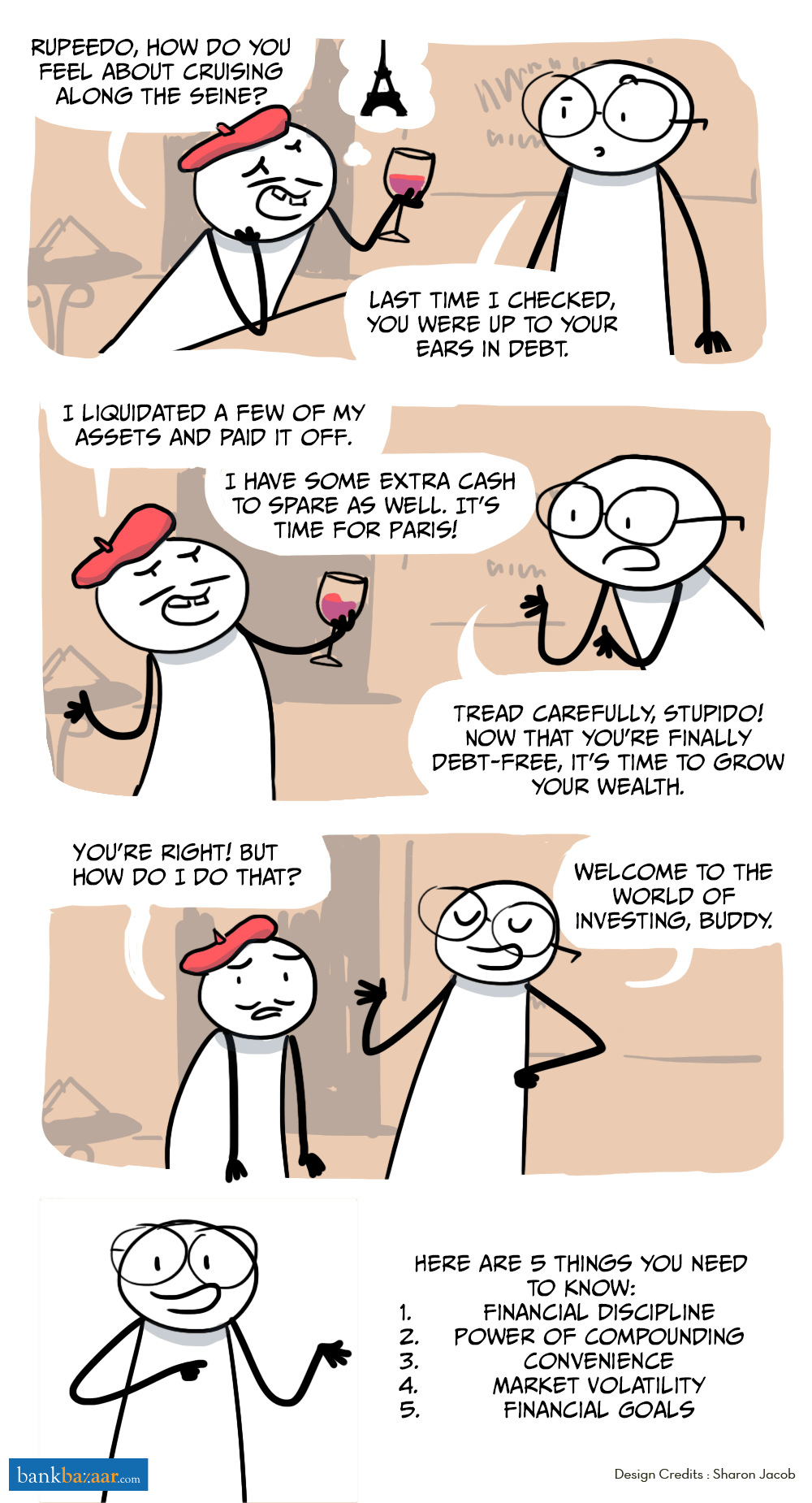

Like Stupido, are you undecided when it comes to investing? Allow us to nudge you in the right direction. Read on to know the benefits.

The key to investing is starting early. This has quite a few benefits. Firstly, you get a longer time to stay invested. Secondly, your money can grow over a greater span of time. Thirdly, you gain an insight into market volatility. If you’re invested for a long period of time, chances are you’ll have a better idea of your risk tolerance.

The point of investing your money is primarily to obtain some sort of return or financial gain after a specific period of time. You have a range of investment vehicles to choose from. These include Mutual Funds, Fixed Deposit, and bonds and stocks among others.

Additional Reading: Short-Term Investment? Here Are Your Best Options!

Why invest?

Wondering why we insist on investing? If money is just left to sit idle in your bank account, it doesn’t grow over time. In fact, cash actually depreciates in value with each passing year because of inflation. This is precisely where Investment steps in.

Confused about why inflation is such a big deal? Let’s say you have an emergency fund worth Rs. 10 lakhs. In fifty years, even though the amount in your fund will grow, the prices of commodities could soar at even greater rates. What seems like a huge amount right now won’t be quite as adequate in the long run.

Additional Reading: A Millennial’s Guide To Tax-Saving Investments

Investments are one of the most time-tested ways of growing your wealth.

5 things you need to know before investing:

- Financial Discipline

Building your wealth is quite easy. However, the difficult part is to be consistent about it. Successful investors are disciplined.

Markets are characterized by volatility. It’s these ups and downs that make it difficult to remain invested. Having said that, long-term investment channels ensure that you allow your money sufficient time to multiply.

Initially, staying invested might be difficult for beginners. In that case, you can consider setting up an automatic depositing system from your checking account to your investment account.

- Power of Compounding

This is quite simple, really. The longer you stay invested, the higher returns you’ll get. It’s a bit like earning interest upon interest. What we mean is, your interests earned get re-invested every year to earn a considerable amount. Such is the power of compounding!

One of the benefits is that you can start with a low sum because the important factor is not the initial investment you make but the time for which you stay invested.

Additional Reading: Income Tax Investment Proofs – A Quick Checklist

- Convenience

If an investment can be made and you can stay well-invested in it quite easily, then you can safely consider the investment avenue a convenient one. So what exactly do we mean by convenient here?

Let’s say that you’re left with a very nominal amount at the end of each month. Can you invest it? Absolutely! The convenience offered by investing lies in the ease with which you can invest even small amounts into well-rewarding channels.

Additional Reading: Optimising Your Investments 101

- Market Volatility

This one’s a toughie! Quite simply put, market volatility is the range of price flux that a security or in this case, investment vehicle, undergoes over a given span of time.

If the price is relatively stable, it is called low volatility. When price experiences ups and downs and is quite erratic in nature, it is called a high volatility.

There are several reasons why price can fluctuate. Uncertainty in domestic as well as global economy, political instability, inflation and rise and fall in currency valuation can affect the market.

Additional Reading: Impact Of Elections On Your Equity Investments

- Financial Goals

Once you’ve set your financial goals, all you have left to do is to align them with appropriate investment strategies. This way, not only can you can balance your financial portfolio but you’re sure to stay fiscally fit.

The first step is to chart a blueprint of your financial goals. Engage in thorough research before choosing the investment apparatus. This will help you decide which investment options are matched with your goals.

The idea is to categorise your investments into short-, mid-, and long-term depending on the time for which you want to stay invested in them.

Additional Reading: Why Is It Crucial To Diversify Your Investment Portfolio?

So, how do you start investing?

First things first. Start by making a list of your short and long-term goals. Once you’ve got a clear picture of exactly what you want to achieve, the next thing to do is to try and figure out the amount of risk you are willing to take. Lastly, depending on your goals, also need to figure out how much you can actually invest at a given point of time.

Additional Reading: Investments To Enhance Tax Saving In The New Financial Year

Consider your investment capacity after considering your defined monthly expenses such as rent/mortgage, Credit Card payments, Loan EMIs, food, clothing, and utilities because these are payment that take away a big chunk of your paycheck.

It’s wise to invest only what’s left after your fixed expenses are taken care of.

Bear in mind that you must back your investments with thorough research. Even if you have the answers to the questions above, choosing an investment plan incorrectly can land you in soup.

Ready to invest your money?