Portfolio Management Services (PMS) are being offered by all and sundry. But are they any good? Are they better than Mutual Funds? Here’s the lowdown on them.

Portfolio Management Services or PMS, as they are popularly known as, offer you personalised investment services. These are similar to Mutual Funds but are offered only to High net worth individuals (HNI) or people with a large amount of surplus money. Most financial institutions that offer PMS promise customisation for your investments. They also mention that you will get higher returns when compared to other investments. Data also reveals that investors are flocking to PMS. As per data provided by the Securities Exchange Board of India (SEBI), Assets Under management (AUM) for PMS have gone up from Rs. 3,62,946 crore in December 2010 to Rs. 10,41,083 crore at the end of 2015. This is an increase of 186% in 5 years!

Given all this, as an investor, PMS might sound very lucrative to you. But there are a number of points to keep in mind before you opt for these services. First, you need to understand what PMS is, what are the services offered under the PMS umbrella, whether the charges are high and finally, are they better than Mutual Funds (MF)? We answer all of these questions just for you.

What is PMS?

PMS refers investment services offered by financial institutions and help manage your investment portfolio based on your return expectations, requirements and risk profile. This is done for a fee. PMS consists of investments in instruments such as stocks, bonds and structured products. Structured product are financial instruments that investment in equity derivatives or commodity derivatives or both. PMS are presently offered by independent PMS firms, banks, Mutual Fund houses and financial institutions. Note that PMS is carried out as an agreement between you and the service provider. So, the onus lies on you to ensure that the terms are in your best interest. They are, of course, meant for only those with huge surpluses to invest and are willing to take high risks. A portfolio manager will be assigned to your portfolio and he/she will take care of your investment needs.

What are the services offered?

There are three types of services that are usually offered by PMS providers.

- Discretionary PMS – Here, the portfolio manager assigned to you will decide which investments to make and when to make them. This is similar to Mutual Funds where the fund manager will decide what to invest in and when to invest in them. There will be minimal customisation of your portfolio.

- Non-discretionary PMS – If you choose this type of PMS, the portfolio manager will suggest investment ideas. You will be the one who will decide whether to execute them. You will also take a call as to when to execute them. The portfolio manager will then make the actual investments based on your decision.

- Advisory PMS – Under this form of PMS, the portfolio manager will only suggest investment ideas. It is totally in your hands to decide whether to execute them. Apart from deciding when to execute the investments, the actual execution will also need to be done by you. This is the totally customised form of PMS.

Most of the PMS firms offer discretionary PMS services, including banks. There are only a few firms that offer all three types of PMS. Note that unless you have equity market or investment knowledge, it is best to stick to discretionary PMS. If you have knowledge and the time to look at your portfolio, you can choose either non-discretionary or advisory PMS.

What is the eligibility criteria?

According to the latest guidelines given by SEBI, the minimum investment for opening a PMS account should not be lower than Rs.5 lakhs. Even though lower-level firms might accept this amount to open a PMS account, note that many top PMS companies or banks require you to make a minimum investment of Rs. 50 lakhs to Rs. 1crore. There are some super-specialty firms that look at only clients having a portfolio of Rs. 4 crores or more. Criteria are not only for investors, but apply to portfolio managers too. A portfolio manager can run a PMS only if the firm’s minimum assets are Rs. 2 crore. The PMS firm must have a certificate of registration provided by SEBI before starting the PMS. Note that this certificate is valid only for 3 years.

How is the portfolio made?

Contrary to popular perception, PMS is not ‘totally’ customised. Typically, PMS firms will offer customisation by not investing in stocks that you don’t want them to invest in. Total customisation happens only for those who have a very large investible corpus of Rs. 1 crore or more.

So, how does this work? Usually the PMS firm will give you a few model portfolios. This will be based on your risk profile, return expectations and other requirements. Then, the portfolio manager will tell you to choose a particular portfolio. Note that the portfolio models will be different in terms of their style of investing. This will include the instruments chosen, the sectors that are taken into consideration and the amount invested in the equity market and debt market. So, how should you choose the right scheme? You need to take a look at the past performance of the model portfolios. Taking the risk adjusted returns of various PMS products will give you the best results. What do you look for? Consistency of performance. Also, check if the model portfolio actually suits your risk appetite.

What about the charges?

Note that PMS doesn’t come cheap. Charges are obviously much higher than that of Mutual Funds. This is because SEBI hasn’t set any limits for charges for PMS, unlike Mutual Funds. According to SEBI, “a portfolio manager shall charge a fee as per the agreement with the client for rendering portfolio management services. The fee so charged may be a fixed amount or a return-based fee or a combination of both.” So, the cost structure provided by the PMS firm might be ambiguous. Note that these charges are not monitored by any regulatory authority. With trading costs being very significant, PMS charges might be high.

When choosing a PMS product, you need to understand all the associated charges. There are several charges including management fees, performance fees or profit sharing, transaction charges, depository charges, demat charges among others. You will find that the charges are usually in two formats. One is the fixed-fee model while the other is the profit-sharing model or the variable fee model. Some could offer a combination of both. PMS firms will also charge you fund-management fees, just like Mutual Funds. The fixed-management fee could be anywhere between 1% and 3% per annum. This is calculated based on the average assets under management (AUM) on a quarterly or half-yearly basis. This will be apart from the depository charges and service tax. Some might skip management charges and instead charge you a performance fee. This fee could be about 15% to 25% of the profits made and generally payable once a year. Transaction costs will be about 0.3% to 0.5% of the AUM, payable on a yearly basis.

When you put all the charges together you might get a huge amount. Typically, PMS charges can be as high as 3% to 5% of your investment which could be a big amount if you are investing a high amount. Many PMS products offer you the profit sharing option. This might be a better model given that the portfolio manager will be forced to dish out a decent return. But note that since the portfolio managers make those profits for you, they might take performance fees from the profits they make. Here you need to look at the water mark level. Water mark level is the highest point or value that a PMS investment can achieve due to the fund manager’s expertise. Typically, the higher the water mark level, the better. This mark will be used as the benchmark for judging the portfolio manager. A high water mark level will ensure that you pay fees to the PMS firm only when the portfolio manager delivers reasonable profits.

How good are the returns?

As you know, PMS is a high-risk product. The returns will become visible only in the long term. As historical data goes, genuine PMS products can only give you only slightly higher returns than Mutual Funds. However, there are still firms offering ‘guaranteed’ returns every year or even every month and investors do get duped. Most of the investors who invest in such PMS schemes end up with a big loss. Take the case of Ambuja, a director in a tech firm. She had been investing in the stock market for over 20 years. However, after becoming the director of her firm, she didn’t have the time to look at her investments. So, she decided to go for a PMS product. Ambuja invested close to Rs. 40 lakhs in PMS, with a popular brokerage that advertises heavily. They promised to give her great returns and that too every month! Their charges were minimal. So, Ambuja decided to go with them. But within a few months of handing over her portfolio to them, the portfolio value had gone down to about Rs.28 lakhs. The brokerage said it was because of a market downturn. In fact, they promised to make up for it. But within the next few months, the portfolio fell to Rs. 25 lakhs and Ambuja decided that enough was enough. She withdrew and went back to the brokerage she was with earlier. She is trying to rebuild her portfolio.

You could become like Ambuja, if you are not careful about the firm you choose. You must understand that you cannot get phenomenal returns in the short term using PMS. Don’t get lured by false advertisements. Also, note that according to SEBI guidelines, PMS firms cannot promise even indicative returns, let alone guaranteed returns. Ask around and talk to existing customers to get an idea about the PMS firm.

Caveats

There are a number of things that PMS firms will tell you but you should be proactive and ask them questions instead of blindly believing everything they say.

- We guarantee ‘x%’ returns – PMS firms are not supposed to offer guaranteed returns. It is against the guidelines laid down by SEBI. You must ask how they are able to guarantee returns. If you don’t get a satisfactory reply, refrain from investing in those companies. This is especially true if the returns are over 15%.

- You can have a free hand with investments – Remember that most firms will offer only discretionary PMS services. So, you will have little say on buying, selling or holding any of the investments. If the PMS firm tells you that they will give you a free hand even for discretionary PMS, check the terms and conditions to see if that is the case.

- We will not provide ad-hoc statements – According to SEBI rules, portfolio managers need to provide clients with reports as and when they request for it. This will, of course, be in addition to the periodic statements that you will be provided with.

- We are a SEBI-approved PMS firm – Note that SEBI only regulates PMS firms. It does not approve any of the PMS firms or their activities. However, a company providing PMS has to register with SEBI and get a license.

- We invest only in ‘safe’ instruments – Investing through PMS could be highly risky. It involves investments in direct equity and structured products which come with high risks. The company offering PMS has to give details regarding the risks involved in making a particular investment. Check with the portfolio manager for the same.

- Our disclosure document is SEBI approved – Disclosure documents are not given a once-over by SEBI. SEBI will not be able to certify the accuracy or adequacy of the contents. So, don’t believe such statements.

- Charges will vary depending on the transactions – According to SEBI guidelines, the portfolio manager has to take prior permission from you for charging fees for each activity for which he provides services. This will be irrespective of whether he gives you the service himself or outsources it. You must clearly understand the fee structure before signing on the dotted line.

Can you participate in the investing process?

Yes. In case of PMS, you will be allowed to participate in the investment process. But only under the non-discretionary and advisory PMS products. These are usually for ones with surplus of Rs. 1 crore or more. However, the PMS firm you choose should have a system using which you can give your feedback to the portfolio manager. Ask them for opportunities to interact with the portfolio manager. There are times when you might need to talk to them. For example, Ambuja (that we mentioned earlier) had told the PMS firm not to touch certain shares in her portfolio. But the PMS firm had sold them and invested in shares that were duds.

The PMS firm should also keep you updated about important events like bonus issues, take-overs and other events of the stocks held. Many PMS firms update their clients regarding these events and ask for their feedback on whether to hold the shares or sell them.

How transparent is the whole process?

Even though PMS products are supposed to be more transparent than Mutual Funds, this is usually not the case unless the PMS firm is proactive. They need to tell you which shares were bought, which were sold and what profits were made. You will also need to know if any investments have resulted in a loss. You can also know exactly at what price these investments were made.

Like Mutual Funds, PMS firms will give you monthly statements along with web access to portfolio information that you can check anytime you want. Usually, PMS firms do provide an audited report that is sent to you at the end of every financial year. You can, of course, request for ad-hoc statements at any point of time. However, updating your portfolio will differ from firm to firm. Some firms may update your latest portfolio statements at the end of day on a daily basis while other might allow you to log in and view your portfolio performance which is updated only once in 15 days. As is obvious, the more frequently your statement is up to date, the better for you to take the right decisions.

Is there a lock-in period?

Just like open-ended Mutual Funds, PMS products generally have no lock-in period. However, there might be an exit load if you decide to close the account within a year. The average charge could be anywhere between 1.5% and 3% of the AUM. There are firms that might restrict you from closing your account within a year. Talk to your firm regarding the terms and conditions. Understand that PMS with a concentrated and customised portfolio is very different from a Mutual Fund. In order to get the best returns, you need to remain invested for at least 3 to 5 years. Most PMS firms will not allow you withdraw partially.

What about taxation?

Even though PMS has been in existence for many years now, there are still no clear rules governing its taxation. PMS could either be taxed as a business income or as capital gains. In a tax judgment regrading PMS, it was held that the determinant factor for identifying income from PMS will be the intention at the time of purchase. It might be taxed as business income if you are looking to make regular profits from the same. When you classify the income, it will get taxed as per your tax slab if it is business income. In case you are not looking at regular income from PMS, you could classify it as investments and the capital gains tax rate will apply. However, note that most often short-term capital gains tax rate might be applied. PMS services will be subject to securities transaction tax as well as service tax.

Note that usually PMS products have a high portfolio churn. Churn is how often investments are bought and sold. So, tax authorities might classify PMS portfolios with a high level amount of churn or trading activity as business activity rather than as investment. This classification will mean that the income from PMS will get taxed as per your income tax slab rather than the concessional rates that are applicable to capital gains from investments.

What are important documents you should be aware of?

When you are signing up for a PMS account, you will be given three documents that are crucial and need your attention. One is the Disclosure Document (DD). The DD will have all the terms and conditions related to the PMS. All the important disclosures that the PMS firm has to make will be available in this document. The next one is the PMS agreement. This agreement will have all the details related to your rights and obligations as regards the PMS product. You need to get the DD at least two days before you sign the PMS agreement. The last important document will be the fee schedule. This will have details regarding all the charges that are applicable to the PMS product. It will also tell you whether the fee will be fixed or variable or both. You should not sign the PMS agreement without going through the DD and the fee schedule. In case you do not understand certain terms and conditions, the PMS firm has to explain the same to you. Another important point is that the PMS firm should take all efforts to determine your risk profile and investment requirement in the right manner. This must be done when you choose the PMS product.

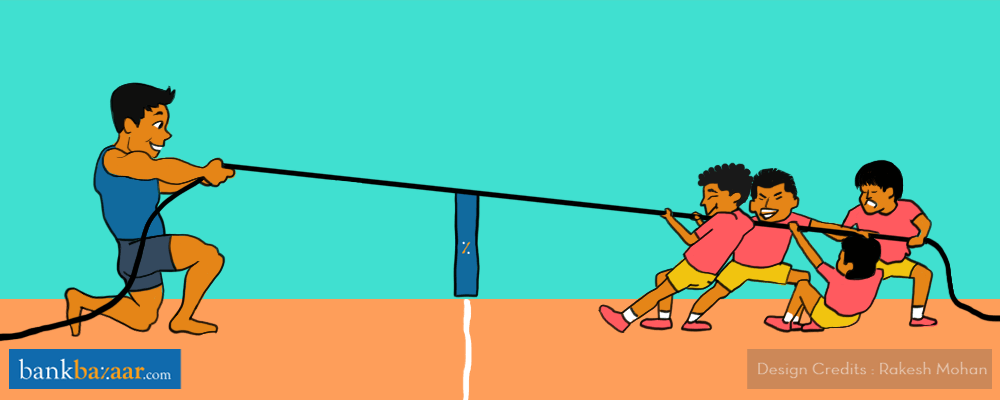

Portfolio Management Services Vs Mutual Funds

If you have a huge investible surplus and big risk appetite, PMS can provide you with better returns than Mutual Funds. However, you might need to do a whole lot of research before choosing a PMS provider. You also need to have the knowledge to choose the right PMS product. The model portfolios should also suit your risk profile and requirements. Customisation might also be minimal. Ideally, you should opt for PMS only if it is substantially different from the standard Mutual Funds on offer. For example, an equity PMS might not be very different from an equity diversified Mutual Fund. Also, note that Mutual Funds are better regulated when compared to PMS schemes. The charges are also capped. The risk and return disclosures will also be very transparent. For any investor, Mutual Funds might be more convenient and easy to invest in, when compared to PMS.

Ready to start investing?

Great article that distinguishes between portfolio management services and mutual funds in a detailed manner. PMSs are broadly similar to mutual funds, as both manage investors’ money by investing the corpus in a portfolio of stocks or fixed income securities, depending on the type of scheme and investment strategy you choose. They offer a variety of schemes, each with a different investment objective. And, these have a designated fund manager to oversee the investments. Thanks for sharing this insightful article.

Hi Jay Mehta,

That is right! Glad this article was useful to you.

Cheers,

Team BankBazaar

Hey Kavya, Nice article. Got to familiar with so many things like SEBI rules and documents. Thanks for sharing this.

Hi Priyanka,

Thanks for writing in. We’re delighted to know at you found our article useful. Please do read our blogs for more such information on personal finance.

Cheers,

Team BankBazaar