It’s every young adult’s dream to finally step out of the nest into the real world – probably one of the most important steps towards independence. Living alone can be fun with no parents to boss you around, no curfews, no one telling you how to live your life. But adulthood comes with responsibility. Living alone also means that you have to look after all your expenses, your parents won’t be around anymore to help you monetarily. It’s important to know how to manage your money when you are living alone since there is the additional expense of food, shelter and bills. The financial tips listed below will help you sail through your new independent life.

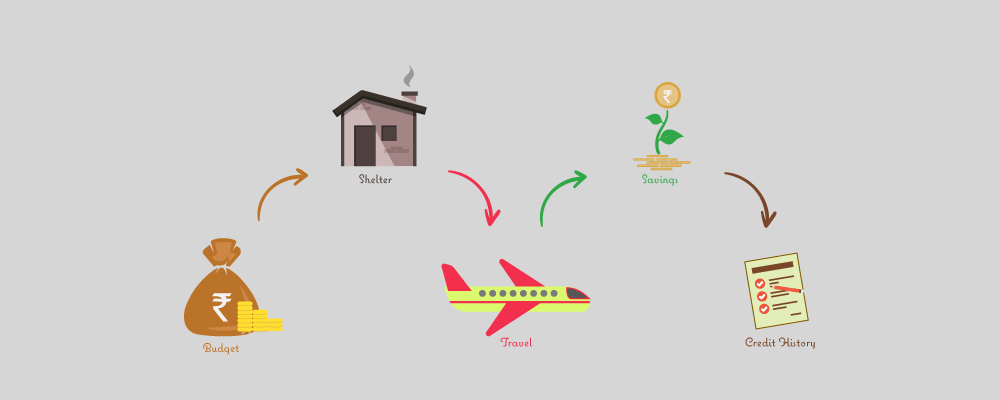

- Make a budget–There will be no hot dinner waiting for you when you get home when you are living alone. More often than not, when young adults start living on their own, they tend to dine outside as it’s easier and more convenient but dining out every day can burn a hole in the pocket. The best way to avoid unnecessary expenses like this is to make a budget. A budget can help you get a clearer picture on your finances and will help you curb unnecessary expense.

- Save on shelter-If you are planning to live in a penthouse on your own money, you might have to sacrifice your everyday meal for the rest of your life. The first thing that establishes your independence is your new place. It’s better to save than splurge on your new place as it’s a long-term commitment. Choose a place which you can afford to pay for every month. The rent shouldn’t hit your pocket hard. After all, at the end of the day it’s only a roof over your head, doesn’t matter if it’s a penthouse or a one bedroom apartment.

- Invest wisely- Make investments when you are young and have the resources. A Fixed Deposit is the best savings plan if you have idle money. Recurring deposits help you by allowing you to save small amounts of money which will lead to a bigger saving overtime.

- Plan your travel- If you are living in a different city away from your family, travelling back home can be expensive. Flight tickets aren’t cheap and no one has the luxury of time to travel in trains and buses. This is when travel Credit Cards come to the rescue. Credit cards offer travel benefits such as free air miles, discounts on tickets, early booking. It’s wise to take advantage of the advantages of the travel benefits offered by the bank.

- Credit history-A good credit history is a reflection of a responsible adult and hence maintaining a good credit history is very important. A good credit history will help you later on in life when you plan to take a Home, Car or Personal Loan.

Copyright reserved © 2026 A & A Dukaan Financial Services Pvt. Ltd. All rights reserved.