While owning a home is a dream come true for most millennials, if you don’t do the math right, you’ll end up despising what was meant to be a profitable investment.

Advantages Of Owning A Home Compared To Renting

With sky-rocketing property prices and a gradual rise in Home Loan interest rates, many tend to opt for renting rather than buying. When determining whether to buy or rent, you need take a number of lifestyle as well as financial implications into account. Let’s weigh our options.

Although owning a home has long been regarded as a tell-tale sign of success for many, it can get difficult to compare renting and buying. While renting allows you to move whenever you choose and requires less investment, buying a home is a profitable investment which will increase your wealth and equity.

Read on to decide what’s best for you.

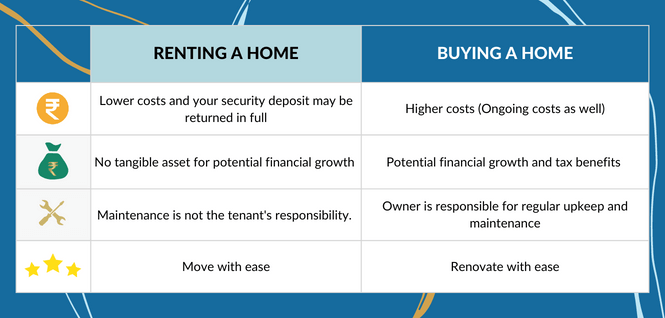

Renting Vs. Buying A Home

Financial Aspects

Renting and buying have different up-front costs.

When you own a home, you are liable for more than just your monthly Home Loan EMI (Equated Monthly Installment) payment. You are responsible for paying for renovations, taxes, repairs, maintenance, and other dues. Owning a home can easily become more expensive than renting due to these added costs.

Only rent and utilities are typically the tenants’ responsibility. Everything else is the responsibility of the home-owner. To move in as a tenant, you will have to pay a security deposit.

Building Wealth

As you continue paying the balance of your Home Loan, you will increase your home’s equity. As per your local real-estate market conditions, equity also grows as the value of your home rises. If you need to borrow money in the future, home equity increases your net worth and can be used as security for a loan. It is important to understand that property values may also decrease depending on market conditions.

Tenants can still build wealth, but you’ll need a different strategy. If renting is less expensive than owning, you can build your net worth by continually investing the difference.

Additional Reading: Why You Should Review Your Home Loan Periodically

Repair And Maintenance

Owning a home is a huge commitment. You must prep yourself for the responsibility, be it repair, maintenance or upkeep. If you rent, most of the required maintenance and repairs will be handled by your landlord. However, you are liable for damages caused by you and the landlord would typically charge you for the same.

Flexibility

Assuming you might need to relocate in the future, renting is a more adaptable alternative. If your employment changes or you need to relocate, you can move at the end of your agreement or you can break your contract, give a month’s notice, and pay any charges specified in your rental agreement. While as a home-owner, you don’t have a lot of flexibility when it comes to relocating. It would have to be rented out, sold, or just left empty.

Secondly, with renting, you typically must accept the home in “as is” condition. Making minor alterations/renovations to the home is not something you can do. However, as a homeowner, you have that freedom.

How To Choose?

Making the choice involves considering your financial situation and how renting versus purchasing would affect you. You can determine which alternative is better for you by comparing your estimated Home Loan payment to the estimated rent payment.

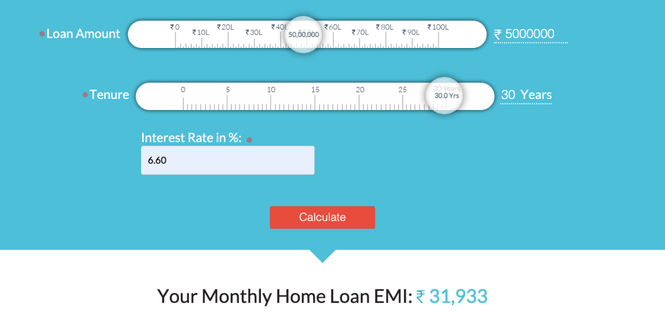

Calculate Your Monthly Loan Payment

Your monthly Home Loan payment will depend on the price, down payment, loan term, property taxes, and interest rate on the loan – highly reliant on your Credit Score. Use the EMI Calculator to get a general sense of what your monthly Home Loan payment could be like.

A loan EMI calculator can help you crunch the numbers.

Additional Reading: Home Loan EMI Calculator: How It Works

When To Rethink Buying Vs. Renting

To make sure that your decision is still the best one, it’s a smart idea to periodically review your living situation as your life and the housing market changes. Purchasing might be a better option if rent prices are rising or if home prices are declining.

Finding the optimum opportunity to buy your dream house might be made simpler if you keep up with the current real estate market. Keep in mind, purchasing a home does entail hefty upfront costs as well as ongoing costs for maintenance, repairs, and property taxes.

If you don’t save or invest the money you would have spent on the higher costs of home-ownership, renting a home won’t allow your money to grow.

However, it’s not a once-in-a-lifetime decision to rent or buy. If your financial situation or your lifestyle changes, you can come back and revaluate at any moment!

Have you made up your mind yet? Check if you’re eligible for a low-interest Home Loan.