.

When can I withdraw my PF money?

It’s good news that restrictions on PF withdrawal have now been eased to a great extent. Earlier you were allowed to withdraw your EPF only at the time of your retirement, switching jobs or under special occasions. On top of it, there were a lot of restrictions on the amount that could be withdrawn.

The Government has now made the PF withdrawal rules more simple and in favor of the employees. Let’s take a look at the new EPF withdrawal rules:

- You can withdraw your EPF amount if you haven’t switched your job within two months from the date of your resignation from your previous job. However, this 2 months period can be ignored in case you get lucky and get a job opportunity abroad. If you are a new mother, the 2 months period becomes invalid if you quit your job to take care of your newborn.

- You can also withdraw from your EPF account under special occasions like medical emergencies, repaying for a Home Loan, marriage etc. However, there are a few restrictions on the amount that you can withdraw.

- Complete withdrawal from EPF is possible only under specific conditions like retirement, after reaching 55 years of age, permanent and total disability or permanent relocation from India.

Additional Reading: Proposed EPF Rules

Taxability

If you make a withdrawal from your PF account after five years of continuous employment, it will attract no tax liability.

In case of employment with different employers, if you transfer your PF account from the old employer to the new one, it will be considered as a continuous employment.

On the other hand, if you plan to dig into your PF account before five years, the amount will become taxable. Keep in mind that the employer’s contribution to PF and interest earned on it is also added to one’s income and taxed accordingly.

Curious to know your EPF balance? Click here to find out.

Additional Reading: How To Withdraw Your EPF Without Your Employer’s Signature

How can I claim EPF online?

In order to avail the online claim facility, you must fulfil certain requirements:

- Your UAN (Universal Account Number) must be issued by the EPFO (Employee Provident Fund Office). Make sure your UAN number is also activated.

- Your mobile number must be registered with the UAN database.

- Make sure your Aadhaar, PAN and bank account details are seeded in the EPFO website.

Here’s your step-by-step guide to claim EPF online:

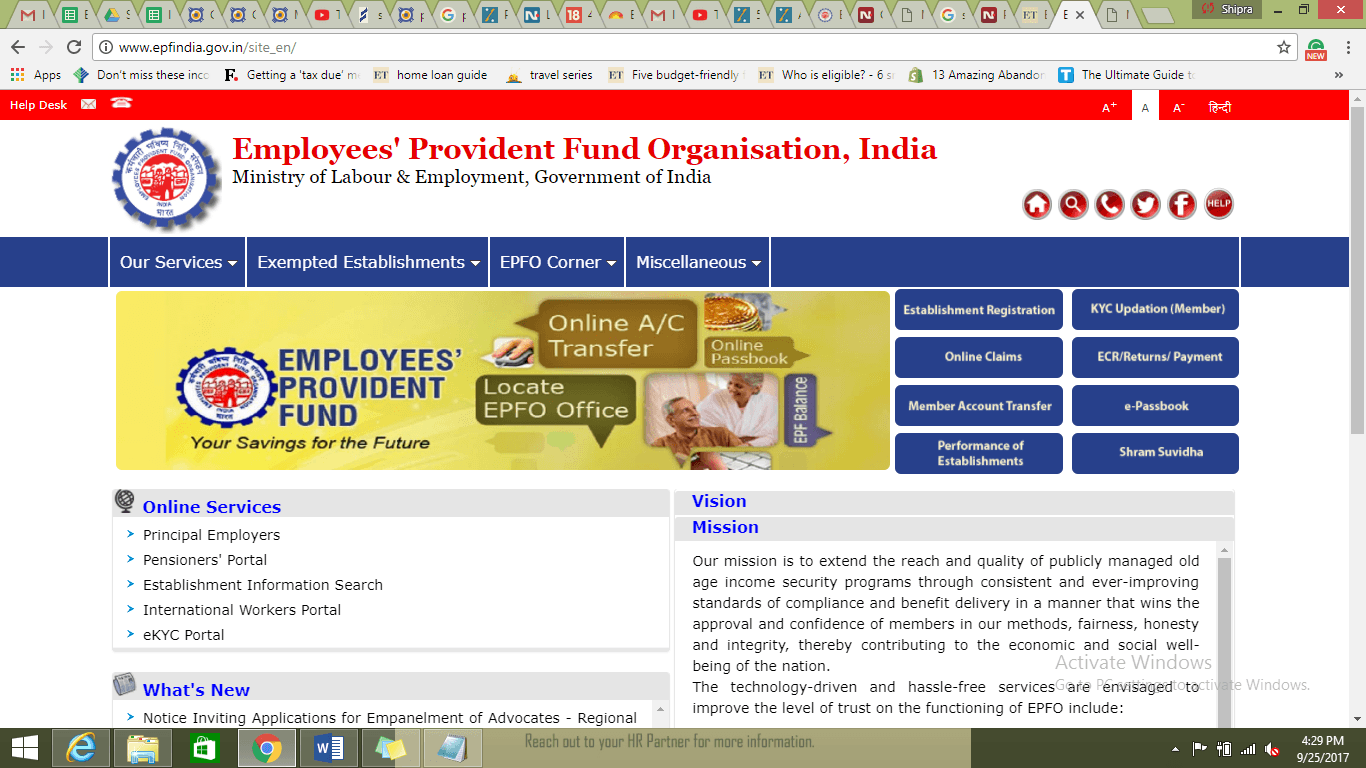

Step 1: Go to www.epfindia.gov.in and click ‘Online Claims’ tab.

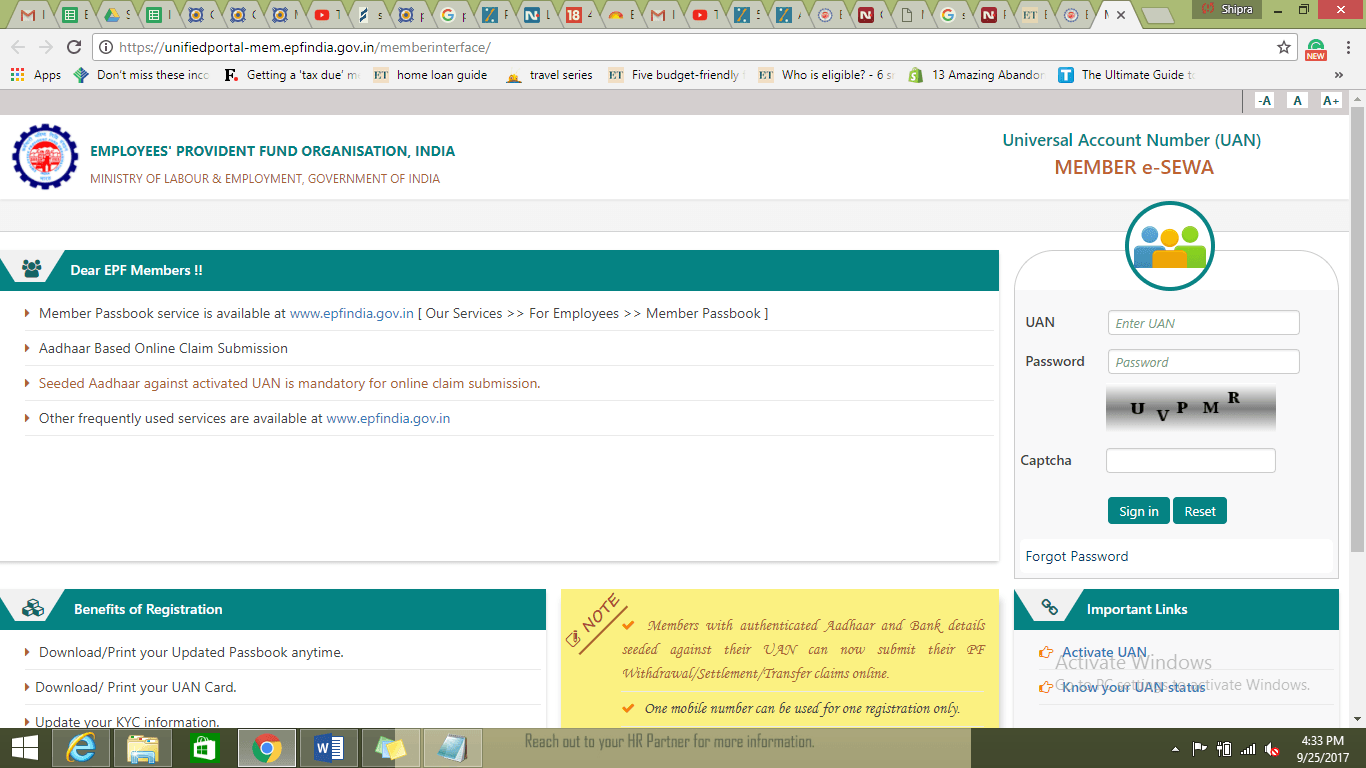

Step 2: Login using your UAN and password.

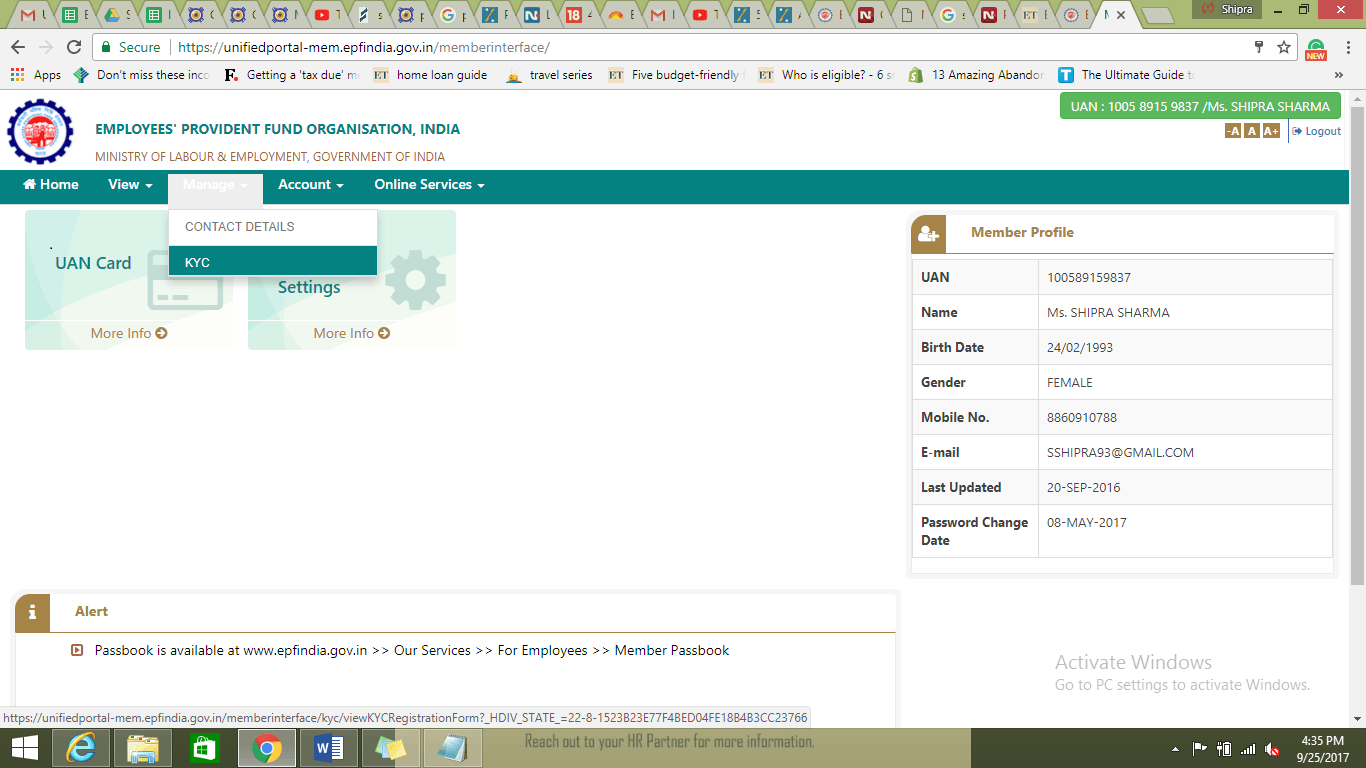

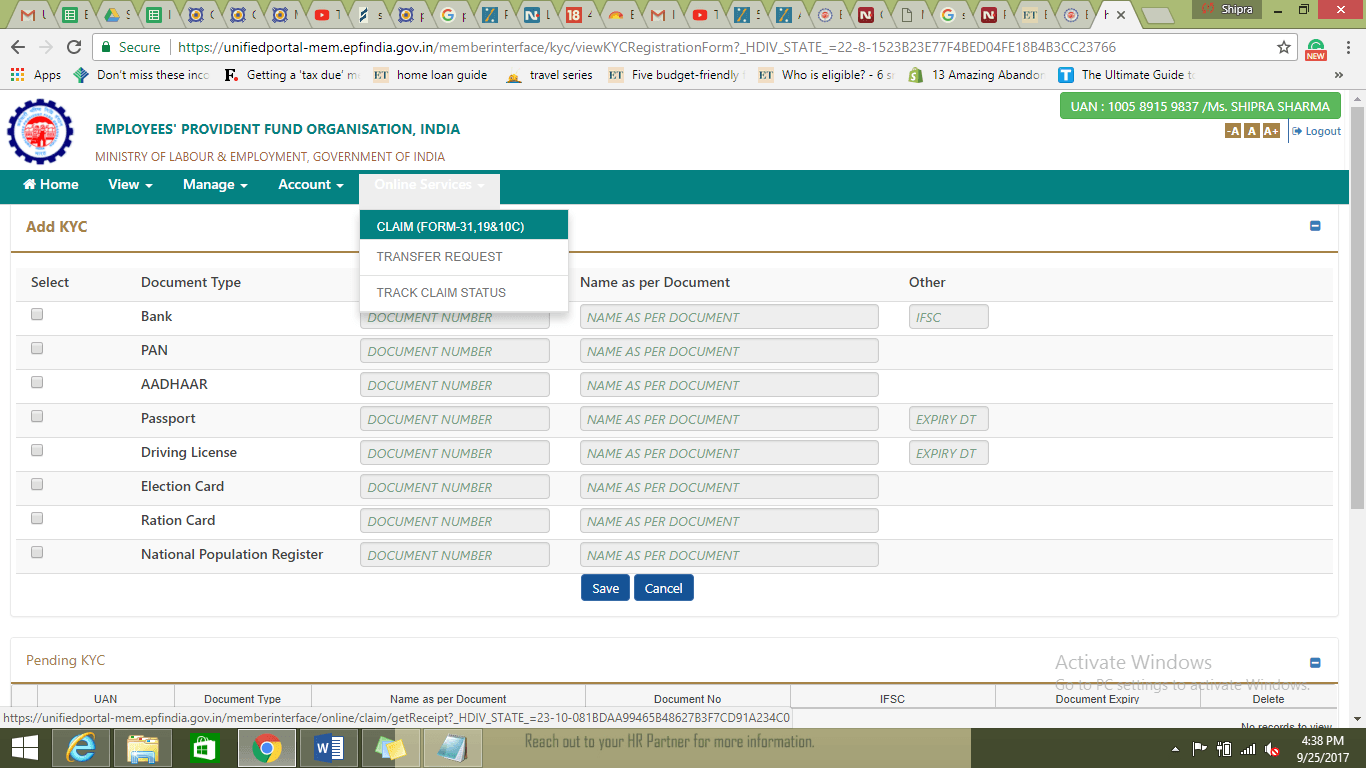

Step 3: Click the ‘Manage’ tab and select ‘KYC’ to cross-check your details like Aadhaar, PAN and bank account details etc.

Step 4: Once you have checked all the details, then go to the ‘Online Services’ tab and select ‘Claim’ from the drop-down menu.

Step 5: On the ‘Claim’ screen, look out for ‘Proceed For Online Claim’ tab. Click on the tab to submit your claim form.

Step 6: In the claim form, select the relevant claim like PF withdrawal, PF advance or Pension withdrawal etc. under the ‘I Want To Apply For’ tab.

Step 7: Fill the form and authenticate using Aadhaar OTP to complete the online claim submission. To check your claim status, simply select the ‘Track Claim Status’ tab, under the ‘Online Services’ menu. That’s it!

With the rising inflation, EPF is clearly not enough to build a sizeable corpus for a peaceful retirement. If you are looking for investment options that give inflation-beating returns, Mutual Funds could be your best bet.

Very useful information..