Let us give you a four-step approach to creating and maintaining a successful investment portfolio.

A well-balanced portfolio is instrumental in achieving success in investing. One way to getting a profitable investment portfolio is by determining the asset allocation that is best suited to your individual investment goals.

In short, your investment portfolio should ideally match your future goals and financial needs. In order to do that you need a systematic investment approach.

Let us give you a four-step approach to creating and maintaining a successful investment portfolio.

Shall we begin?

-

Step 1: Determine your asset allocation

Assess your financial goals and consider your life stage when making your investment decisions. Allocate money to various investment assets accordingly. This is the first thing you need to do when you want to create your investment portfolio.

Factors to consider: Think about your present age and how much time you have to remain invested. Also, take into consideration the amount of money you are willing to invest.

For instance, if you are fresh out of college and newly employed with minimal or no financial responsibilities, your investment strategy will be very flexible in terms of your risk tolerance. You can definitely afford to take the plunge, given that you will reap high returns.

As your life stage evolves, so will your investment needs. Your financial strategy will need to change to keep pace with your lifestyle.

Additional Reading: Avoid These Worst Investing Mistakes

Types of investors

There are mainly two types of investors – Conservative investors and aggressive investors. This categorisation of investors is based on their risk tolerance. What type of investor are you? If you allocate a large portion of your investment corpus to equities rather than bonds and fixed-income investments, you have a higher tolerance for risk.

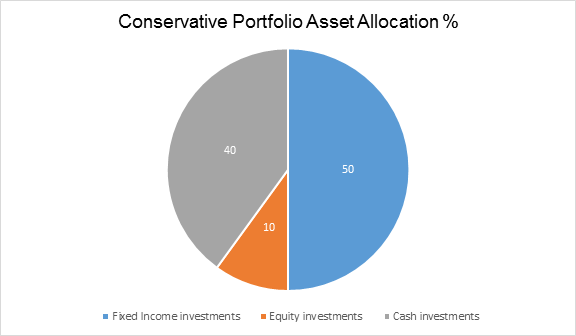

Let’s give you a glimpse of a conservative investment portfolio.

The aim of a conservative investment portfolio is to maintain its capital. The investment would give an investor steady income from bonds and long-term capital growth from the equity investments.

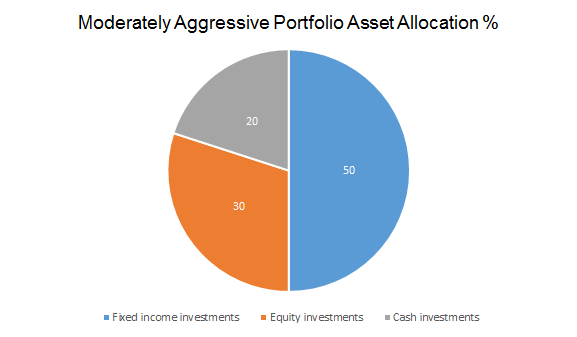

Now, take a look at a moderately aggressive investment portfolio.

The moderate investor will be one who is not willing to expose his capital investment to excessive risks and has an investment horizon of 5 years. The idea behind a moderately aggressive investment portfolio would be to cater to investors with a slightly higher tolerance for risks compared to conservative investors. This type of portfolio strikes a balance between capital growth and income with approximately 50% of the portfolio invested in equities.

-

Step 2: Achieve the ideal portfolio

After you have successfully identified the appropriate asset allocation for your investments, you will need to divide your investment corpus between equities and bonds.

An investor can also decide to further spread his investments across various investment classes such as large-cap funds, mid-cap funds, and small-cap funds.

Your debt investment portion can be divided among short-term funds, long-term funds and government or corporate debt instruments. Government debt instruments will include treasury bills and savings certificates.

Choosing assets

Selecting Bonds

When you begin choosing which bonds to invest in, you should consider various factors, including the annual interest rate paid on bonds (called a coupon rate), maturity period of the bond, the type of bond and so on.

Choosing Mutual Funds

Mutual Funds are available for investors who are interested in investing in different asset classes. Choose between Equity Mutual Funds, Debt Funds or plain Equity Funds that invest in stocks. In Equity Mutual Funds, you can select the type of asset classes among large-cap, mid-cap, and small-cap funds or stocks.

Exchange Traded Funds (ETFs)

ETFs are an alternative investment option if you don’t want to invest in Mutual Funds. Exchange Traded Funds are like Mutual Funds and are traded similar to stocks.

-

Step 3: Reassessing Investment Weightages

After you have created your investment portfolio, you should allow it to generate suitable returns for you over time.

It is also important to rebalance your investment allocation periodically, to keep pace with the changes in market trends. Any changes in your financial situation, investment requirements and risk tolerance may also prompt you to consider rebalancing your investment portfolio.

-

Step 4: Strategically rebalancing your portfolio

Identifying the need to rebalance your investment allocations is only part of the process. After identifying when to rebalance the portfolio, you need to decide which securities you will buy to realign your investment mix appropriately.

Perhaps you will reduce investing in high-risk Mutual Funds in favour of more steady returns from Debt Funds. Select carefully, depending on any additional investment-related costs you may have to incur.

For instance, you may need to pay a sizable sum in capital gains tax if you sell all your equity holdings. To avoid paying a high amount of capital gains tax, you can probably reduce your contributions to any funds in a certain class, such as equities for example. Instead, you could focus your contributions towards other assets classes and investment products.

Additional Reading: Set Your Goals Before Investing In Mutual Funds

Remember, it’s never too late or too early to begin investing. So, invest now, start growing your wealth and secure your financial future.