Unlike the common perception, saving money isn’t hard as they make it seem. Check out these eight simple ways that can help you save a great deal of money every month.

If there’s one thing that this whole pandemic situation has taught us, it is the importance of saving money. This includes cutting down on our monthly budgets and having enough funds to fall back on in case there is an emergency situation.

So, want to save more than you’re saving currently every month? Maybe you should try living your life a little differently. We’ve compiled a list of eight simple ways with which you can cut down on your monthly expenditures. Some are pretty straightforward, while some may be kind of unconventional. But, if you really want to save a few extra bucks, you wouldn’t mind trying them.

Check out great offers on Loans and Credit Cards

Turn out the lights, now!

One of the easiest ways to save a little extra every month is by turning off lights and any/all electrical appliances when you aren’t using them. Minimal use of lights and electrical appliances means low utility bills to pay. So, you’ll have more money in your pocket, and additionally, you’ll be playing your part in saving the environment too.

The closer, the better!

We know that most of you are working from home these days and, of course, are saving big on commute. However, this next hack will come handy once we return to normalcy.

Move closer to your office and you’ll save a great deal on travel. Plus, you’ll get extra time for yourself too. In case you can’t or rather don’t want to move closer to your office, you should totally try ridesharing. Even if you’ve got your own vehicle, you can earn a couple of extra bucks by offering to share your ride with those who are travelling to the same part of the city.

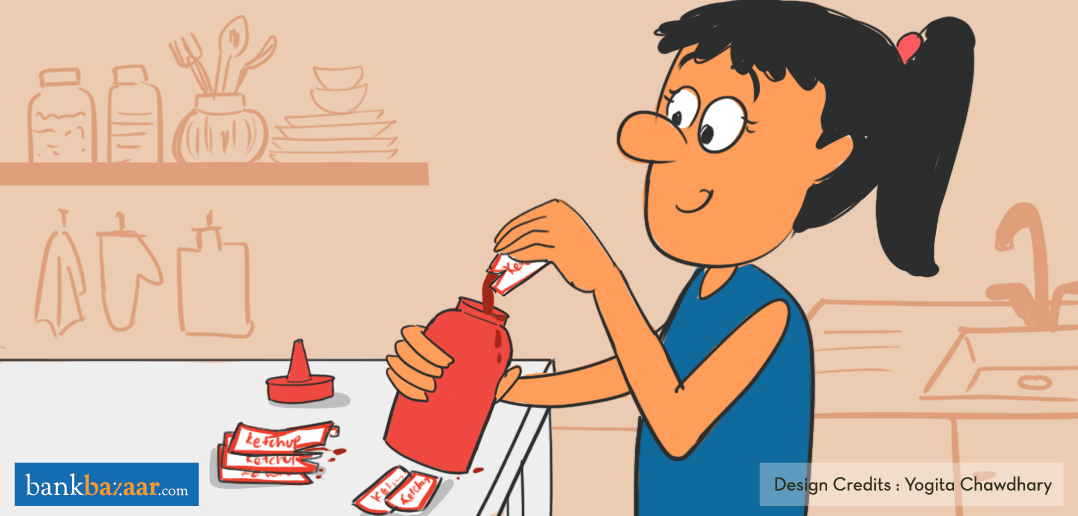

Save the condiments, please!

Don’t throw away the condiments you get with your food orders. Instead use them to refill your condiment bottles. You’ll be amazed at how long that bottle of ketchup or tub of oregano will last. We even know of a few extremely weird people who actually take (read: steal) the condiments when eating out too <wink>. Nothing to be ashamed of, seriously!

Additional Reading: Strange And Unconventional Money-Saving Tactics

Kill the expensive addictions!

Do you often chill with a can or two of beer or a bottle of vodka/whisky and a pack of cigarettes? Well, trust us when we say that this habit of yours is something that’s draining quite a bit of your income every month.

Let’s assume that you consume a total of 3 cigarette packets of 10 each and about 30 cans of beer in a month. Assuming a 10-pack of cigarettes costs Rs. 150 and a can of premium beer costs Rs. 150, you’re spending Rs. 4,950 every month on just alcohol and cigarettes. Costly much, right?

Homemade food is BAE!

Have you been ordering-in food every day? Maybe it’s time you stop completely or make it just a weekly affair. Why? Well, let’s do some quick math. Let’s assume that you are single and you order breakfast, lunch and dinner every day, and for each meal, you spend Rs. 150. That’s Rs. 450 in a day and Rs. 13,500 in a month for just food. Whoa!

Now, if you limit your orders to just once a week and cook your meals for the rest of the days, your total expense on food will easily be cut down to half of what you’ve been spending currently.

Stop the pub-hopping, dear socialites!

We get it. YOLO, right? Anyway, we aren’t trying to spoil your social life. We just want you to know that you can still enjoy a really awesome social life, but on a budget. Pubs are a costly affair – we bet you can’t disagree! So, how about you call your friends home? Have a potluck and BYOB party with music and probably some fun games – try Truth or Dare, UNO, Rummy, Bluff, Scrabble or anything else you prefer. Or you could just NetFlix and chill too.

Ain’t this way cooler than those overcrowded and extremely loud pubs? Of course, it is, and plus, you’ll be saving a great deal on your monthly expenses.

Additional Reading: Dreading A Broke Month End? Here’s How You Can Still Have Fun

Forget postpaid, prepaid is in!

Still stuck to a postpaid mobile plan? Move on, dear friend! Prepaid is in, offering great advantages like full talk-time offers, free calls, free data up to a limit every day, no roaming charges and more. Basically, with a prepaid connection, you’ll save a lot of money without compromising on anything. Give it a try, you won’t be disappointed.

Get a Credit Card, yo!

Yes, it’s true! A Credit Card can help you save a few extra bucks every month on your spends. But, you must choose a card that offers you deals on things that you spend on the most. For instance, if you spend quite a bit on fuel, a Credit Card that helps you save on fuel will be ideal.

For groceries and supermarket spends, go for a card that gets you cash back and reward points on your purchases. If you’re a movie buff, there are quite a few cards out there that give free movie tickets every month or offers discounts on bookings.

Need help finding the right Credit Card? Well, you’ve come to the right place. Just click the link the below and we’ll assist you. There are great offers on IndusInd and SBI Credit Cards waiting for you and the application process is completely contactless – no physical meetings or documents. Check ’em out now.