7 things to do in a downturn

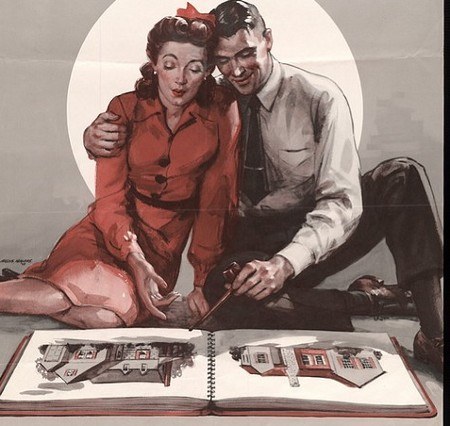

One sure way to find some excess cash in a downturn is to reduce expenses and lifestyle purchases. The point is not to cut down on the fresh fruit that we buy for our children, but on the new sofa set that we planned for our living room. The new model mobile phone or the… Read More »