As you might know already, the Unified Payment Interface (UPI) is a payment system that helps users transfer funds across bank accounts in India. You can even use it to pay your bills.

Psst… your Credit Card is another handy way to pay your bills.

The UPI payment system doesn’t require you to enter your bank account number or IFSC code to transfer funds. You just need a unique ID to use the app to send money almost instantly. This unique ID is a virtual payment address similar to your email ID. You can give this ID to anyone who wants to transfer funds to you without having to worry about your bank account details being compromised. The app will automatically store the IDs of those who receive funds from you. So, you need to enter the ID to transfer funds just once.

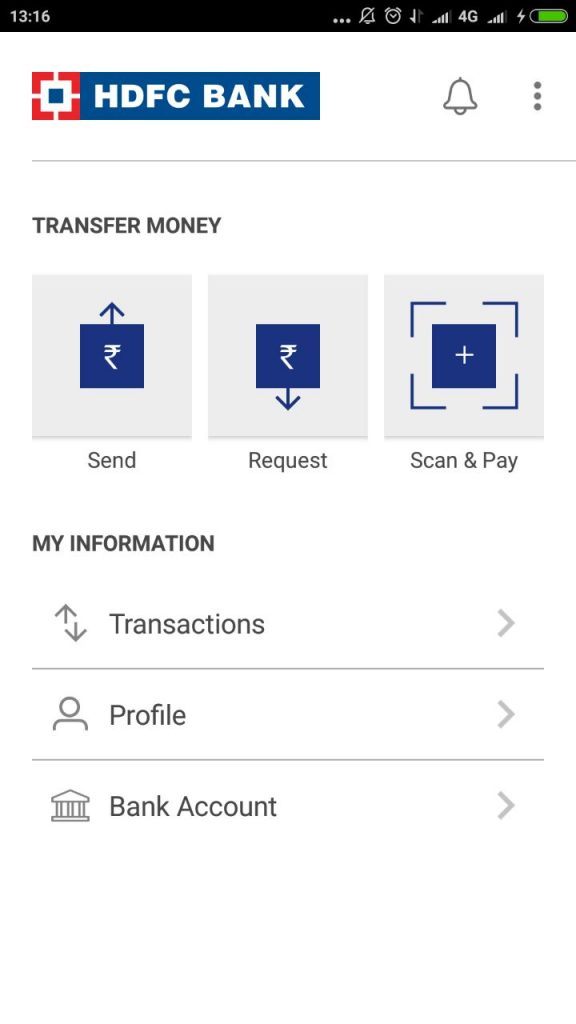

While all of the apps allow you to transfer funds, some of them allow you to make purchases online and also pay your bills. There are also a few that can be used as mobile wallets as they are integrated with the bank’s mobile banking app.

Additional Reading: Unified Payment Interface (UPI): Mobile Payments Now As Easy As An SMS

How To Download The UPI App

The UPI app is available across banks and each bank offers its own app. You can use any of these apps to create a virtual address or unique ID to transfer funds. All you need is an Android or Apple smartphone and internet data connection on that phone. Note that some banks have incorporated UPI into their existing app. If you have an app for your bank, check if you can update the app to include UPI. Haven’t got a bank app? Then, you can download the UPI app offered by any of the banks from the Google Play Store or Apple App Store. At present, there are about 20 UPI apps available on both Google Play and Apple App Stores.

You can download the UPI app from one bank and connect your other bank account to it. For example, you can download ICICI Bank’s UPI app and link your Union bank account to it. Before choosing a UPI app, speak to people who are already using one to understand how good the interface is. The smoother the interface, the better your transaction experience. If you think all this is too technical, try using the BHIM app.

Additional Reading: Why You Should Give UPI & BHIM A Chance

How To Connect Your Bank Account?

You can connect many bank accounts to one unique ID or virtual address. However, in case you are using BHIM, you might be able to connect only one bank account. The first time you connect your bank account to your UPI app you will need to use your Debit Card. Once you enter your bank details, you will get a One Time Password (OTP) on your registered mobile. Once the OTP is entered, you will receive your unique ID and you can start transacting. You will also have to set a passcode to open the app.

Additional Reading: Can BHIM Outshine The Other Mobile-Payment Apps?

How Does It Work?

Your UPI app is not a mobile banking app or wallet. So, you don’t have to load money into it. You just need to link your bank account to it. UPI just facilitates the use of your bank account to transfer funds and pay bills. The process of transferring money and paying bills might differ from one UPI app to another.

Here are the general steps for transferring funds using the UPI app.

- Open your UPI app using your passcode

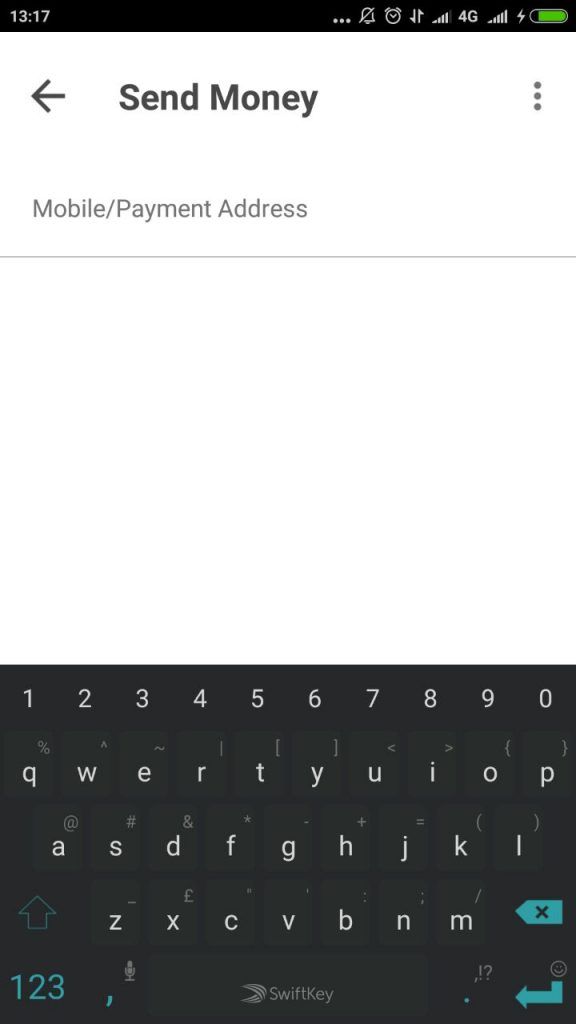

- Choose Funds Transfer or Send Money

- Choose the account from which you want to send money (in case you have linked multiple accounts).

- If the receiver is yet to be added, add them using their unique ID

- Select the receiver using their unique ID. Note that you also have the option of entering bank account number and IFSC code to transfer money if you want to. However, it is the most convenient to use virtual addresses.

- Enter the amount you want to send and click send.

- The app will ask you for your passcode before sending the money.

- Once you enter the passcode, the amount will get credited to the recipient’s account instantly.

Additional Reading: Now You Can Use E-Wallets To Make Investments

Now, isn’t that really simple? If you love quick transactions, then go for the UPI app. You can use it for bill payments and auto-debit your loan accounts. Or, if you still love swiping your card for bill payments, then choose a Cashback Credit Card that will help you save while you spend.