Fixed Deposits maybe one of the most traditional instruments of saving but they’re also one of the most popular. Let’s take a look at what’s the latest happening on the Fixed Deposits front.

When it comes to managing your finances, there is no one-size-fits-all rule. Each has their own approach towards saving based on their risk appetite and financial goals. Fixed Deposits are one of the most popular investment options for risk-averse investors to park their money in. Fixed Deposits offer guaranteed returns and are exposed to much lower risk. Lately, several banks have hiked their Fixed Deposit interest rates. This -has raised the attractiveness of it as an investment option. Let’s understand what’s happening on this front better.

Additional reading: How To Switch From Fixed Deposits To Debt Mutual Funds

What are Fixed Deposits?

Also known as Term Deposits, Fixed Deposits are not eligible for tax sops. However, if you hold a Fixed Deposit for five years or more, your Fixed Deposit will qualify for tax benefit under Section 80C of the Income Tax Act. By parking one’s money in a tax-saving Fixed Deposit, one can claim up to Rs. 1.5 lakhs as a tax deduction. The amount one invests in a tax-saving Fixed Deposit will get deducted from one’s gross total salary. But before you make up your mind about ploughing all your money into a tax-saving Fixed Deposit, here are some quick facts that you must acquaint yourself with:

- The bank will determine the rate of interest that it will levy on your Fixed Deposit account.

- Only individuals and Hindu Undivided Families can invest in a tax-saving Fixed Deposit.

- You can select the duration of the Fixed Deposit before you start. Most banks offer durations of as little as 7 days and up to 5 years.

- Like most investments, there is a minimum amount you must invest in a tax-saving Fixed Deposit. You can start with an amount as low as Rs. 500 but this varies from bank to bank.

- If you break your Fixed Deposit before the tenure that you opted for, your account may incur penalties.

- If the interest income exceeds Rs. 10,000 in a particular financial year, TDS will be applicable.

- Your bank may deduct TDS before paying out any interest due to you on Fixed Deposit. However, if the TDS rate is lower than your personal tax rate, you are liable to pay interest on the Fixed Deposit when you file your tax returns.

- Senior citizens can also ask their bank for preferred rates and can also enjoy higher interest rate on Fixed Deposits.

- Banks do not grant loans against tax-saving Fixed Deposits.

- You can also transfer your tax-saving Fixed Deposit from one post office to another.

Additional reading: Fixed Deposits Or Liquid Funds: Where To Park Your Surplus For Stable Returns?

Fixed Deposit in recent news:

On May 30, the country’s largest lender, State Bank of India, hiked the interest rates on Fixed Deposits by up to 25 basis points. Effective from May 28, 2018, the new rate will be applicable on retail deposits below Rs. 1 crore. As per the latest rate structure, the deposits for 1-2 years will now enjoy an interest rate of 6.65% as against 6.40% earlier. The rates have been hiked for senior citizens to 7.15% from 6.90% earlier. For investments ranging from 2-3 years, the interest rate is revised to 6.65% from 6.60%. However, there is no change in interest rate for deposits less than one year. Just days after this, Axis Bank, India’s third largest private sector bank introduced a new Fixed Deposit tenure of 12 months 5 days to under 12 months 11 days. This will earn interest at the rate of 7.4% for deposits under Rs. 1 crore. Deposits of Rs. 1 crore to less than Rs. 5 crores will accrue an even more attractive interest rate of 7.60%.

Additional reading: How Safe Are Your Fixed Deposits?

From these moves, it is clear that banks are in a bid to grow their deposits. In fact, credit off-take and Fixed Deposit rates are conversely related. When the demand for credit is low, banks reduce deposit rates because they don’t require funds. When the demand is high, banks take the help of their customers to get more funds to increase their lending capacity.

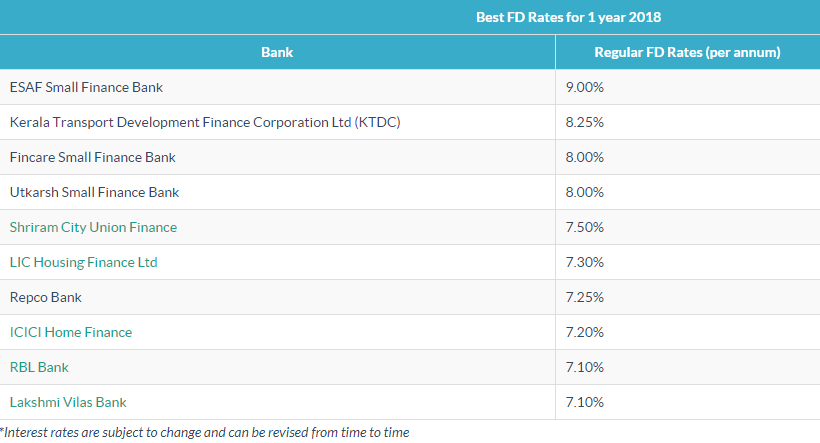

Keen on investing in Fixed Deposits after reading this? Check out the list below of 10 banks that pay the highest interest on Fixed Deposit schemes with a one-year tenure in 2018:

Explore best interest rates on Fixed Deposits by clicking on the link below.

It really feels splendid when you come across such a professional unit run by an SBI in New York. A very friendly team and dedicated staff. I am really Happy with their services. Big cheers for the team!!

Hi Nikitta,

That’s nice to hear. Glad you enjoy the customer-banker relationship with SBI.

Cheers,

Team BankBazaar