What Is A Credit Score?

- A three digit score based on your past financial transactions.

- Used to decide if you have the ability to repay loans on time.

- Changes every time you make a financial transaction.

- Ranges between 300 and 850.

Who Determines Credit Scores?

- Credit bureaus such as CIBIL and Experian.

- A Credit Bureau is a company that collects information from various sources such as financial institutions for providing credit information about individuals.

- Bureaus provide a Credit Score based on the information collected.

- This is used to assess your credit eligibility.

Factors Affecting Your Credit Score

Payment History

- What? The measure of your on-time payments.

- Impact – High (35%).

- How to ace it? Never miss out on a payment due date.

Card Utilization

- What? The outstanding balance on your Credit Card. Keep it low.

- Impact – High (30)%.

- How to ace it? A new card or an enhanced credit limit can help achieve low card utilisation.

Age of Portfolio

- What? The average age of your credit accounts. Higher, the better.

- Impact – Medium (15%).

- How to ace it? Avoid closing your old credit instruments unless absolutely necessary. Use old Credit Cards to pay utility bills every month.

Credit Enquiries

- What? The count of all the hard enquiries that banks initiate when accessing your profile. This needs to be low.

- Impact – Low (10%)

- How to ace it? Apply for loans and cards only when you’re sure of your eligibility.

Total Accounts

- What is it? The total count of your Credit Cards and Loans. This must be on the higher side.

- Impact – Low (10%).

- How to ace it? Have a healthy mix of unsecured and secured loans backed by collaterals.

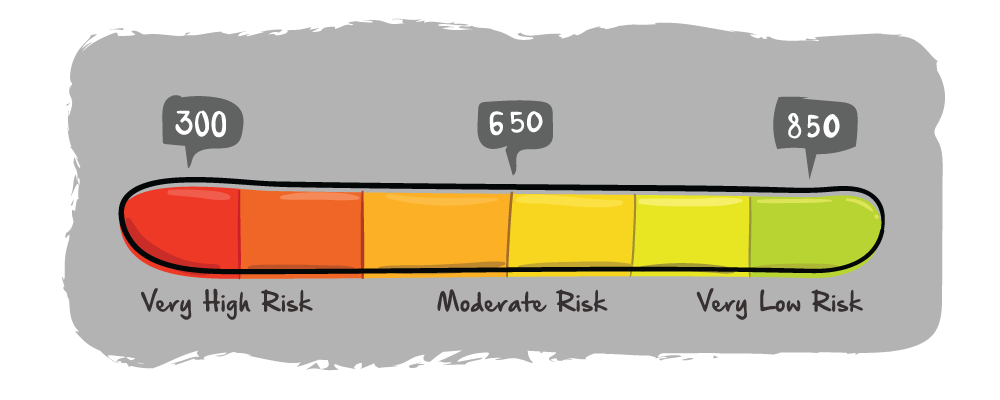

What Is A High/Low Score?

Experian says

- Scores of 300-500 are considered low.

- Experian terms this as ‘Very High Risk’ where a majority of people with such scores are likely to experience serious repayment problems.

- Those with a score of 850+ are considered ‘Very Low Risk’.

- ‘Moderate Risk’ starts with a Credit Score of 650.

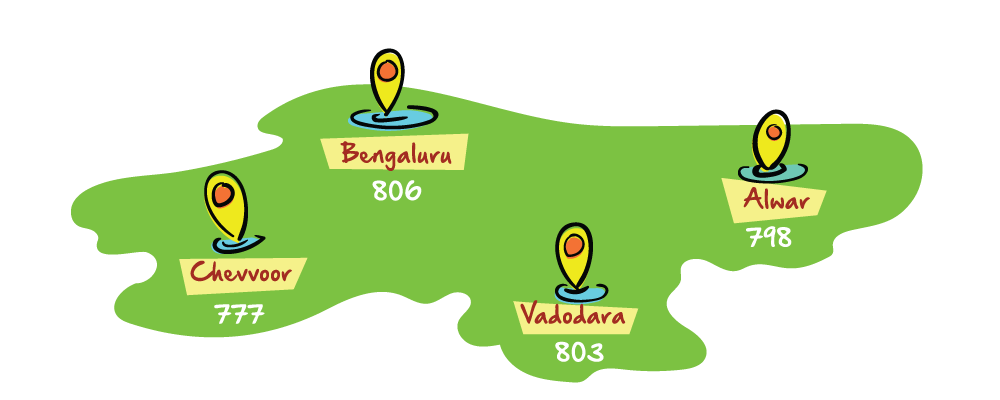

What’s The Median Score?

Experian says the median score for:

- Tier I, such as Bengaluru, is 806.

- Tier II, such as Vadodara, is 803.

- Tier III, such as Alwar, is 798.

- Tier IV, such as Chevvoor, is 777.

What Could Adversely Affect Your Credit Score?

- High outstanding balance on Credit Cards.

- Unnecessarily opening new loan accounts.

- Moving around loans instead of paying them off.

- Paying your loan instalments late.

So the next time your loan application gets rejected, check if it is due to your low Credit Score. In case is, don’t fret! You can improve your Credit Score. We’ve got just the blog post for you: Tips To Improve Your Credit Score.

Copyright reserved © 2026 A & A Dukaan Financial Services Pvt. Ltd. All rights reserved.