As you might know, on 5th April 2016, the Reserve Bank of India (RBI) cut its repo rate (the rate at which it lends to banks), by 25 basis points, to 6.5%.This is the lowest rate in almost five years. In order to ensure that banks pass on the rate cuts to you, the consumer, it has reduced the reserve requirements for banks. Cash Reserve Ratio is the amount of deposit banks need to keep with the RBI. This rate has been reduced from 95% to 90% now. Essentially, all you need to know is that banks now have more funds on their hands.

In a nutshell: The RBI has reduced the repo rate and increased the reserve repo (rate at which banks earn interest on deposits with the RBI) to 6%. Banks now pay less interest on borrowings and receive more interest on deposits. So, all this means that banks need to pass on the rate cuts, given that they are enjoying better rates and also have funds on hand.

Another important reason why banks will pass on rate cuts is the Marginal Cost-Based Lending Rate (MCLR). This new method of calculating the banks’ cost of funding (loan rates are based on this) has simplified the way a bank’s costs are estimated. Since deciding on these MCLR rates is now easier, banks can translate these to loan rates quickly. Banks moved to MCLR from 1st April 2016.

Additional Reading: MCLR Linked Loans – More Affordable Loans For You

BankBazaar had previously mentioned that the cut in small savings rates would lead to lower loan rates pretty soon and this is becoming a reality now.

Rate Cuts Have Begun

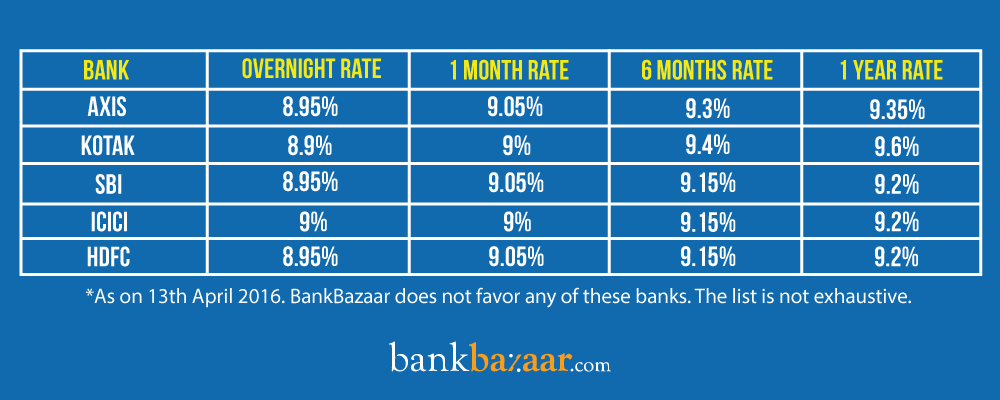

Axis Bank is the first bank to begin reducing its lending rates after the RBI cut its repo rate this month. It has reduced its MCLR by 15 basis points across tenures. This will be effective from 18th April 2016. At Axis Bank, overnight rates will now cost 8.95%, 1 month rates will be 9.05%, the 6 months rate is pegged at 9.3% and the one year loan rate, which should concern you, will cost you 9.35%. However, note that there are other banks with better loan rates. It is important to shop around.

It may not be long before other banks also start lowering their rates. However, since MCLR rates are reset every month, it is possible that banks might wait till 1st May to cut their lending rates. But note that it is widely anticipated that deposit rates will be cut before lending rates are brought down. So, while you wait for the rate cuts for your loans, you should lock in your deposit rates for the long term as they might go down as well.

How Does It Impact You?

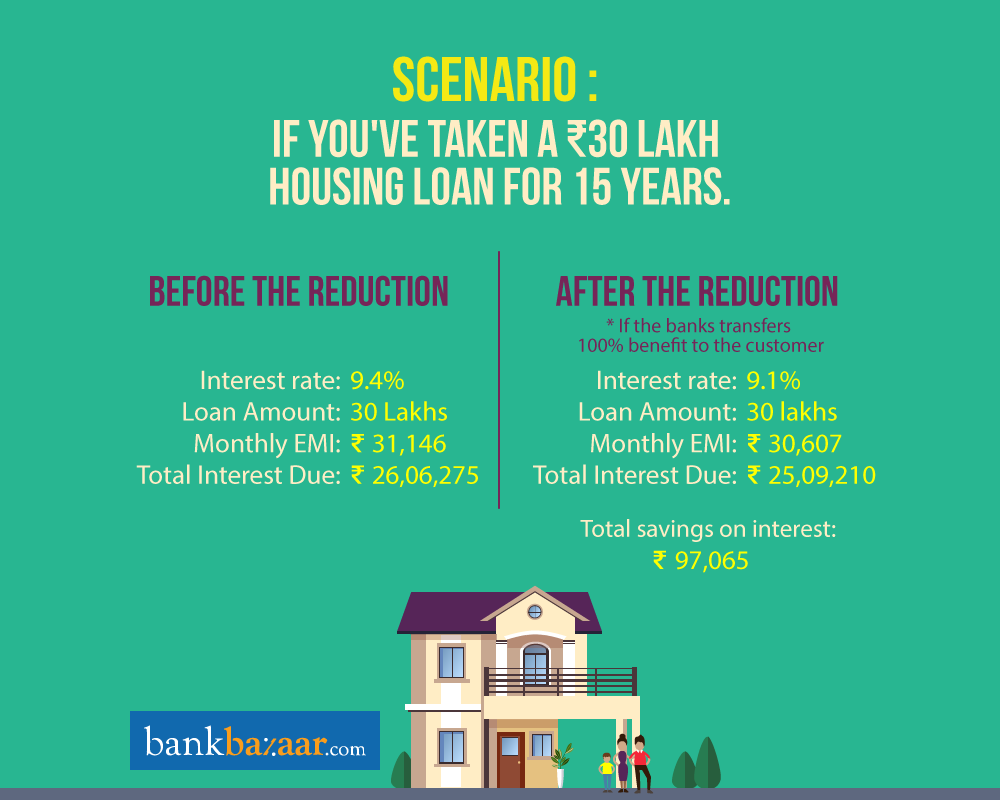

Any drop in loan rates will mean lower interest outgo for you. For instance, if you had taken a Home Loan of Rs.30 lakh for 15 years at 9.4%. Your monthly outgo would have been Rs.31,146 and the total interest outgo would be Rs.26,06,275. Suppose your Home Loan rate is now 9.1%. You could make significant savings on your interest. Here’s a scenario.

Happy Times Here To Stay

At least for the next year or so, we can hope to see more such rate cuts, which will help make loans more affordable. So, stay alert for those updates and choose the right lender to get the best rates from the market.