The last year has been rather epic for us Indians. In the most eventful year that was, India witnessed a revolution in 2016. Some would say it was something just as big as the freedom struggle way back in 1947. While there were no protest marches, the nation did get a big jolt. And everything came to a standstill.

And no, we aren’t talking about P.V Sindhu’s silver in the Rio Olympics, or the death of Chief Minister Jayalalitha. Neither are we talking about the telecom revolution and the distribution of free JIO sim cards.

We’re talking about the ban on currency notes, aka, demonetisation. Life changed for millions of Indians in India and even across the world. A wave of chaos covered the entire country overnight. In an effort to get rid of black money, our government came up with this fantastic plan – it simply made all old currency notes illegal.

Additional Reading: What Demonetisation Taught Us About Money Management

This new rule did undergo a few roadblocks at the start. But kudos to the banks and other organised government committees who stuck by the government’s decision of imposing this ban in order to curb black money.

However, post demonetisation, in November, the average Indian citizen suffered the most. With ATMs running out of cash, and ironically, sacks of old currency notes being discreetly burnt in various nooks and corners of certain big cities, it seemed like the nation had been turned upside down for a few weeks.

But over the course of time, when the new notes were issued along with rumours about how they had a microchip in them, the economy gradually stabilised.

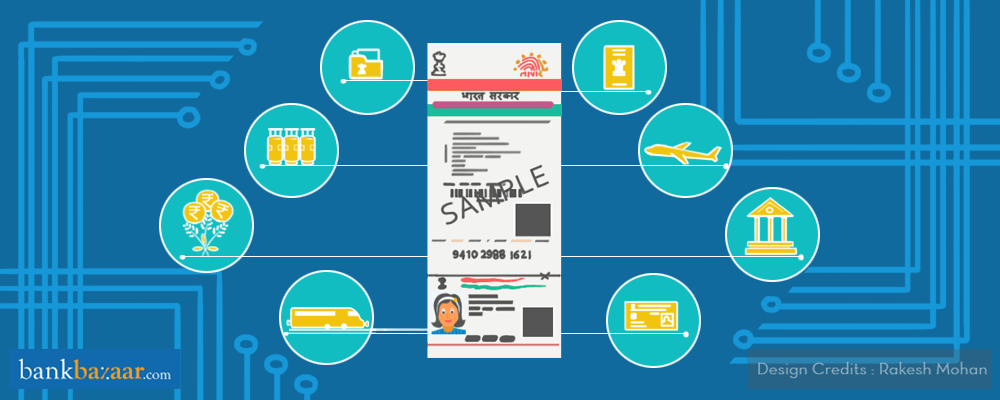

The demonetisation drive put a lot of things in the spotlight. It’s not tax– evading, corrupt individuals with lots of black money that we’re talking about but the humble Aadhaar Card. To regulate the whole drive, Aadhaar became compulsory and a big tool to keep a check on fraudulent activities.

Today one needs to have this card to apply for almost everything. Whether it’s a gas connection you need, or a new passport, providing your Aadhaar number is now a mandatory part of the application process.

Here’s the list of utilities and services that require Aadhaar to be linked to them:

1. Aadhaar Pay: With the 2017 budget, the government has taken digital transacting one notch higher by proposing the addition of 20-lakh Aadhaar-based POS systems by September, 2017. An Aadhaar Card, along with the bank account it has been linked to, and a fingerprint authentication is all you’ll need to make payments going forward.

Additional Reading: The Beginner’s Guide To Aadhar Pay

2. Driving Licence & Vehicle Registration: In a move to check the duplication of driving licences issued, the centre has made it mandatory for all states to make Aadhaar compulsory to issue licences and also to renew existing ones. Linking Aadhaar to vehicle registration is also expected to help check the registration of stolen vehicles and with the transfer of vehicles from one state to another.

Additional Reading: Aadhaar Mandatory For Driving Licence

3. LPG Connection: Under the Pradhan Mantri Ujjwal Yojana, women of households will need an Aadhaar Card to avail free LPG connection and get other subsidies on LPG.

4.Filing IT Returns: The government has made it mandatory to quote your Aadhaar number while filing your income tax return. So, don’t put off linking your Aadhaar through the Income Tax e-filing portal if you haven’t done it already.

Additional Reading: Aadhaar For ITR Filing: What You Need To Know

5.PAN Card: If you don’t have a PAN card yet, you’ll need an Aadhaar card first in order to apply for one.

6.Passport Application: Getting a passport will now require you to furnish your Aadhaar details as valid ID and address proof.

Additional Reading: It’s Now A Whole Lot Easier To Get A Passport

7. Bank Account: Linking your bank account to your Aadhaar Card has been made mandatory too. Further, The Income Tax Department has instructed financial institutions to block non-linked accounts. So, hurry up if you haven’t already linked your account to this magic card!

Additional Reading: Aadhaar Linkage Mandatory For Bank Accounts

8. Government Schemes: Earlier last month, the government of India made it mandatory to have an Aadhaar Card to avail 11 welfare schemes. You can read more about it here: Aadhaar Made Mandatory For 11 Government Schemes

9. Employees’ Provident Fund (EPF)

Aadhaar has been made mandatory for contribution to your pension account. However, it is not mandatory for the final settlement. Still, it might be a good idea to link your Aadhaar to your Employee Provident Fund account. The Employees’ Provident Fund Organisation (EPFO) has extended the deadline for submitting Aadhaar to 30th June 2017.

Additional Reading: 5 Things You Need To Know About The Single Page EPFO Withdrawal Form

10. Domestic Air Travel: Earlier this month, the government approached IT giant Wipro to develop a blueprint for Aadhaar-based biometric access to flyers at all airports across India. Wipro is expected to give a report in May and the process to use the Aadhaar fingerprint scan will be sufficient for all domestic air travel. How cool is that?

11. Defence Pension: All retired defence personnel and family members of deceased personnel will need to enrol for an Aadhaar card by 30th June 2017 to be able to claim their pensions from the government. The Ministry of Defence has now issued a notification to this effect.

12. Haj Pilgrimage Application: The Uttar Pradesh government is mulling over its decision to link the Haj application process with the Aadhaar number of the applicant to ensure greater transparency in the selection of pilgrims. Officials believe that this system would help in identifying those who have undertaken the pilgrimage more than once. The minister also made an appeal to the rich Muslims of UP to consider giving up the Haj subsidy, so that the poor and deserving would get an opportunity too.

13. Aadhaar-enabled OTP eKYC (Know Your Customer): The Reserve Bank of India, in a giant leap towards digitising finance in India, has requested financial institutions to onboard customers through an OTP (One Time Password)-based Aadhaar eKYC process. This process is a mobile-based paperless and presence-less solution. Customers no longer need to be physically present at the bank branch to open an account or apply for a loan. The process can be done online at their convenience.

Additional Reading: BankBazaar CEO – Adhil Shetty On Aadhaar-enabled OTP-based eKYC & Digital Payments

14. Crop Insurance Policies: The agriculture ministry has issued a directive to rural financial institutes to comply with the new rule from the kharif (summer) season starting 1st April 2017. The new rule being mandating Aadhaar to availcrop insurance policies for the kharif sowing season. The banks have been asked to persuade farmers to furnish their Aadhaar identification card at the time of sanction/renewal/ disbursement/inspection of the loan or on visiting a bank branch.

15. Booking Train Tickets Online: The railways will soon move towards an Aadhaar-based online ticketing system to prevent touts from blocking a bulk of tickets, end fraudulent bookings, and curb cases of impersonation.

16.Availing Subsidised Food Grains: Aadhaar has been made mandatory to avail food grains from ration shops too.

Seems like Aadhaar is the new food for thought. In case you haven’t got yours yet, we suggest you apply for it as quickly as possible. Did you know you don’t need an Aadhaar Card to apply for a Personal Loan?