Are men and women completely opposite in nature when it comes to finances? While that may be a bit of a stretch, there are some things we can all learn from the ladies.

It isn’t really a secret that women, in general, budget better than men. Of course, this isn’t a blanket statement and exceptions can be found aplenty. I speak from experience and my own research. However, we all stand to improve the way we handle our finances, so any insight is worth pondering over.

It isn’t really a secret that women, in general, budget better than men. Of course, this isn’t a blanket statement and exceptions can be found aplenty. I speak from experience and my own research. However, we all stand to improve the way we handle our finances, so any insight is worth pondering over.

Additional Reading: 4 Sportswomen Who Can Teach Us A Thing Or Two About Investing

So, what can we learn about money management from women? Here we go!

Asking for help or advice isn’t a bad thing at all. In fact, it helps greatly.

Bankrate, a popular finance website says, “Men tend to accumulate more debt than women and default on mortgages more often, while more females seek out help for debt problems than males.”

Well, we see that happening all around us, don’t we? In fact, I have always been reluctant to seek money-related advice from others. But my spouse is the exact opposite. Ironically, I give her advice all the time. Should we take a Personal Loan for a certain big expense? Which Credit Card should I get?

Yet, she’s the one who handles all our finances and I have to say she’s pretty damn good at it. There’s just this natural practicality that she shows when it comes to financial matters. She’ll get on the phone with a friend or call someone who works with money. Somehow, she ends up saving us a big chunk of change. Men may not want to seek professional help but just observing women’s financial and budgeting skills can be beneficial to all.

Additional Reading: Lessons For Womankind From Some Of The Most Phenomenal Women in History

Thou shalt take calculated risks.

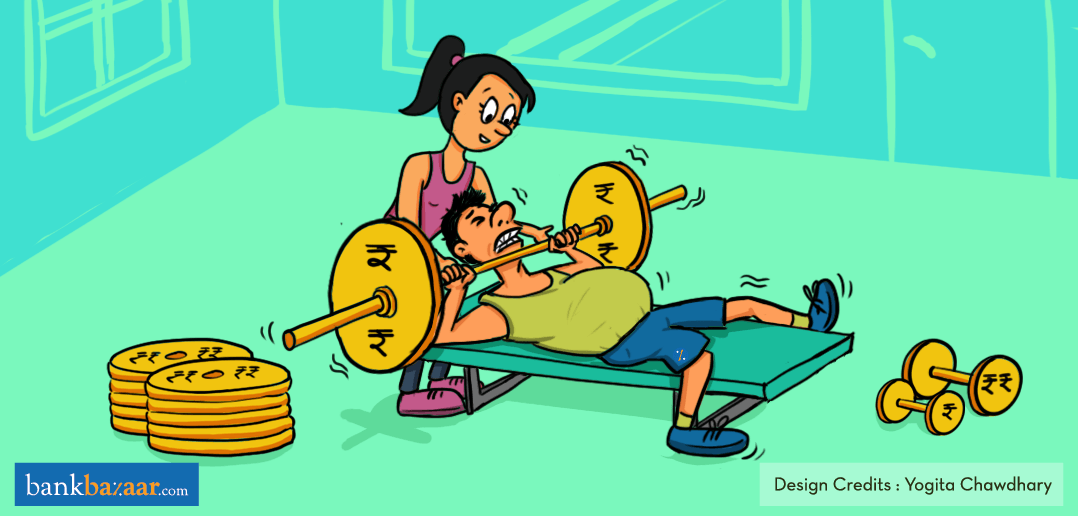

Fidelity- the world’s biggest financial managers have stated that women are better at savings and investments but most lack the courage to invest. They say that women are better students, see their plans through and do not gamble. They are, in general, better behaved than men. Yes, risks aren’t a bad thing but whether they’re calculated ones or not makes all the difference. In that regard, women are a step ahead and do not accumulate debts compared to their male counterparts. It is that innate conservative nature of women that makes them better at money management and risk-taking.

Additional Reading: Lessons in Leadership From Queens Of The Wild

Impulsiveness? What’s that?

According to a survey by CreditCards.com, men were significantly more likely than women to spend serious money on that unplanned purchase. When women did make impulse purchases, they were of lesser value compared to the items that men purchased. That’s something to ponder over and further goes to show that that money is safer in the hands of women. Impulse purchases, especially large ones, can kill a budget.

Additional Reading: A Woman’s Guide To Financial Independence

That’s a lot of damning evidence, isn’t it? This doesn’t mean we should leave the finances completely to the ladies. The word we’re looking for is ‘inspiration’. Let’s all try and be a little smart about our finances. It’s amazing how much we can get out of every rupee if we’re just a little smart.

And that’s what we’re here to do as well. Make money matters simple and help you access the right financial products. Credit Cards, Personal Loans,or Home Loans – they’re all here.