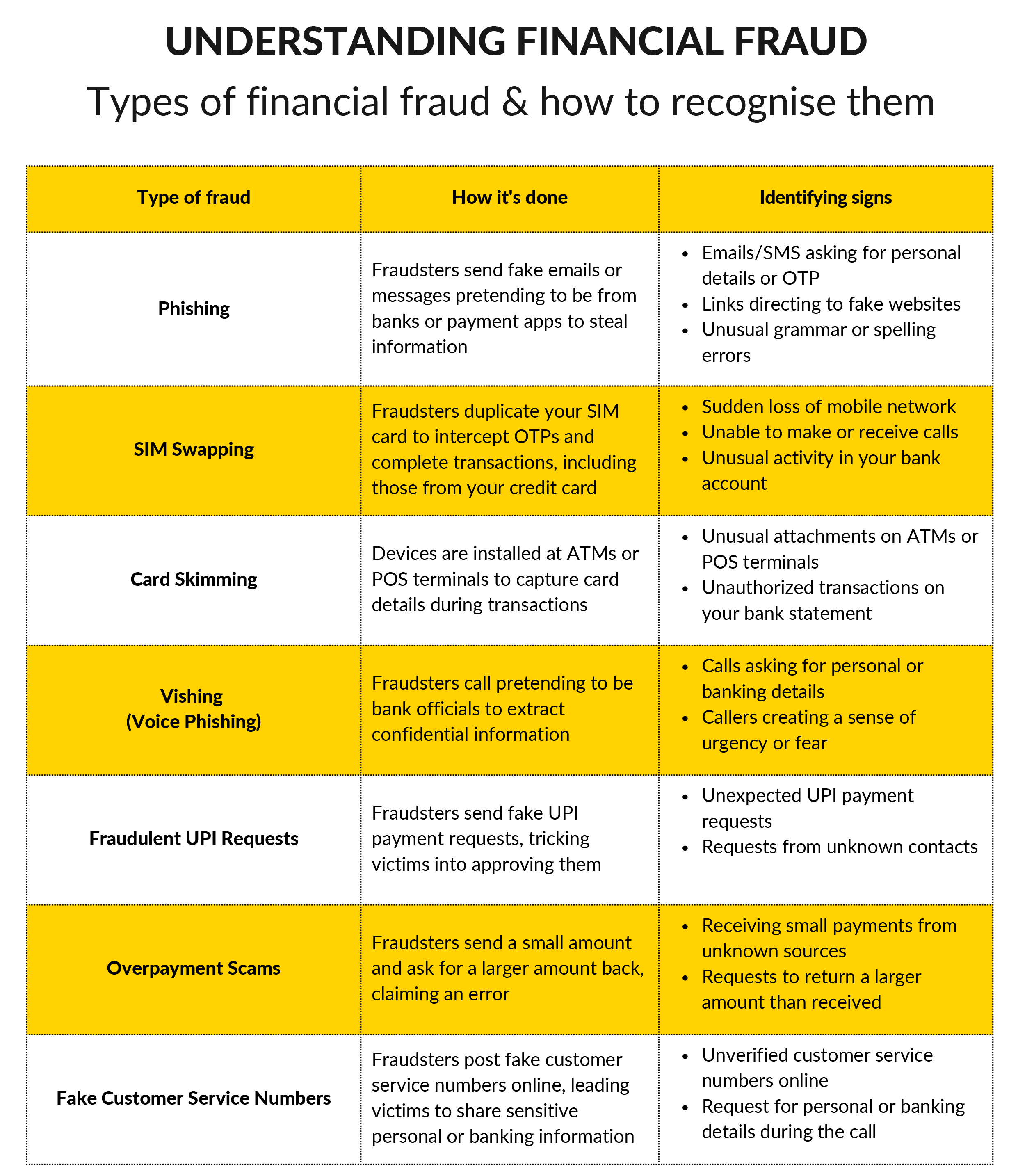

Financial fraud is an ever-evolving threat that you, or someone you know, has likely been a victim of. This threat extends to banks and financial institutions dealing with customers’ financial data. With AI, financial frauds are becoming highly sophisticated and often hard to detect.

The Indian Cybercrime Coordination Centre (I4C) reported that over the last three years, digital financial frauds have led to staggering losses worth ₹1.25 lakh crore.

In 2023 alone, over 13,000 cases of financial fraud were recorded, nearly half of which were digital payment fraud (card/internet). According to data from the National Cybercrime Reporting Portal (NCRP), victims of digital financial fraud reported to have lost at least ₹10,319 crore.

The rising popularity of digital payment methods, including credit cards, has led to an uptick in digital financial fraud. Staying vigilant and aware has, thus, become essential. This primer covers various types of fraud and the warning signs to watch out for. Also included are practical fraud-prevention strategies you can use to protect your finances and a glimpse into the Reserve Bank of India’s rules on credit card fraud prevention that you will find useful.

What To Do If You Lose Money

- Report the incident immediately: Promptly report the fraudulent incident to your bank or UPI app provider. Here, time is of the essence – the earlier you report, the higher will be your chances of being eligible for zero eligibility protection, subject to conditions.

- Block your cards: Request the bank to freeze your account and block your card to prevent further misuse.

- Provide relevant details: When reporting the incident to the bank, provide all information such as emails, SMSs, screenshots, transaction details, or any other incident-related details, if necessary. This documentation can help support your case.

- Dispute resolution: After filing the report, follow up on the dispute resolution process. Adhere to the reporting deadline and provide all necessary documentation to maximize chances of recovering your funds.

- File a police report: If required, file a complaint with the local cybercrime unit or police which can serve as an official record and may be necessary for further investigations.

- Notify your credit bureau: Don’t forget to notify your credit bureau of the fraudulent incident to prevent it from impacting your credit score.

- Monitor your accounts: Check your credit card accounts regularly to track your transaction activity. This will allow you to flag and report suspicious without delay.

Best Practices For Fraud Prevention

- Set transaction limits: As a first line of defence, make use of your credit card’s built-in controls to limit where and how your card can be used, i.e., online, point of sale terminals, or via tap & pay. You may also set transaction limits different types of transactions to limit your liability in case of unauthorised use of your card. Check if you can tweak these settings for domestic and international transactions.

- Never share sensitive information: Sensitive data like credit card details, PINs, and login passwords must never be shared with anyone. Also refrain from sharing personal information online. Avoid using public Wi-Fi or entering sensitive banking information over unsecured public networks.

- Set up transaction alerts & review credit card statements: Transaction alerts, for primary and add-on cards will help you keep tab on what the card is being used for. Review your credit card and bank statements frequently to check for unauthorised transactions.

- Never leave your card unattended: When making payments at restaurants or fuel stations, always keep your card within sight when handing it over to the attendant. Use EMV chip cards to reduce the risk of skimming and inform the staff promptly if you notice anything unusual with the card slot or Point of Sale device.

- Shop online safely: Only shop from trusted and established websites that offer secure payment gateways. Enable Two-Factor Authentication (2FA) for your accounts for added security.

- Update devices regularly: Security patches and updates are typically offered by the device manufacturers and software developers to help device owners stay protected against the latest cyber security threats.

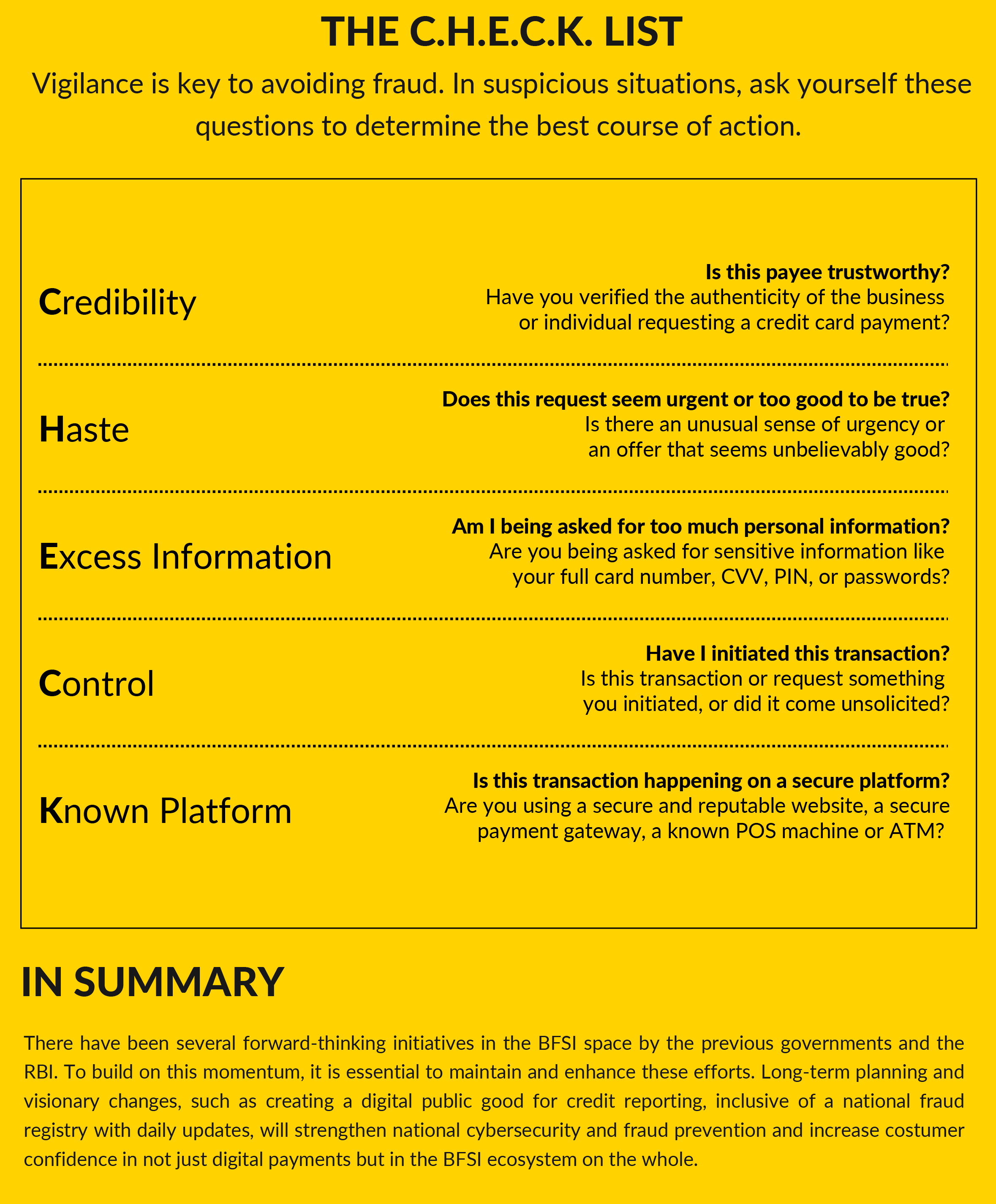

- Be vigilant: Acquaint yourself with the warning signs of online scams. These could be suspicious emails/SMSs/websites, unsolicited payment requests, suspicious links, or request for banking information, among other things. If fraudulent activity occurs, promptly report it to your bank.