Congratulations! You are now a VIP HSBC Visa Platinum Credit Card holder! To make the most of the host of offers, benefits and unique privileges on your card, please follow any of the options below to activate your card.

Registration & Activation

There are 3 ways you can register and activate your card:

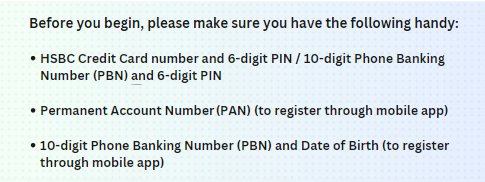

1. Via the mobile app:

- First, download the HSBC India Mobile app via the App Store or Google Play Store.

- Next, open the app and, when prompted, select ‘No’ if you’re not a registered online banking user. This will guide you through setting up online banking, mobile banking, and your Digital Secure Key in one go.

- Once set up, your account will be ready for both mobile and online banking.

- Then proceed to activate your card by tapping on ‘Credit Card’ on the Home page.

- Once done, tap ‘View more’ > ‘Manage cards’ to select and activate your card.

- Finally, tap on ‘Activate card’.

Note: The app will serve as your Digital Secure Key. You’ll use it every time you log on to HSBC’s online or mobile banking services. It will also help protect you and your accounts from any fraudulent activity.

More questions? Click here.

2. Online:

- There is a 3-step process to registering online. Click here to start.

- Once done, please download the HSBC India Mobile app via the App Store or Google Play Store to enable your Digital Secure Key (you’ll use this every time you log on to HSBC’s online banking).

3. Via IVR:

- Dial 1800 121 4015 from your registered mobile number

- Select your preferred language

- Enter your Credit Card number followed by #

- Enter the OTP received on your registered mobile number

- Your card is now activated

- Once your card is activated, you will receive an SMS stating that your PIN is ready

- SMS the first 2 letters of your Name + Date of Birth (DDMM format) + Last 4 digits of your Credit Card. Example: Manoj born on 28 October with 1234 as the last 4 digits of his Credit Card would SMS: MA28101234

- Send this SMS to +919958418884 to get your PIN

Note: If you are unable to generate your PIN via SMS, please call HSBC’s customer care for more assistance: 1800 267 3456/ 1800 121 2208 . You will need to enter this 4-digit PIN whenever you swipe your card.

Other Methods to Generate Your PIN:

Via ATM: You can also generate your Credit Card PIN at your nearest HSBC ATM.

Here’s what you need to do:

- Insert your HSBC Credit Card into the machine

- Choose your preferred language

- Click on ‘Create new ATM PIN’

- Choose the ‘using OTP’ option

- Then enter the OTP sent to your mobile

- Add your mobile number when prompted

- Add a 4-digit PIN of your choice

- Once done, re-type the PIN and click ‘Submit’

Via Online Transactions: You can generate your PIN by making an online transaction that requires you to add your PIN. On making a transaction, you can add the OTP sent by the bank to authenticate the transaction. Once done, you can choose to add a new PIN during the transaction.

Via IVR: You can also call HSBC Credit Card customer care at 1800 267 3456 or 1800 121 2208 to set your Credit Card PIN.

Common FAQs:

Q: What if I forget my 6-digit Mobile App PIN?

A: You can reset the 6-digit app PIN by providing your password and a one-time activation code. Just tap the “Forgot your PIN” link on the log on page of the HSBC India app. The bank will send an activation code to the mobile number registered on your account.

Q: Will I receive a new PIN for a re-issued or renewed Credit Card?

A: No, you can use the same PIN in case of a re-issue of your Credit Card.

Q: What should I do if I have lost my phone?

A: If you lose your phone, you’ll need to de-link it from your profile. If you’ve set up the app on another device, you can do this in 3 quick steps:

- Log on to HSBC India Mobile Banking App on the other device

- Select the “Profile” icon on the top right-hand side, go to “Security” and select “Manage devices”

- Find the lost device in the list and select ‘Remove device’

- If you haven’t registered Mobile Banking on any other device, please call HSBC Phone Banking to report your lost phone and the bank will de-link it for you.

Please Note: Your card may be closed due to non-usage if not activated within 45-60 days of receiving the card, as per RBI regulations.

Note: This page is for informational purposes only. Information is valid at the time of publishing this page and is subject to change without notice. Please refer to the bank website for the latest information.