Design Credits: Rakesh Mohan

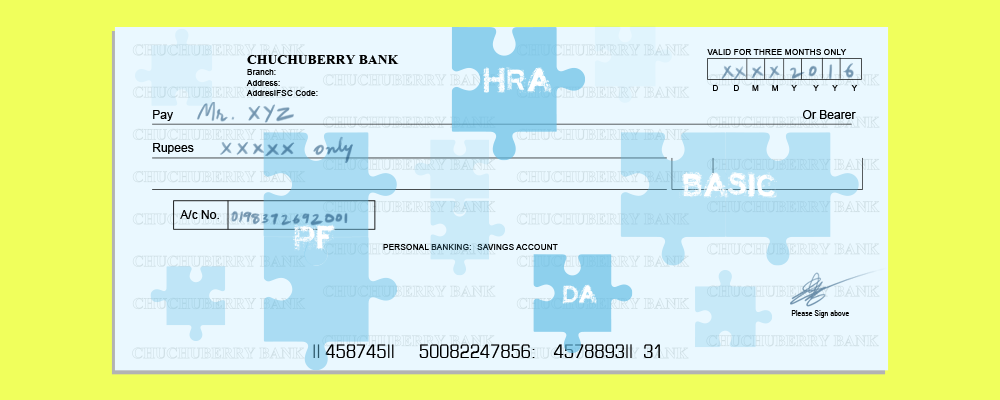

Have you always wondered why there is a difference between your take-home salary and your CTC (Cost to Company)? Though a complicated financial document to decipher, your salary slip will help you understand the reason behind this. Though the CTC break-up varies from company to company, here is a brief guide to the important components of a standard payslip.

Basic Salary

This is the most important component in your salary slip. Your basic salary is a fixed amount and is usually the biggest chunk of your salary. Ideally, your basic should be 40% to 50% of your CTC. This can vary from organisation to organisation. Irrespective of the amount, your basic salary is completely taxable.

House Rent Allowance

House Rent Allowance or HRA is provided to all employees. Provided by their respective employers, HRA is given to employees to meet their accommodation expense. It is not applicable to salaried individuals who stay in their own house or in a rent-free accommodation. If you live in a rented accommodation and pay rent, claim HRA exemption if you want to save on taxes. The 2016 Budget increased the maximum deduction under HRA to Rs. 60,000 per year.

Employees’ Provident Fund

EPF or Employees’ Provident Fund refers to a compulsory saving amount which is contributed by both the employee and the employer. EPF is a commonly sought-after choice for tax-saving and saving for retirement.

Additional Reading: Now Withdraw From EPF Without Restrictions

Professional Tax

Levied by the state government, the professional tax amount varies according your income. It has a maximum deductible limit of Rs. 2,500 per annum.

Tax Deducted at Source

Tax Deducted at Source or TDS refers to the Income Tax deducted by your employer and it is calculated for individuals according to the Income Tax slab under which they fall. This is a mandatory deduction put across by the government.

Conveyance or Transport Allowance

Your employer pays you Conveyance or Transport Allowance to compensate for the cost of the commute between your residence and the office. You can avail tax exemption of up to Rs. 1,600 per month on this.

Medical Reimbursement

With the medical reimbursement facility, you can submit medical bills for all medical expenses incurred by you and have the amount reimbursed. You can get a tax exemption of up to Rs. 15,000 per year as medical reimbursement.

Education Cess

In order to fund primary and secondary education initiatives for children, the government has levied a tax which is referred to as Education Cess. The amount charged is usually 3% of your Income Tax amount.

Fuel Reimbursement

If you have a vehicle of your own, you can claim reimbursements on petrol/diesel expenses. However, you’ll have to provide the original bills for the same. Companies may or may not provide this to all their employees.

Telephone/Mobile Expenses

Submit your telephone or mobile bills to your employer and get the amount reimbursed. You do not have to pay any tax on this expense. Remember that not all companies provide this facility.

Food Coupons

If your employer provides you meal coupons or vouchers, they are added as a component in your salary slip. Usually, these have a tax exemption limit up to Rs. 50 per meal.

Leave Travel Allowance

This is the amount paid by the employer for an employee’s travel within the country only. It is usually a part of your salary package and the amount you claim as Leave Travel Allowance (LTA) is tax-free.

And that folks, is what your Salary Slip is made up of!

Additional Reading: How to Calculate Taxable Income from Salary