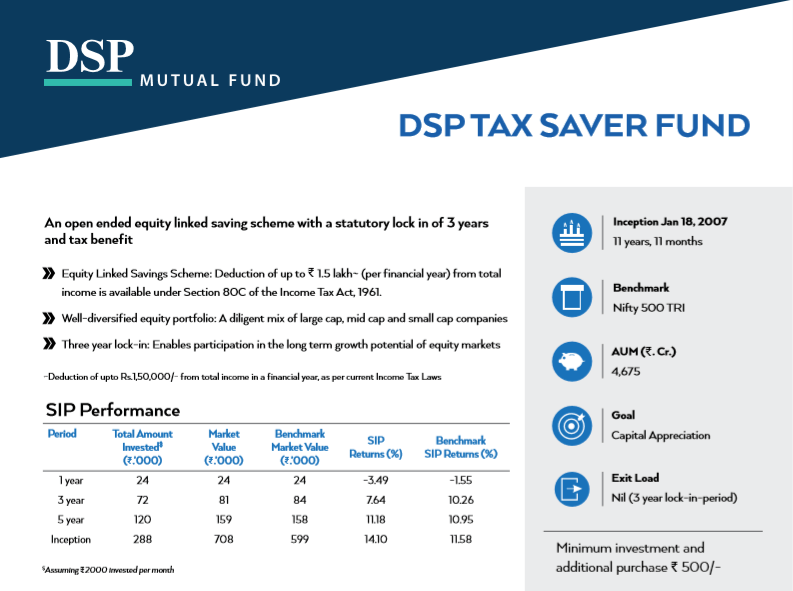

The easiest way to save taxes under Section 80C is to invest in tax-saving Mutual Funds or Equity Linked Savings Schemes (ELSS). You can save taxes of up to Rs. 46, 350 by investing in these funds. ELSS funds come with a lock-in of 3 years and are equity diversified funds that invest across sectors. However, there are many funds available and choosing one might be tough. However, here’s a fund that you can consider.

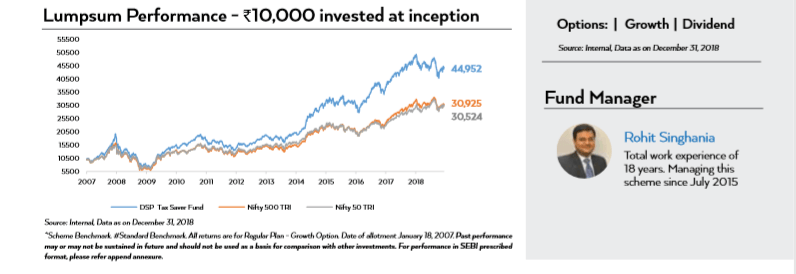

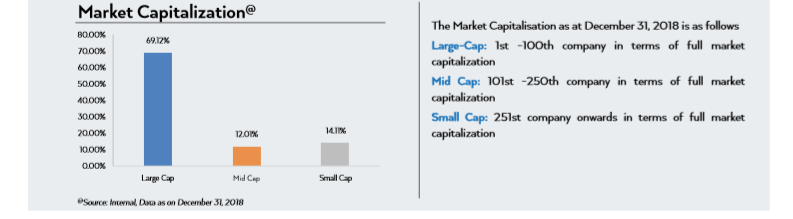

With Assets Under Management (AUM) of close to Rs. 4, 000 crores, this fund has been around for the last 11 years and has yielded good returns when compared to its benchmark Nifty 500. The fund invests across market capitalisation but has a bias towards large-cap stocks. Want to know more? Read on.

Features of DSP Tax-Saver Fund

Looking for other ELSS options? We have plenty on offer at BankBazaar.