Here’s a step-by-step guide to e-verify your income tax return (ITR). Don’t forget to file your return and verify it before the tax-filing deadline of 31st July!

The deadline to file your income tax return (ITR) (31st July) is drawing near. If you haven’t already filed your tax return, better get cracking to avoid paying a late fee!

Additional Reading: How To File Tax Returns Online!

If you’ve already filed your income tax return, here’s something else you should be aware of – Simply filing your return is not enough. According to our tax laws, the filing of your return is not valid until you verify that it has been filed (either electronically or physically). So, remember, the next step after filing your income tax return is to verify it.

Did you know a Home Loan gives you tax benefits? Click here to explore Home Loans.

There are three steps involved in the processing of your income tax return:

1: File your income tax return

2: Verify your return

3: The Income Tax department processes your return

Here’s a step-by-step guide to verify your income tax return.

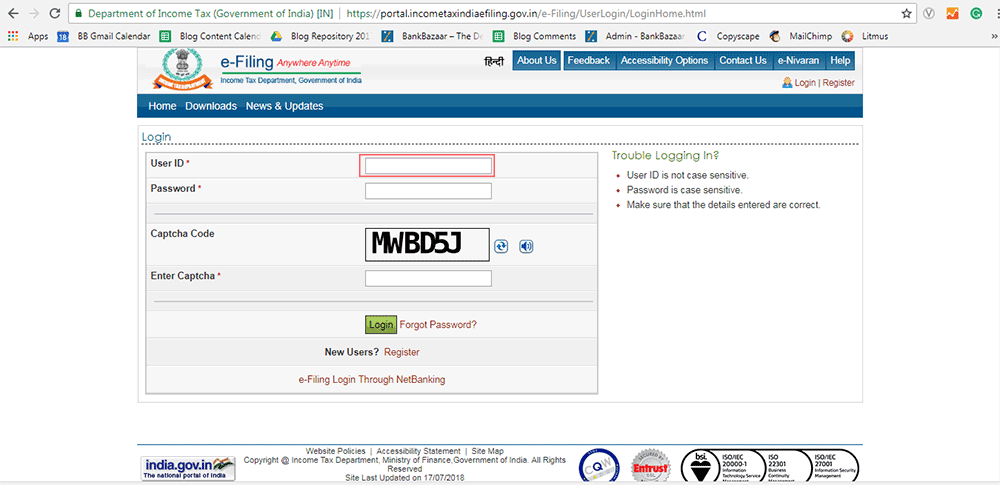

Step 1: Go to the Income Tax website (incometaxindiaefiling.gov.in) and log in

Tip: Your User ID is your PAN

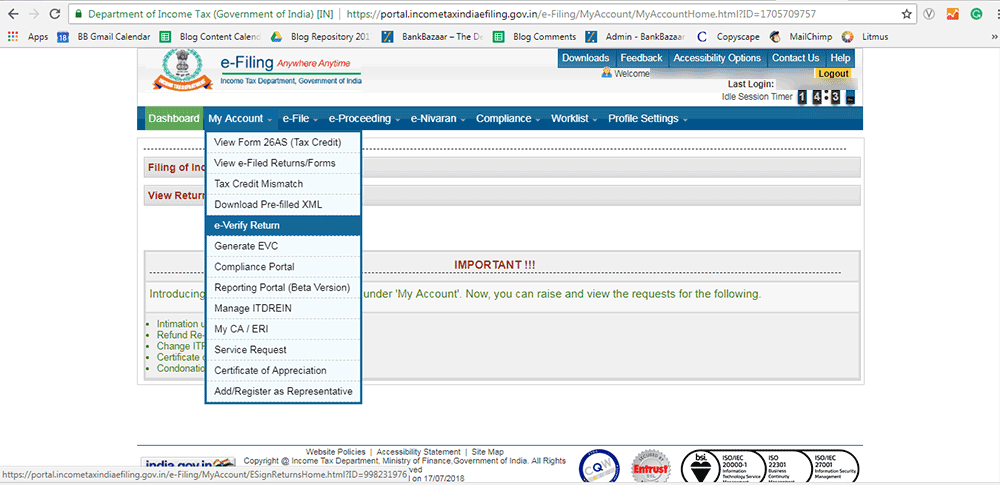

Step 2: Click on the ‘e-Verify Return’ option under ‘My Account’. You will be taken to the e-Verify Return page

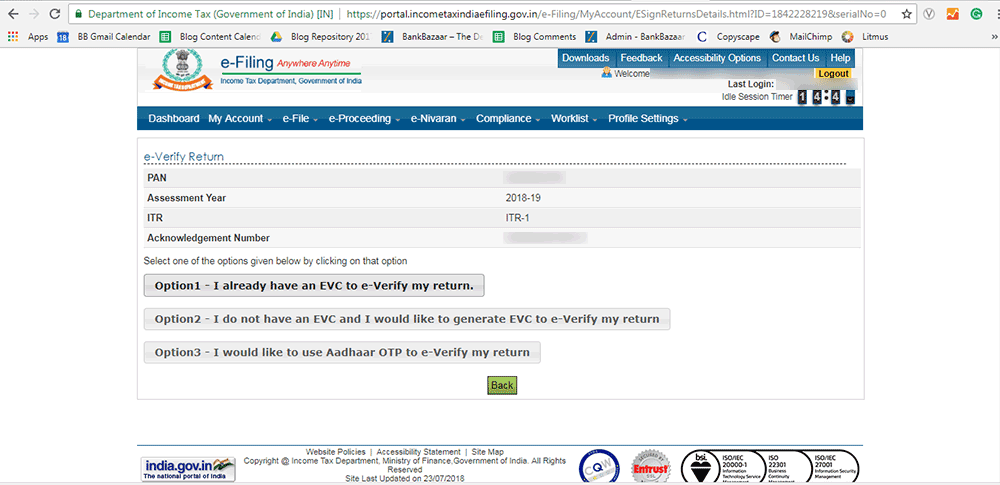

Step 3: Click on e-Verify. You will be taken to a page with the following options:

- Option 1: I already have an EVC to verify my return

(EVC = Electronic Verification Code)

If you choose this option, enter the EVC and click ‘Submit’. You will be taken to a ‘Success’ page.

- Option 2: I do not have EVC and would like to generate EVC to e-Verify my return

If you choose this option, you will be asked to select one of the following:

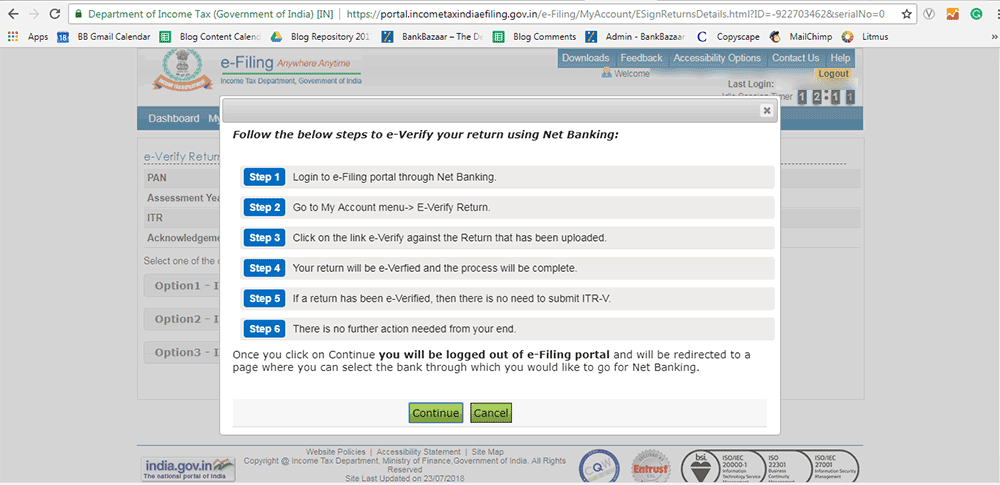

- EVC – Through Net Banking

You can follow these steps to e-Verify your return using netbanking

Log into your netbanking account. Go to income tax filing section and choose the e-verify option. This will take you to the e-filing website. Log in and select ‘Generate EVC’ under ‘My Account’. A 10-digit code will be sent to you email address and mobile phone. Use this code to e-Verify your return. Please note that the code is only valid for 72 hours.

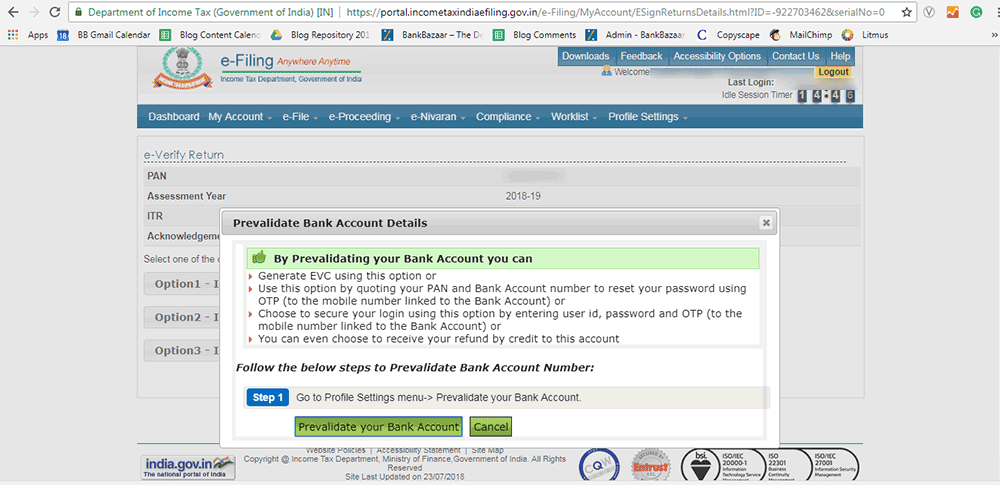

- EVC – Through Bank Account Number

In order to use this option, you must first pre-validate your bank account. Follow the steps in the visual below to do this. You will need to enter details such as bank account number, IFSC, bank name, mobile number and email ID. Once the bank validates these details, an EVC can be generated and sent to the mobile number linked to that bank account. Use this to e-verify your return. Please note that at the moment only 12 banks offer this facility.

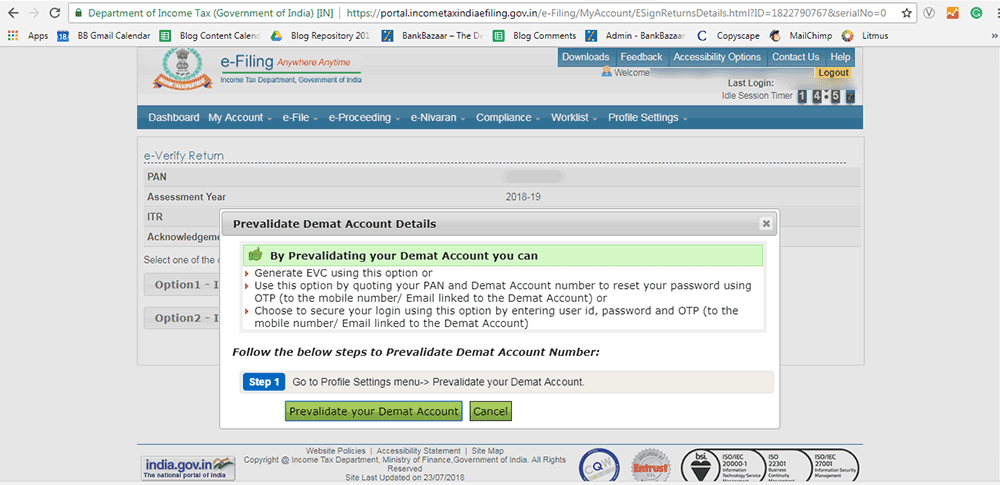

- EVC – Through Demat Account Number

If you select this option, you will also need to pre-validate your DEMAT account. You will have to enter details such as your depository type, mobile number and email ID. Once these details are validated by the depository, an EVC can be generated and sent to your mobile number.

- Option 3: I would like to use Aadhaar OTP to e-Verify my return

If you would like to use this option, please note that your mobile number must be linked to your Aadhaar number. Once you click on this, an OTP will be sent to your mobile phone. Enter the OTP in the box provided and click on submit. You will be taken to a ‘Success’ page. Keep in mind that the OTP is only valid for 30 minutes.

Once you complete this step using one of the above methods, you can consider your end of the bargain complete. All you have to do is sit back and wait for the IT department to process your return.

Additional Reading: Make Sure You Complete Your ITR Process With These Steps

Are you eligible for a refund from the income tax department and are wondering what to do with it? How about investing in an ELSS Mutual Fund and saving on tax? You can invest online in a few minutes on the BankBazaar website.

I have filed my IT Return for the Assessment Year -2018-2019 yesterday.

I have 2 bank accounts:

State Bank Of India

Punjab National Bank.

My State Bank Of India account was opened in Guwahati and now I have transferred by account to Kolkata as a result of which my IFSC code has changed.

While giving the bank details during the filing the Return i have given the IFSC code of Guwahati branch instead of Kolkata branch.

How do I rectify this mistake now ?

Hi Soumendra Chakravarti,

You can file a revised return and give the correct details.

Cheers,

Team BankBazaar