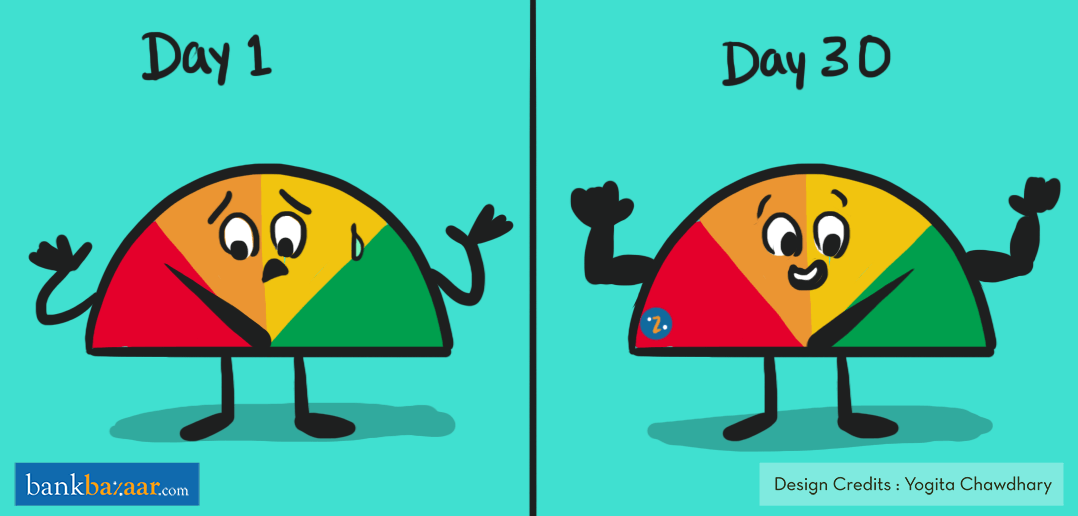

Your mission, should you choose to go through with it, is to improve your Credit Score in 30 days. Below are the essential hacks you need to employ to succeed in this mission. Are you ready? Let’s go!

How much can be done in 30 days? Turns out, a lot – especially if you’re talking about your Credit Score. Yes, it’s true. Now, before we go ahead, let’s set the expectations right. If you’re someone who has a Credit Score below 600, don’t expect it to cross the 800 mark in these 30 days; this article will help you to get to a zone where you can get potentially closer to the golden number. Ready? Let’s do this.

Clear As Much Debt As You Can

Clearing your debt can go a long way in cleaning up your credit profile. If you’ve been paying just the minimum due on your Credit Card, it’s time to pay up a little more. Why? Because not only does paying the minimum due cause your outstanding amount to slowly mountain up thanks to high interest rates, it also doesn’t look good on your credit report.

Lenders like to see if you’re good at exercising restraint when it comes to credit; just because you have a big limit, it doesn’t mean you need to use it up. Now, by not paying your Credit Card dues in full or at least in sizeable chunks, you’re allowing your credit utilisation ratio to look bad. When it comes to Credit Cards, always pay up as much as you can, when you can.

Additional Reading: 6 Obvious Reasons To check Your Credit Score Regularly

Add A New Ingredient To Your Credit Cocktail

One of the best ways to quickly up your Credit Score game is to get a Credit Card. This works especially well if you currently only maintain loans and have a reasonably good Credit Score that will help you get a Credit Card. Once you do, your portfolio becomes more interesting. Not only will doing so help your score, it will also help you save tons on shopping and movie tickets. Want to get started? Click here to get a Credit Card.

Additional Reading: Check Your Credit Score On The Go

Check Your Report For Errors

When you’re on a mission of this nature, you’ll want to leave no stone unturned. Go through your latest credit report and scan it for errors. Who knows? Rectification may bump your score up quickly. Besides, it’s just good practice to be vigilant about your credit report so that you can say error-free.

Additional Reading: The Credit Score Guide For 20-Somethings

Make Small Transactions On Inactive Cards

Holding Credit Cards that you barely use? They’re adding nothing to your Credit Score. Instead of just using one card, make transactions on all your Credit Cards; this way, they’ll all be active – it’ll help your score. What’s more? It’s important to keep your oldest Credit Card active as it will make your credit line look better.

These four quick steps should help you give your Credit Score a significant bump within in a month. Get started on the mission by seeing where you stand now: