In personal finance, budgeting is often viewed as a necessary but daunting task. For many, the very idea of creating a budget conjures up images of endless spreadsheets, complex formulas, and a whole lot of number crunching. But what if we told you that budgeting doesn’t have to be terrifying? Just like Dr. Frankenstein pieced together his monster, we’ll assemble a budget that’s not only manageable but also a vital tool for achieving your financial goals.

The Anatomy Of A Budget

Before we dive into the nitty-gritty of budgeting, let’s understand what a budget actually is. At its core, a budget is a financial plan that outlines your income and expenses. It’s a blueprint for how you’ll allocate your hard-earned money. Think of it as the skeleton upon which you’ll build your financial future.

Start With The Basics: The Brain

Every budget needs a brain and that’s your financial goal. Your financial goal serves as the central nervous system of your budget, guiding all your decisions. Are you thinking about tackling your debts, saving up for a vacation, or perhaps building an emergency fund? The first step is to identify your primary objective.

It’s crucial to have a clear, specific and measurable goal. This goal will keep you motivated and focused as you piece together your budget. Once you know what you’re aiming for, you can start adding the other parts to your budget.

The Heart: Income And Expenses

The heart of your budget is your income and expenses. Just like Frankenstein’s monster needed a functioning heart, your budget needs a robust system for tracking your financial inflow and outflow. It’s important to have a clear picture of the money coming in and where it’s being spent.

Make a list of all your income sources, whether it’s your salary or rental income. Then, list your essential expenses like rent or mortgage, utilities, groceries and transportation costs. The key is to create a clear picture of your financial landscape.

The Limbs: Categories And Allocations

Now, let’s add the limbs to your Franken-finance budget. Categorise your expenses into groups like housing, transportation, groceries, entertainment and savings. Just like a creature needs legs, arms, and hands to function properly, your budget needs these categories to operate smoothly.

Allocate a specific amount of your income to each category based on your financial goal. This is where you get to make choices about how you want to prioritise your spending. The more you align your allocations with your goal, the more successful your budget will be.

Additional Reading: 7-Step Guide To Becoming Financially Strong In FY2023-24

Additional Reading: 7-Step Guide To Becoming Financially Strong In FY2023-24

The Senses: Tracking And Monitoring

Frankenstein, the monster, had heightened senses. Your Franken-finance budget needs them too. Regular tracking and monitoring are essential to keep your budget on track. Use financial tools or the BankBazaar mobile app to help you keep an eye on your spending and progress. Credit Cards can also be invaluable for maintaining a budget. They offer detailed monthly statements that categorise expenses, making it easy to see where your money is going.

Additional Reading: Credit Cards for the Uninitiated: A Beginner’s Guide

The Skin: Flexibility And Adaptability

Life is full of surprises and your budget should be able to accommodate unexpected expenses or changes in your income. Build in a buffer for these fluctuations and don’t be too hard on yourself if you need to adjust your budget from time to time.

The Lightning Rod: Emergency Fund

Your Franken-finance budget should have a built-in lightning rod for financial emergencies. Just as Dr. Frankenstein needed his trusty lightning rod to bring his monster to life, you need an emergency fund to keep your budget safe from unexpected shocks. Strive to set aside a minimum of three to six months’ worth of your living expenses in an account that you can easily access.

Having an emergency fund provides peace of mind and ensures that a financial setback won’t turn your budget into a nightmare.

Additional Reading: Emergency Funds 101 – Hacks You Need to Know Now

The Soul: Mindset And Discipline

Last but not the least, the soul of your Franken-finance budget is your mindset and discipline. While it may not be a physical body part, it’s a crucial element that holds everything together. Maintaining a positive financial mindset and staying disciplined in your spending and saving habits is what will bring your budget to life and keep it thriving.

Incorporate positive financial habits into your daily routine, like reviewing your budget regularly, avoiding unnecessary debt, and seeking opportunities to increase your income.

Bringing Franken-finance To Life

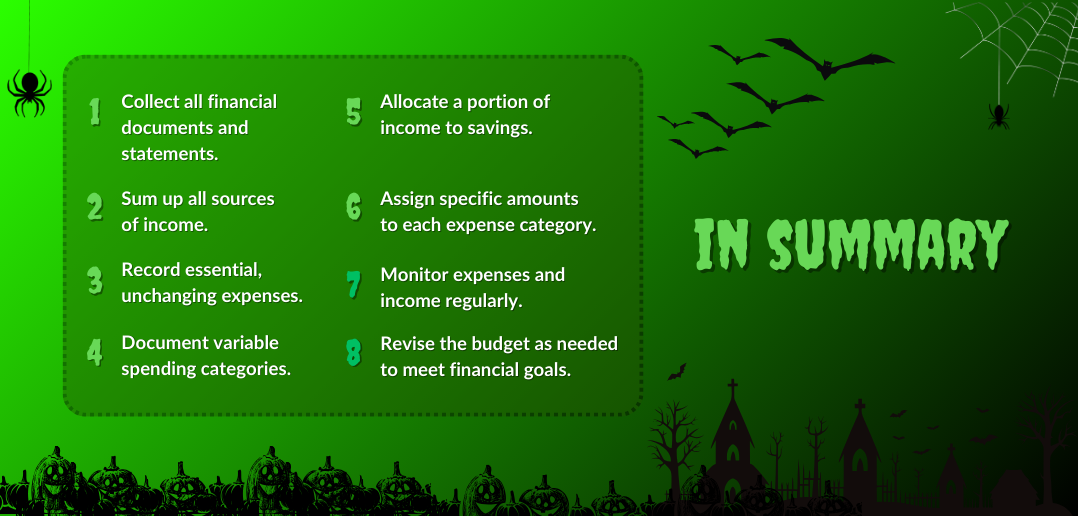

Creating a budget doesn’t have to be a scary or overwhelming process. With the right approach and mindset, you can piece together a budget that serves your financial goals and aspirations. Start with a clear objective, identify your income and expenses, allocate your resources wisely, and keep your budget flexible and adaptable.

Remember, your Franken-finance budget is not set in stone and should be adjusted as your financial situation evolves. By incorporating these key components, you can create a budget that won’t scare you, but rather empower you to take control of your finances and achieve your financial dreams. So, what are you waiting for? It’s time to bring Franken-finance to life and make your financial goals a reality.