Following the recent demonetisation of Rs. 500 and Rs. 1,000 currency notes, there has been a flurry of questions regarding the new currency introduced by the Reserve Bank of India.

The biggest question is how to declare any legitimate cash that has been stashed away at home, without falling prey to the taxman.

Tax experts are reassuring taxpayers that they have nothing to worry about if they have small amounts of cash lying around at home. As long as you can satisfactorily explain the source of the money, you’re safe. Go ahead and bank that money.

However, be careful that the money deposited in the bank matches the income declared on your Income Tax return.

The Income Tax department will keep a tab on bank accounts that have seen deposits exceeding Rs. 2,50,000. These account holders’ Income Tax returns will be reviewed and any discrepancy will be considered as tax evasion.

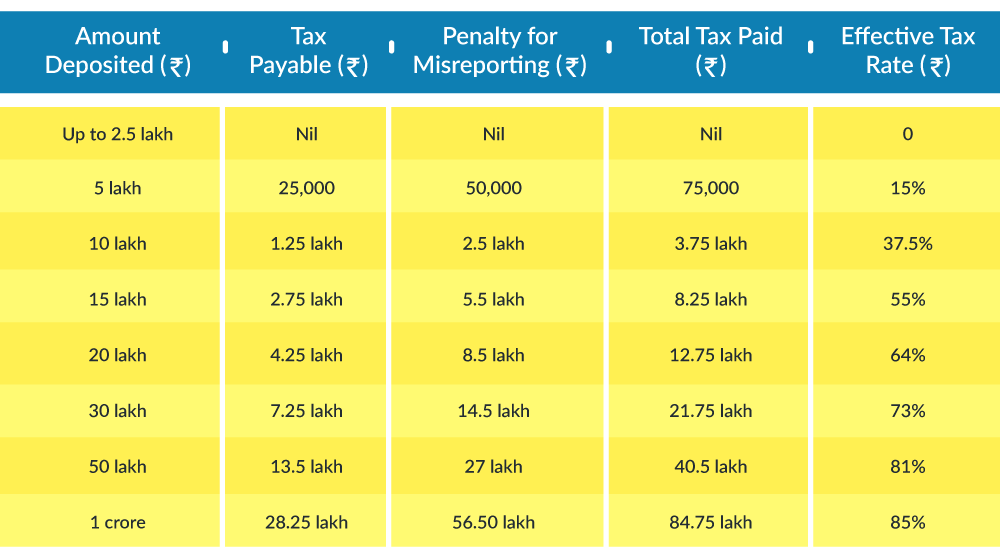

If you were hauled up for misrepresentation of income, you will be liable to pay a hefty penalty that amounts to 200% of the tax payable under the new Section 270(A) of the Income Tax Act.

Additional Reading: Depositing Black Money? Income Tax Notices To Watch Out For

In case you are depositing Rs. 3-5 lakh, you will not have too many hurdles to cross. The tax payable and penalty falls within reasonable limits. But, if you have a larger amount of money that you need to deposit, be prepared to fork out a larger sum as a penalty. For instance, for an individual depositing Rs. 20 lakh, the effective tax amounts to 64%. The percentage rises with an increase in the deposit amount.

Missed your chance with the Income Declaration Scheme?

If you missed the opportunity to declare any unaccounted money under the Income Declaration Scheme (IDS) for which the deadline was 30th September 2016 – too bad, dude! Under this scheme, you were required to pay only 45% as tax with no questions asked. Now, you have cause for worry as you will be peppered with umpteen questions about such funds.

Paying a higher tax amount does not mean you get away scot-free. You are still liable to be prosecuted. Sorry, buddy! There was enough and more encouragement given by the government for everyone to declare their unaccounted income under the Income Declaration Scheme.

Additional Reading: IDS: Why You Should Declare Your Undisclosed Income Right Now

People are looking for ways to avoid tax scrutiny

Everyone has been making a beeline for Chartered Accountants and tax consultants in the wake of the demonetisation of the currency, looking for ways to circumvent the ban on the high denomination notes. “How do you convert unaccounted money into legitimate funds?” is the question on many people’s minds.

Here are some ways you can do that.

Savings stashed away by homemakers

It’s ok to show money which has been saved by housewives from their monthly household budget. Homemakers can also declare a reasonable amount as their personal spending money.

While there is no specific sum that can be declared as savings in this manner by housewives, a reasonable amount can be declared safe. Keep in mind that this must tally with the total income earned by members in the household and also match with the monthly expenses.

For instance, if a taxpayer earns a sum of Rs. 80,000 per month and the household expenses amount to Rs. 40,000, his spouse should be able to salt away approximately Rs. 8,000-10,000 every month.

What to look out for

Beware of scrutiny by the tax department if the amount of money saved is in excess of 20-25% of the household expenses budget.

Additional Reading: Top 5 Savings Accounts Schemes For Women

Income earned from tuition and cookery classes

If you are a homemakers or college student who has been conducting home tuitions and cookery classes to earn an extra buck, you can safely show an income of up to Rs. 2,50,000 per year as income earned from this.

Not been filing tax returns?

Now is considered a good time to file any pending tax returns you might have not cleared earlier. Pay your tax dues and get back on track with taxes. This will allow you to declare a higher income this year.

What to look out for

If the income that you report is too high, the tax department will review your returns filed and ask assessees to furnish the details of the tuition classes that you are supposedly conducting. In some cases, the department may deem it necessary to keep a watch on the taxpayer’s daily routine. Talk about snooping, huh?

Monetary gifts from family and relatives

Got cash stashed away at home which was gifted to you by relatives? Monetary gifts from certain relatives do not come under the tax scanner if the recipient is an adult. Remember, the amount declared as a gift must be within reasonable limits. For instance, a family earning a monthly income of Rs. 1 lakh can show cash gifts of about Rs. 40,000-50,000 in a year.

Weddings and Mundan ceremonies

People who got married this year or whose children had a mundan ceremony recently can consider themselves lucky. Monetary gifts received on the occasions of weddings and mundan ceremonies are considered to be tax-free.

What to look out for

In case the amounts shown as gifts is found to exceed reasonable limits, the tax department may require you to furnish the names of those who gave you the money and assess their sources of income.

Remember, a monetary gift of a sum above Rs. 50,000 a year will be taxed as per your individual tax bracket.

Payments of advances and loans to workers

Entrepreneurs, salaried individuals, and small businessmen can use cash to pay advance wages to vendors and employees. While there is no limit to the amount of cash that can be disbursed in this manner, it should be within reasonable limits, to avoid inconvenience to the recipients.

What to look out for

In some cases, if the money given amounts to 2-3 months’ advance payments, employees could be tempted to change jobs. It is better to give loans with proper documentation.

BB Tip: Dreading the long queues at the ATMs and banks? Go cashless with a Credit Card. And here’s an idea – use a Cash Deposit Machine to bank your money.

Be careful

The Income Tax Department has started sending notices to those who deposited more than Rs. 2.5 lakh recently. This is in a quest to know the source of funds for those deposits. These notices have been issued under Section 133(6) of the Income Tax Act. The notice will have the date and amount deposited and will ask for supporting documents, bills and books of accounts for justifying the deposit. Note that if it is a current account, deposits over Rs. 12.5 lakh will be scrutinised. If you are planning to make any such deposits, be ready for that notice.

Here’s a handy table to help you understand the tax liabilty for different deposit amounts.

Now that you have some ideas on how to manage those small amounts of money lying around at home, how about looking at some investment options? BankBazaar’s got you covered.