Gear up for the festive month with the best of Credit Cards, Personal Loans, Car Loans and Home Loans in town! Here’s the insider view.

The joy of festivities can often be marred by big-ticket purchases that can invariably make a big dent in your pockets. In fact, saving up for the entire year to be able to afford these expenses without feeling a pinch may still not be enough. The good news is that big-ticket purchases don’t have to burn a hole in your pockets if you make some smart money moves-like for instance, get a Credit Card or Personal Loan. With these crackling offers on Credit Cards, Personal Loans, Car Loans and Home Loans, big-ticket purchases are all set to get pocket-friendlier for you this year.

Whether you’ve been eyeing that OLED television, that dream-on-wheels, or a home renovation plan that’s been on hold for months, this fantastic range of Credit Cards, Personal Loans, Home Loans and Car Loans should have your back at all times.

Take a look at the top of the chart Credit Cards, Personal Loan, Car Loan and Home Loans offers handpicked just for you.

Top Credit Card offers for October 2018

With Dussehra and Diwali only a few weeks away, there’s probably a long list of big purchases that you plan on making soon. A Credit Card can help you meet all these needs and in fact, even reward you with benefits and cashbacks that will make all that spending seem worth it. Running out of funds is not the only reason why you should consider getting a Credit Card. Did you know that a Credit Card can help you build a good Credit Score? A good Credit Score can fetch you a sizeable loan and put your finances in the pink of health.

Here’s our pick of the best Credit Card offers that should help you take care of those big-ticket expenses this year:

- 1,000 reward points on joining

- 10X points on spends at select merchants like Uber, BigBasket, Swiggy etc.

- 40 points for every Rs. 150 spent at select retail partners

What you’ll love: Exchange your reward points for air miles at leading airlines and hotels (1 reward point=1 air mile)

- Up to 2 free movie tickets at PVR every month

- Use the ticket to book any day and any show across PVR cinemas

What you’ll love: Up to 2 free movie tickets at PVR every month

Additional Reading: Ten-10-a-Ten Offers – Credit Cards

- Earn 4 points for every Rs. 100 spent at departmental stores

- Earn 2 points for every Rs. 100 spent on consumer durables and electronic goods

- Earn 1.5 points for every Rs. 100 spent on dining and books

What you’ll love: Flexibility to choose your Reward Plans to match your lifestyle.

Top Personal Loan offers for October 2018

Personal Loans are undoubtedly one of the most flexible financial products out there. They can be your saviour if you’re looking to rescue yourself from a financial crunch or consolidate your debts. Whether you’re planning to renovate your home or meet your wedding expenses, Personal Loans can be availed to meet any need. A Personal Loan is a type of loan wherein there are no restrictions on how you wish to use the loan amount advanced. Most banks won’t even ask you the reason for taking this loan.

In fact, contrary to common belief, applying for a Personal Loan won’t sink your Credit Score. In fact, your score will only slip by a few points. How you manage and pay your loan, however, will surely impact and determine your Credit Score. In fact, if you’re in the age group of 22-30 years, you can even avail short-term loans like EarlySalary that will be disbursed in an instant. Borrowing a reasonable amount and not biting off more than you can chew are the words to live by when you’re borrowing a loan.

- Loan amount ranges from Rs. 8,000 to Rs. 1,00,000

- Attractive interest rate

- Loan tenure ranges from 7 to 43 days

What you’ll love: No pre-closure charges.

- Attractive fixed interest rate starting at 10.99%

- No guarantor required

- Balance transfer, part-payment and loan top-up options available

What you’ll love: Conditional pre-closure and part payment after 1 year.

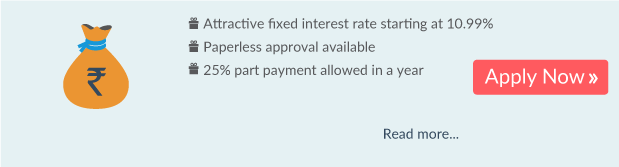

- Attractive fixed interest rate starting at 10.99%

- Paperless approval available

- 25% part payment allowed in a year

What you’ll love: No guarantor required and no part-payment fee.

Additional Reading: Ten-10-A-Ten Offers – Personal Loan

Top Car Loan offers for October 2018

Tired of the daily commute to work and cab drivers cancelling on you? A dream on four wheels isn’t too distant if you have a Car Loan. Whether you opt for a used car or a new one, there is a plethora of Car Loan offers that you can choose from.

Take a look at some of the best Car Loan offers in town handpicked just for you:

- Attractive fixed interest rate starting at 8.40%

- Paperless approval available

- One-time processing fee of up to Rs. 4,720

What you’ll love: No guarantor required and part-payment option available

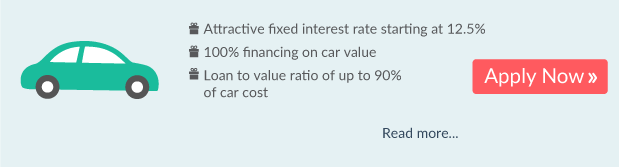

- Attractive fixed interest rate starting at 12.5%

- 100% financing on car value

- Loan to value ratio of up to 90% of car cost

What you’ll love: No guarantor required

Additional Reading: Car Loan: Top 5 Frequently Answered Questions

Top Home Loan offers for October 2018

Buying a house is probably one of the biggest purchases that you will ever make in your life. And it may have become even more difficult to afford today with property prices on the upward trend. However, buying your dream home doesn’t have to wait until you’re 40 or for a windfall gain. You can easily buy one with a Home Loan.

Take a look at some of the best Home Loan offers in the market today:

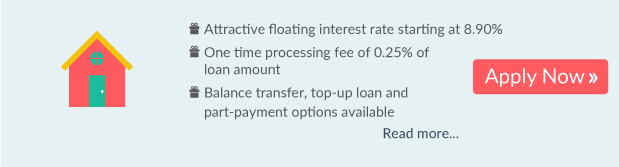

- Attractive floating interest rate starting at 8.90%

- One time processing fee of 0.25% of the loan amount

- Balance transfer, top-up loan and part-payment options available

What you’ll love: No guarantor and part payment fee required

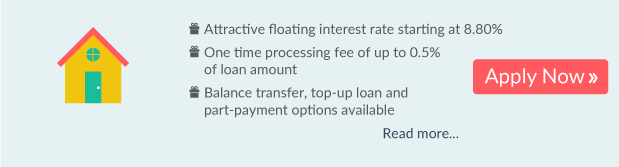

- Attractive floating interest rate starting at 8.80%

- One time processing fee of up to 0.5% of the loan amount

- Balance transfer, top-up loan and part-payment options available

What you’ll love: No guarantor, part payment and pre-closure fee required

Additional Reading: Home Loan FAQs

So there you have it. An array of amazing offers that for sure is set to take care of your financial priorities and big-ticket purchases this Dussehra and Diwali. Go ahead and take your pick!

Psst…If these cards or loans don’t tickle your fancy, here’s an offer that is set to make your Diwali purchase even cheaper. Apply for a Credit Card or a Personal Loan between now and the 13th of October’18, and walk away with a 49” Sony smart TV, OnePlus 6 phone or assured gift vouchers from select merchants like Amazon, Foodpanda etc.